Market volatility saw investors seek the safe confines of government debt during the summer, which saw yields fall while bond prices climbed. Corporate bonds were an option for investors seeking yield in 2019, but will 2020 bring a down year for corporate debt?

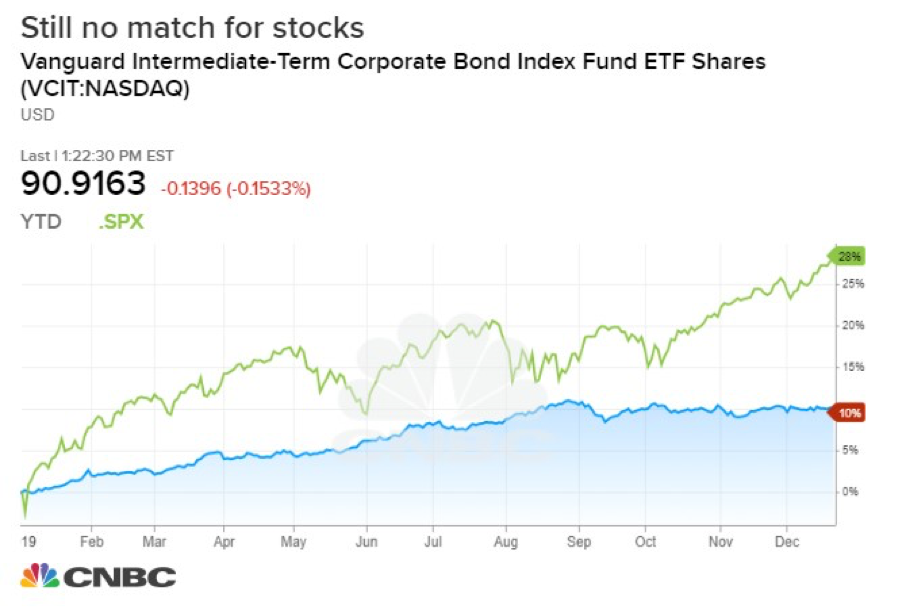

“Coming out of 2019 everything worked but some asset classes, some sectors worked better than others. If I look at investment grade corporate bonds, they’re up about 10% year-to-date,” said Kevin Mahn, CIO and president of Hennion and Walsh.

A CNBC report used the Vanguard Interm-Term Corp Bond ETF (NASDAQ: VCIT) as a case-in-point scenario for how corporate bonds have fared. VCIT seeks to track the performance of a market-weighted corporate bond index with an intermediate-term dollar-weighted average maturity, namely the Bloomberg Barclays U.S. 5-10 Year Corporate Bond Index.

While VCIT holds debt issues with maturities between 5 and 10 years, they are all investment-grade holdings to minimize default risk. The fund is up about 13% based on Yahoo Finance performance numbers, but that still pales in comparison to the S&P 500, which is up close to 30%.

What Goes Up Must Come Down

Corporate bond performance in 2020 could simply be a case of what goes up must eventually come down. With a banner year in 2019, it would be a difficult performance to duplicate in the new year.

“It would be hard to imagine we could do better than we did in 2019. It was kind of perfect from a total return standpoint. It was a combination of yield levels moving lower and credit spreads narrowing,” said Jon Duensing, director of investment grade corporates at Amundi Pioneer.

Furthermore, an environment of easing by the Federal Reserve and a strong economy highlighted by low unemployment levels could be priced into this year’s gains.

“If you look where spreads are now relative to long term averages, they’re certainly inside of long term averages. You could point to decent economic conditions, very supportive monetary policy positions from the U.S. central bank and supportive demand from non-U.S. business investors. A lot of that is priced in,” said Duensing.

Still, some market experts think corporate bonds have more room to run in 2020.

“We like corporate bonds for next year because global banks led by the Federal Reserve have essentially extended the cycle by lowering rates and also pumping massive liquidity into the system,” said Alicia Levine, chief strategist at BNY Mellon Wealth Investment Management. “They’ve just stabilized the market, not that it wasn’t stable.”

For more trends in fixed income, visit the Fixed Income Channel.