When choosing a dividend growth ETF, dividends aren’t the only thing that matter. The cost to hold the ETF over time is an important consideration.

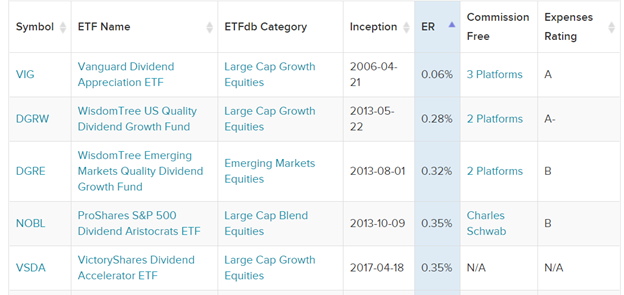

These ETFs reap the most reward for investors who can hold on to them for a long time. Here are the five cheapest dividend growth ETFs:

Source: ETFdb.com

The Vanguard Dividend Appreciation ETF (VIG) is a U.S. large cap equity ETF that tracks the performance of the Dividend Achievers Select Index. This is a passively managed ETF that includes stocks that have a ten-year record of increasing dividends. With a 0.06% expense ratio, this is the cheapest dividend grower you can add to your portfolio.

The WisdomTree US Quality Dividend Growth Fund (DGRW) has a 0.28% expense ratio and also focuses on U.S large caps. DGRW uses a weighted index to allocate its holdings among dividend paying stocks with the most potential, using financial metrics like forward-looking earnings estimates and return-on-equity to weight its stocks.

With an expense ratio of 0.32%, the next cheapest dividend growth ETF is the WisdomTree Emerging Markets Quality Dividend Growth Fund (DGRE). This ETF, which uses similar screens as DGRW, focuses on large cap companies in emerging markets, such as Brazil, China, India, and Russia. Its biggest holding is currently Taiwan Semiconductor Manufacturing Co. Ltd. (2330).

The ProShares S&P 500 Dividend Aristocrats ETF (NOBL) has an expense ratio of 0.35% and a year-to-date return of 16%. NOBL tracks “dividend aristocrats,” companies that have increased their dividend payments every year for the past 25 years or more.

Rounding out the list is the VictoryShares Dividend Accelerator ETF (VSDA), a large cap growth equity with an expense ratio of 0.35%. This ETF tracks large companies with a minimum of five years of dividend growth and a high probability of future surges, using a blend of fundamental and technical metrics to select its constituents.

For more news, information, and strategy, visit the Free Cash Flow Channel.