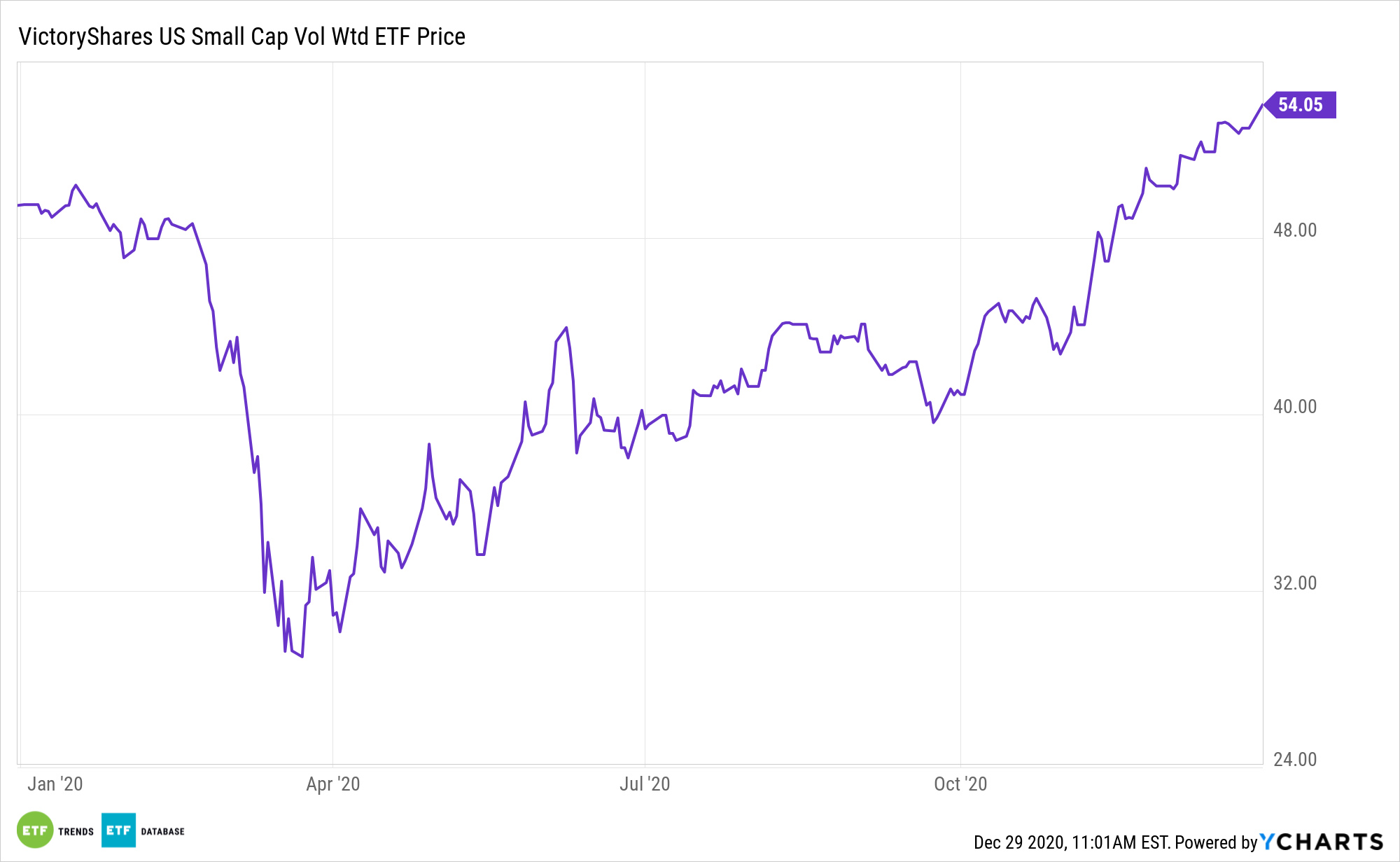

Small caps are on a torrid pace to close to 2020, and market observers are betting on more of the same next year. Investors can get in on the action with lower volatility with the VictoryShares US Small Cap Volatility Weighted ETF (Nasdaq GM: CSA).

CSA seeks to provide investment results that track the performance of the Nasdaq Victory US Small Cap 500 Volatility Weighted Index, which is an unmanaged, volatility weighted index. The index identifies the 500 largest, profitable U.S. companies with market capitalizations of less than $3 billion measured at the time the index’s constituent securities are determined.

CSA offers a better approach to small caps than what investors get with many of the most widely followed benchmarks providing exposure to this asset class. In fact, the VictoryShares fund can be seen as a higher quality alternative to Russell 2000 Index funds.

Traditional capitalization-weighted index funds weight holdings based on their market cap, so companies that have done well also make up a larger weight in the indices, which leaves investors overexposed to yesterday’s outperformers.

CSA: The Right Way to Access Small Caps

The weighted average market capitalization of stocks in CSA’s underlying index is $1.76 billion, compared to $2.89 billion in the Russell 2000. Three-year earnings growth for stocks in CSA’s benchmark is 13.07%, as opposed to 11.29% in the Russell 2000.

CSA is worth a look as the economy rebounds from the ill effects of the COVID-19 pandemic. While investors may flock to the relative safety of large cap equities during a recession to lessen the blow of market volatility and provide a cushion during market downturn, small cap performance is worth watching as the economy exits a recession. As such, investors may want to give small cap equity funds a look now to make a factor-oriented play.

The size factor is one of the most durable themes in the factor space, but many investors often overlook the benefits of focusing on higher-quality, small cap equities. While growth prospects remain compelling with smaller stocks, evidence suggests there’s waning quality in the group, potentially exposing investors to undue risk.

CSA allocates over 24% of its weight to financial services stocks, a group that’s widely expected to rebound in 2021 as the economy recovers and banks aren’t forced to hold back cash to cover bad loans. Industrial and technology stocks combine for over 31% of the fund’s weight.

For more news, information, and strategy, visit the Free Cash Flow Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.