Some broad market benchmarks may not be as diverse as investors are led to believe. Take the case of the S&P 500 where six stocks – Apple (NASDAQ: AAPL), Microsoft (NASDAQ: MSFT), Amazon (NASDAQ: AMZN), Facebook (NASDAQ: FB) and two share classes of Alphabet (NASDAQ: GOOG) combine for over 21% of the index’s weight.

That may not be the level of diversity investors are looking for, and can sometimes introduce them to more volatility than is desired. The VictoryShares US 500 Volatility Wtd ETF (CFA) is an exchange traded fund that aims to rectify this scenario.

The $706 million CFA, which turns seven years old on July 1, follows the Nasdaq Victory US Large Cap 500 Volatility Weighted Index. That index not only makes it a point to only include companies with four straight quarters of positive earnings, it weights components by volatility. Less volatile names receive larger weights while the more volatile names in the benchmark garner lower allocations.

CFA could be a credible idea for investors looking for strategies that are truly diverse at the holdings level, not just dominated by a smaller number of companies.

“Remember, in recent years domestic market leadership has been dominated by just a handful of mega-cap stocks. As of the end of the first quarter, the top 10 stocks in the S&P 500® Index represented 27.4% of the Index,” writes Victory Capital’s Scott Kefer. “That type of overweight position was fine when the proverbial FAANG + M stocks—Facebook, Apple, Amazon, Netflix, Google (i.e. Alphabet) and Microsoft—were providing a nice tailwind and powering returns in the S&P 500.”

None of CFA’s holdings exceed a weight of 0.40%.

CFA Refreshes Broad Market Exposure

For investors that want truly diverse large cap exposure without concentration risk, CFA is one practical option. Additionally, the fund’s volatility-weighted methodology is suitable for risk-averse investors seek core exposure.

“For example, a volatility-weighting methodology allocates to stocks based on volatility, so each stock in the portfolio has an equal contribution to overall risk,” adds Kefer. “Not only is that a more diversified approach, but it could insulate investors against the possible underperformance of mega-cap stocks versus the broad market, while also providing greater exposure to cyclical stocks and sectors.”

CFA has another benefit: by weighting stocks by volatility, the fund is overweight some value sectors – namely financial services and industrials. Those groups combine for over 34% of CFA’s roster, as compared to less than 21% of the S&P 500.

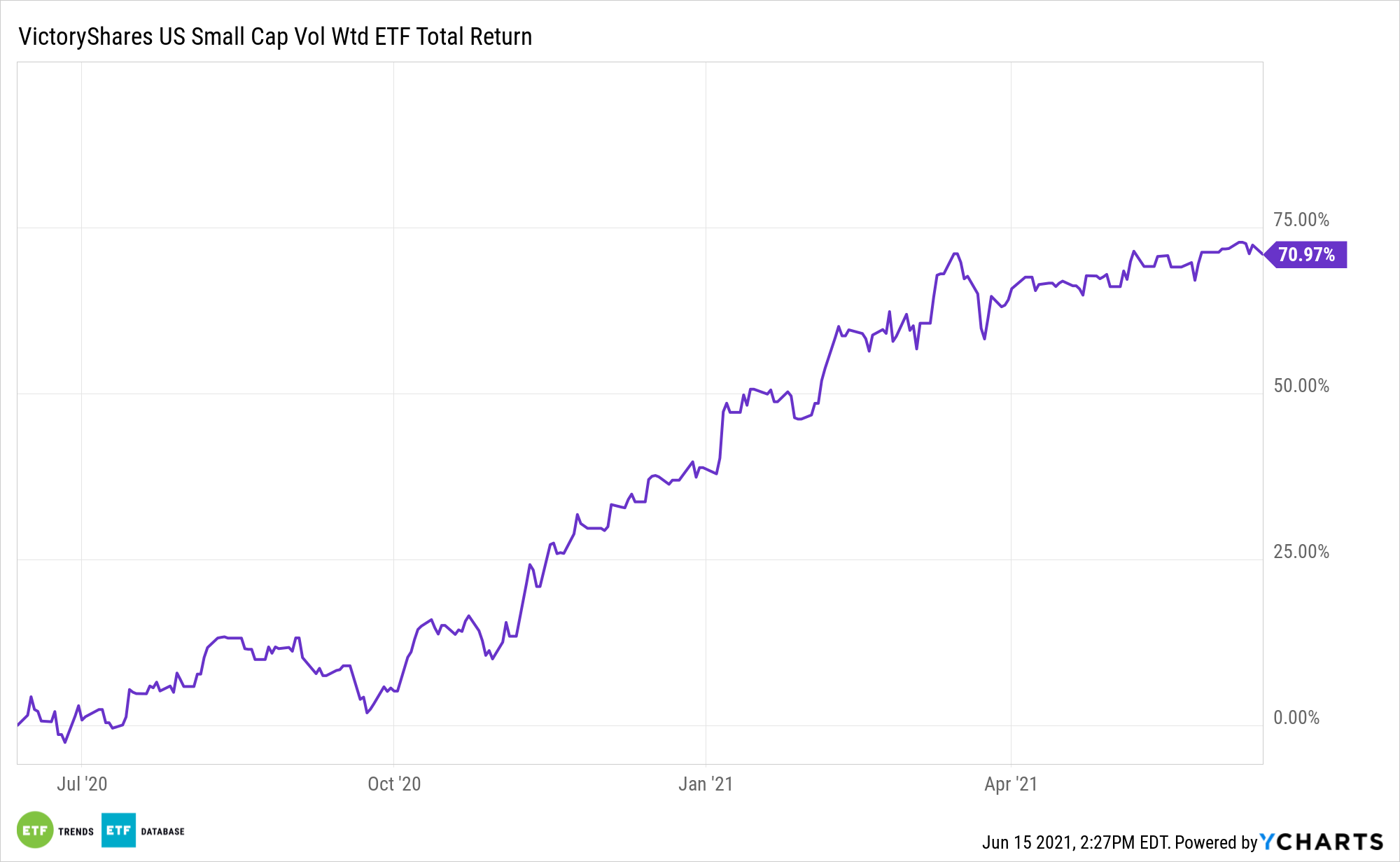

Those differences are meaningful because CFA is slightly outpacing the S&P 500 this year while trouncing the MSCI USA Minimum Volatility Index.

For more news, information, and strategy, visit the Free Cash Flow Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.