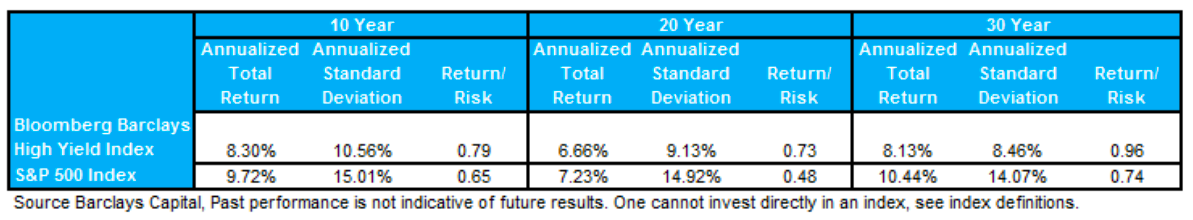

Additionally, as investors look at how to navigate this return to volatility in financial markets, it is worth noting that over its history, the high yield bond market has had less volatility (as measured by the standard deviation of returns) than the equity market, with a relatively similar returns profile.(1)

![]()

Volatility is a key measure of risk used by investors, and for those investors that are looking to reduce volatility versus equities while still generating income and potential upside, we believe that an actively managed high yield strategy can be an attractive alternative for investors.

Disclosure Information

(1) Bloomberg Barclays Capital U.S. High Yield Index covers the universe of fixed rate, non-investment grade debt (source Barclays Capital). The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. S&P 500 index data sourced from Bloomberg, using a total return including dividend reinvestment. Annualized Total Return and Standard Deviation calculations are based on monthly returns. Return/Risk calculated as the Annualized Total Return divided by Annualized Standard Deviation. Data as of 2/28/18. Although information and analysis contained herein has been obtained from sources Peritus I Asset Management, LLC believes to be reliable, its accuracy and completeness cannot be guaranteed. This report is for informational purposes only. Any recommendation made in this report may not be suitable for all investors. As with all investments, investing in high yield corporate bonds and loans and other fixed income, equity, and fund securities involves various risks and uncertainties, as well as the potential for loss. High yield bonds are lower rated bonds and involve a greater degree of risk versus investment grade bonds in return for the higher yield potential. As such, securities rated below investment grade generally entail greater credit, market, issuer, and liquidity risk than investment grade securities. Interest rate risk may also occur when interest rates rise. Past performance is not an indication or guarantee of future results. The index returns and other statistics are provided for purposes of comparison and information, however an investment cannot be made in an index