An ETF’s spread is the difference between the price at which investors can buy the fund on the exchange and the price at which it can’t be sold. For sure, an ETF’s spread is important, especially for shorter holding periods. But when does its expense ratio become more significant? According to new research from Vanguard, it could be sooner than one may think.

Tallying the total cost of ownership for an ETF may seem as simple as adding its expense ratio and spread. But it’s actually a bit more complicated than that. That’s because this doesn’t consider the critical component of time. The longer the holding period, the more an ETF’s expense ratio becomes a deciding factor.

See more: “Don’t Expect Rates to Go Down Just Yet”

VCIT vs. LQD: A Case Study

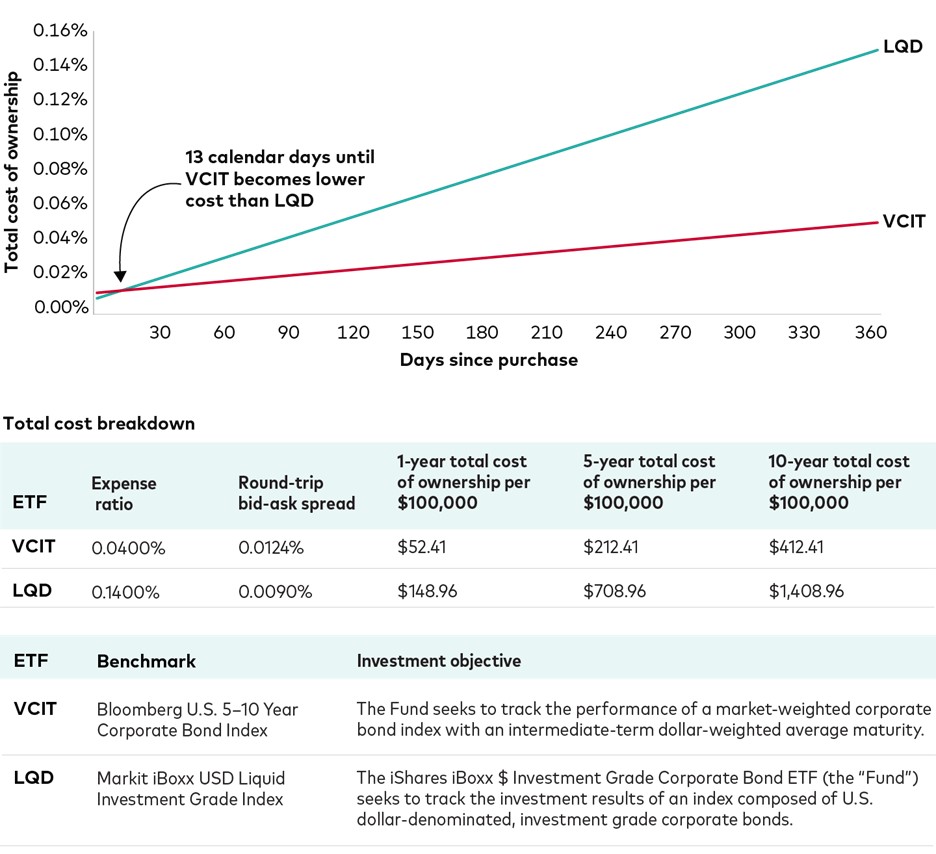

To demonstrate this, Vanguard compares the Vanguard Intermediate-Term Corporate Bond ETF (VCIT) and the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD). VCIT includes intermediate-term bonds between 5 and 10 years of maturity. Meanwhile, LQD includes bonds all along the corporate bond yield curve (with a tilt towards more liquid bonds).

Despite their differences, these funds are similar in terms of risk with both having intermediate durations.

All told, it took 13 trading days for VCIT’s lower expense ratio to make up for the spread difference. The difference in the funds’ expense ratios — VCIT’s 4 basis points vs. LQD’s 14 — offset LQD’s slight spread advantage (0.90 bp vs. VCIT’s 1.24 bps).

Source: Bloomberg, From January 1, 2022, to December 31, 2022.

According to Vanguard: “the longer the holding period of VCIT, the lower expense ratio will enable your clients to maximize returns by minimizing costs.”

An investor holding $100,000 worth of VCIT for a year before selling would incur a total cost of ownership of $52.41. Meanwhile, holding $100,000 of LQD for a year before selling would cost an investor $148.96.

VettaFi’s vice chairman Tom Lydon called Vanguard “the Hoover of the ETF industry” for how it’s vacuumed up investor dollars.

“They are just rock solid,” Lydon said. “They’re low-cost and always very, very dependable.”

For more news, information, and analysis, visit the Fixed Income Channel.