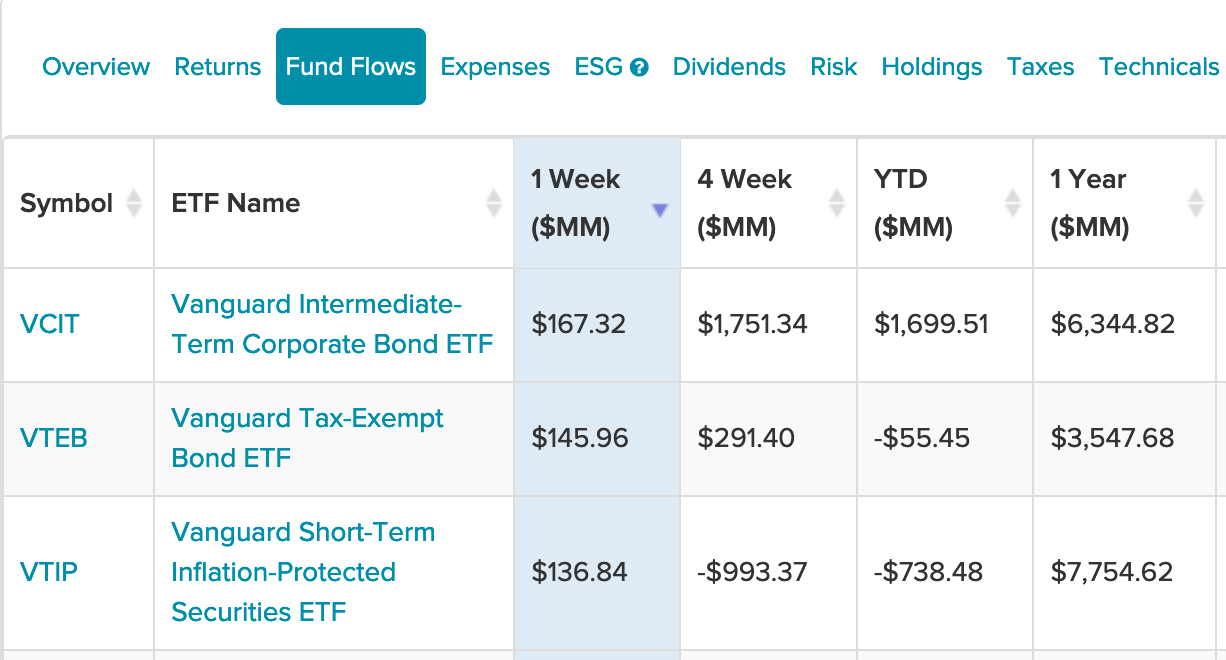

Fund flows into Vanguard bond exchange traded funds (ETFs) over the past week are certainly a reflection of the current market environment for bonds and how investors are addressing them.

The search for yield continues, and investors are willing to step out further on the yield curve with ETFs like the Vanguard Interim-Term Corporate Bond ETF (VCIT) leading inflows over the past week. A move towards more yield is a sign of the times, especially with the prospect of rate hikes by the Federal Reserve looming.

VCIT seeks to track the performance of a market-weighted corporate bond index with an intermediate-term dollar-weighted average maturity. The fund employs an indexing investment approach designed to track the performance of the Bloomberg U.S. 5–10 Year Corporate Bond Index, which includes U.S. dollar-denominated, investment-grade, fixed-rate, taxable securities issued by industrial, utility, and financial companies, with maturities between five and 10 years.

Reducing Taxes and Hedging Inflation

A move towards municipal bonds as of late is not only a sign of safe haven exposure, but investors looking for ways to minimize their tax bite. That said, inflows have been heading into the Vanguard Tax-Exempt Bond ETF (VTEB), which offers low-cost exposure to municipal debt.

VTEB tracks the Standard & Poor’s National AMT-Free Municipal Bond Index, which measures the performance of the investment-grade segment of the U.S. municipal bond market. This index includes municipal bonds from issuers that are primarily state or local governments or agencies whose interests are exempt from U.S. federal income taxes and the federal alternative minimum tax (AMT).

Of course, inflation remains a top-of-mind issue for investors. That said, rounding out the top three bond ETF inflows is the Vanguard Short-Term Inflation-Protected Securities Index Fund ETF Shares (VTIP), which seeks to track the Bloomberg U.S. Treasury Inflation-Protected Securities (TIPS) 0-5 Year Index’s performance.

The index is a market capitalization-weighted index that includes all inflation-protected public obligations issued by the U.S. Treasury with remaining maturities of less than five years. The manager attempts to replicate the target index by investing all, or substantially all, of its assets in the securities that make up the index, holding each security in approximately the same proportion as its weighting in the index.