The advent of exchange-traded funds (ETFs) has given investors access to certain asset classes they wouldn’t have been able to obtain previously, such as bonds. Here are three reasons investors should use bond ETFs in their respective portfolios.

First, investors can get targeted exposure to bonds via ETFs. If investors want to get corporate, U.S., international, municipal, short duration, or long duration bonds, there’s a bond ETF available from providers like Vanguard that tailor to the investor’s specific needs.

In addition, if investors are looking for bonds to offset their equities, there is an ETF for that. Investors who want to supplement their U.S. bonds with debt markets overseas may rest assured that there’s an ETF for that as well.

With a plethora of options available, this speaks to the diversification aspect that bonds can provide. This is especially so when you encase bonds in an ETF wrapper — Vanguard has a number of ETF options available for investors looking to get bond exposure.

Lastly, getting bond exposure via an ETF takes out a lot of guesswork. With a universe of bonds available to an investor, it can be easy to get lost in that space.

As such, investors don’t have to analyze individual bonds to determine whether they fit their portfolio requirements. An ETF that holds several bonds can also limit concentration risk resulting from being too heavily invested in one specific bond.

Where Should Investors Start?

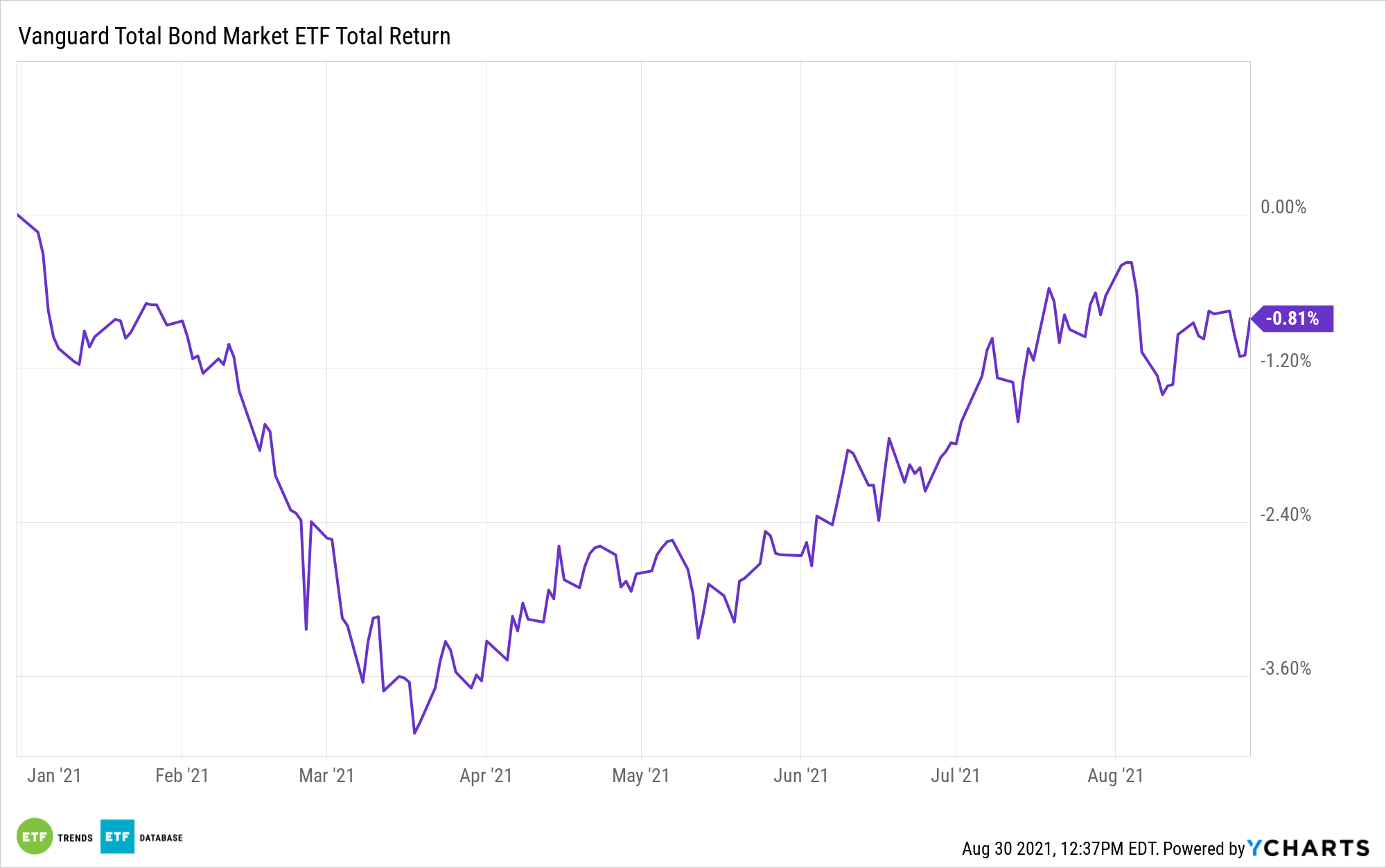

Investors looking for an all-encompassing bond fund can use the Vanguard Total Bond Market Index Fund ETF Shares (BND). BND seeks the performance of Bloomberg Barclays U.S. Aggregate Float Adjusted Index, which represents a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States, including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities, all with maturities of more than one year.

Strategic bond investors can use BND as a traditional hedging component when the equities market goes awry. Additionally, short-term traders can also use the ETF, given its dynamic ability to be bought and sold quickly in the open market.

With its exposure to debt markets outside of the U.S., BND also gives bond investors the necessary diversification in their fixed income portfolios. This can help with capturing yield or reducing concentration risk in one specific debt market.

For more news, information, and strategy, visit the Fixed Income Channel.