VictoryShares believes that healthcare companies have the potential to generate high future free cash flow (FCF) yields. From the information available, while concerns are out there, having the right fundamentals in place is ultimately advantageous.

According to Michael Mack, Associate Portfolio Manager for VictoryShares and Solutions, investors have many concerns about the healthcare sector. There are regulatory fears, uncertainties regarding drug prices, and concerns about patents. However, Mack noted that “while valuations are low, long-term fundamentals are still intact.”

See more: “Beyond Earnings: Navigating Future Growth with Expected Free Cash Flow Yield”

“We’re back at the phase where healthcare is deeply out of favor, so many of these stocks are currently at a low valuation and stock price,” he said. “Expectations bottom out, and valuations decline. When earnings start to recover, expectations come back, and subsequently, valuations expand.”

Mack added that there are “low expectations baked into the [healthcare]stocks, so when good news happens, the investors should benefit.”

The VictoryShares Free Cash Flow ETF (VFLO) tracks an index that seeks to target profitable U.S. large-cap companies with high FCF yields.

As of November 30, healthcare companies made up 32.72% of VFLO’s Index, the Victory U.S. Large Cap Free Cash Flow Index. By comparison, healthcare stocks comprised 14.68% of the Russell 1000 Value Index[1].

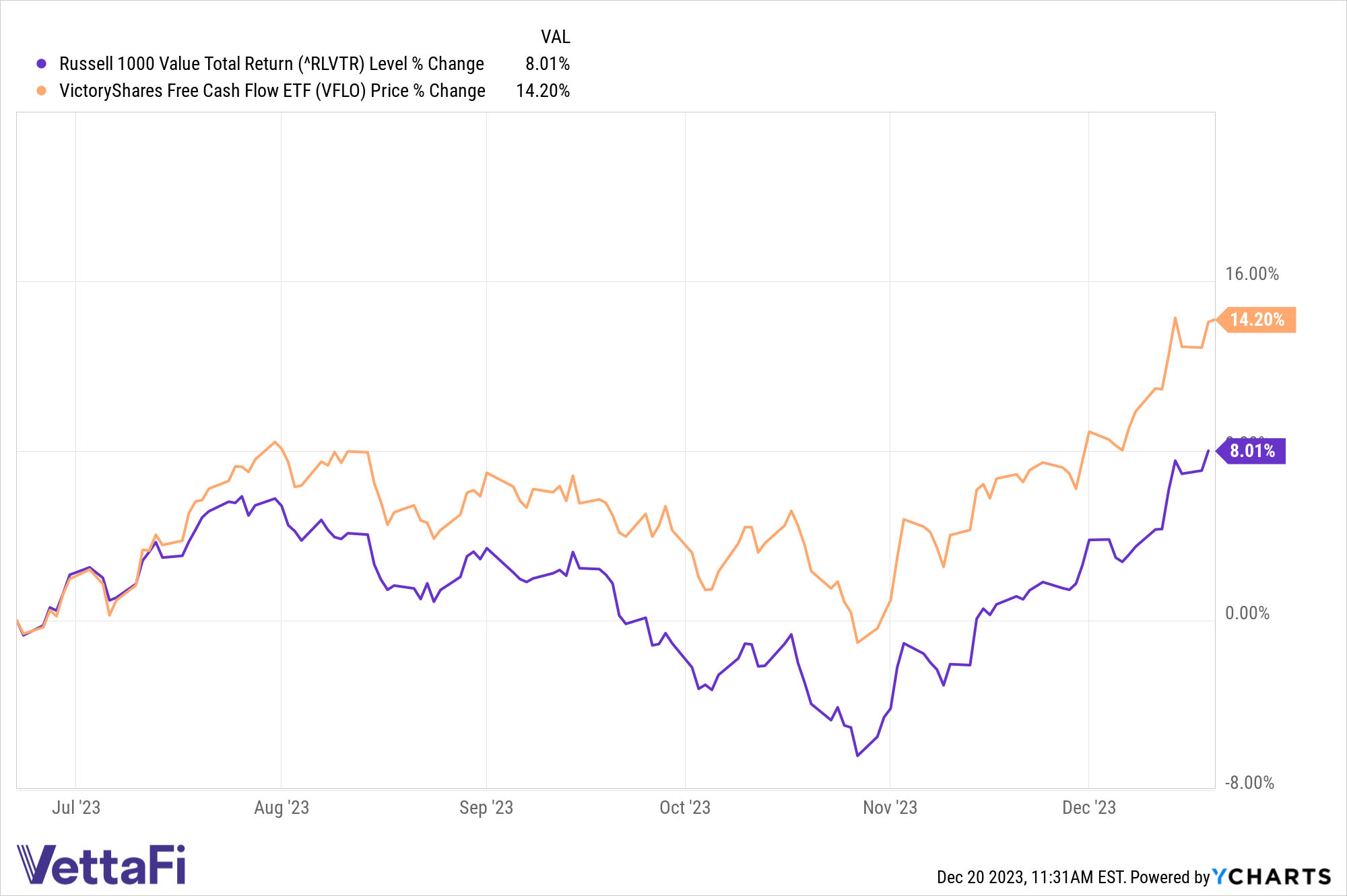

Data from YCharts shows that VFLO has returned 11.04% (Market Price Return) since its inception on 6/21/2023 as of the start of this year. By comparison, the Russell 1000 Value Total Return returned 5.12% during the same period.

Source: YCharts

Past performance does not guarantee future results. The performance data quoted represents past performance and current performance may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, click here. ETF shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. Market price returns are based on price of the last reported trade on the fund’s primary exchange. If you trade your shares at another time, your return may differ. ETF redemptions are limited and commissions are often charged on each trade. ETFs may trade at a premium or discount to their net asset value.

Returns include reinvestment of dividends and capital gains. Performance for periods greater than one year is annualized.

Fee waivers and/or expense reimbursements were in place for some or all periods shown, without which, fund performance would have been lower.

As of 12/31/2023 the VictoryShares Free Cash Flow ETF (VFLO) returned 9.57% for both a NAV Return and Market Price Return for the 4th quarter; and returned 14.16% NAV Return and 14.21% Market Price Return since inception 6/21/2023. The Russell 1000 Value Index returned 9.50% over the quarter.

VFLO’s Index selects companies from a universe of U.S. large-cap stocks[2] by applying a profitability screen, excluding financials and real estate. It then selects companies with the highest free cash flow yields that exhibit relatively higher growth potential based on trailing and forward-looking metrics.

For more news, information, and analysis, visit the Free Cash Flow Channel.

VettaFi LLC (“VettaFi”) is the index provider for VFLO, for which it receives an index licensing fee. However, VFLO is not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of VFLO.

[1] https://advisor.vcm.com/products/victoryshares-etfs/victoryshares-etfs-list/victoryshares-free-cash-flow-etf

[2] The Victory U.S. Large Cap Free Cash Flow Index’s starting universe is the VettaFi 1000 Index, which consists of market cap weighted U.S. large-cap stocks.

Free cash flow (FCF) yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share.

Disclosure Information

Carefully consider a fund’s investment objectives, risks, charges, and expenses before investing. To obtain a prospectus or summary prospectus containing this and other important information, visit http://www.vcm.com/prospectus. Read it carefully before investing.

All investing involves risk, including the potential loss of principal. Please note that the fund is a new ETF with a limited history. The Fund has the same risks as the underlying securities traded on the exchange throughout the day. Redemptions are limited, and commissions are often charged on each trade. ETFs may trade at a premium or discount to their net asset value. The Fund invests in securities included in, or representative of securities included in, the Index, regardless of their investment merits. The performance of the Fund may diverge from that of the Index. Investments concentrated in an industry or group of industries may face more risks and exhibit higher volatility than investments that are more broadly diversified over industries or sectors. Derivatives may not work as intended and may result in losses.

Large shareholders, including other funds advised by the Adviser, may own a substantial amount of the Fund’s shares. The actions of large shareholders, including large inflows or outflows, may adversely affect other shareholders, including potentially increasing capital gains. Investments in mid-cap companies typically exhibit higher volatility. The value of your investment is also subject to geopolitical risks such as wars, terrorism, environmental disasters, and public health crises; the risk of technology malfunctions or disruptions; and the responses to such events by governments and/or individual companies.

Additional Information

The Russell 1000® Value Index is a market-capitalization-weighted index that measures the performance of Russell1000® Index companies with lower price-to-book ratios and lower forecasted growth rates.

The information in this article is based on data obtained from recognized services and sources and one can believe it to be reliable. There is no intention for the mention of securities, if any, to represent individual investment advice.

Distributed by Foreside Fund Services, LLC (Foreside). There is no affiliation of Foreside with Victory Capital Management Inc. (VCM), the Fund’s advisor. Neither Foreside nor VCM have an affiliation with VettaFi.

20240117-3318627