Getting globalized bond exposure doesn’t mean that investors have to own debt issues from several countries. Two ETFs from Vanguard can suffice.

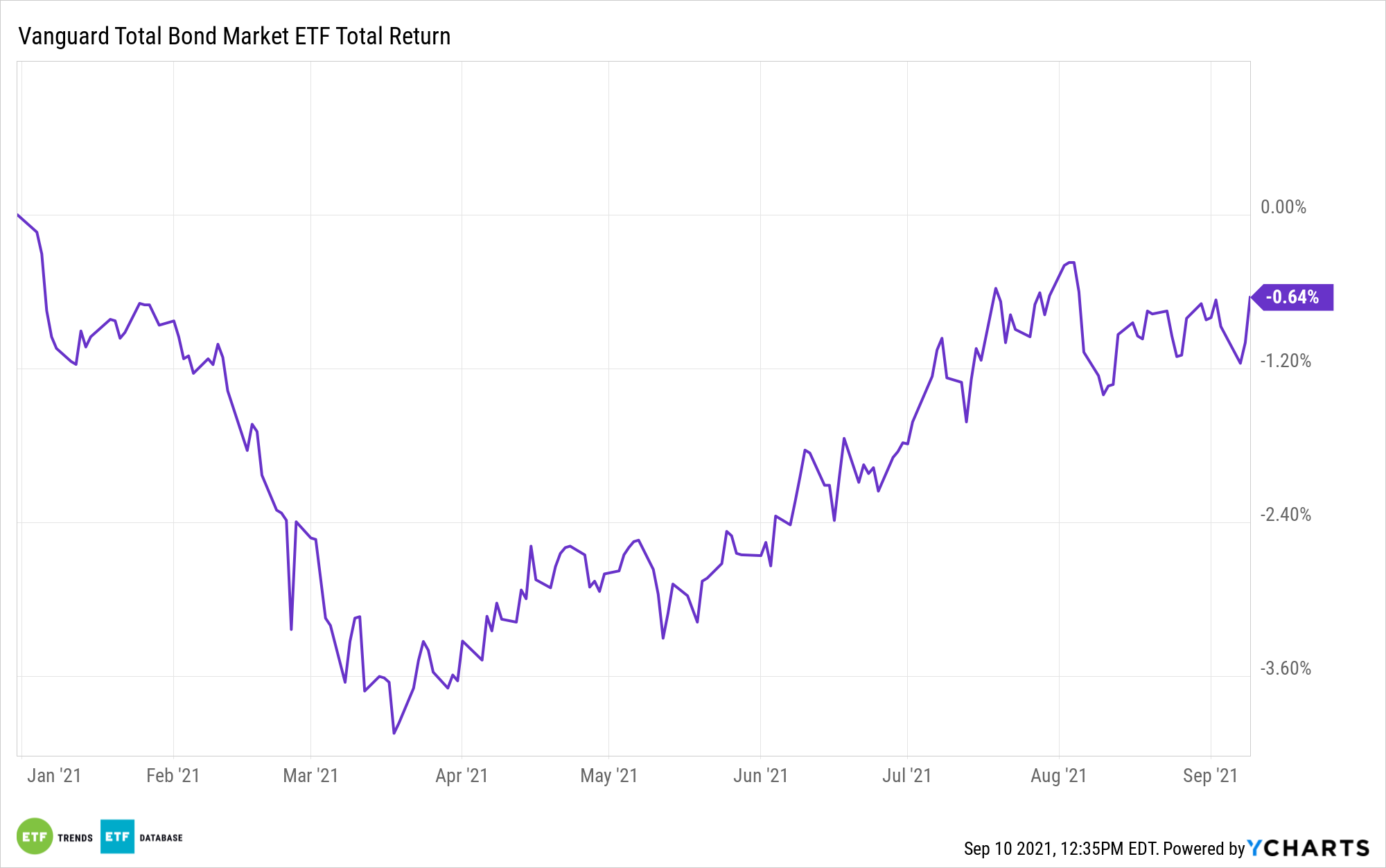

First off, investors may want to invest right here at home with a U.S.-focused ETF, namely the Vanguard Total Bond Market Index Fund ETF Shares (BND). For the diversification aspect of a bond portfolio, BND can be paired with the Vanguard Total International Bond Index Fund ETF Shares (BNDX).

BND presents bond investors with an all-encompassing, aggregate solution to getting U.S. bond exposure. It’s an ideal solution for investors seeking to complement their equities exposure.

BND seeks the performance of Bloomberg U.S. Aggregate Float Adjusted Index. The Bloomberg U.S. Aggregate Float Adjusted Index represents a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States, including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities, all with maturities of more than one year.

In summary, BND:

- Provides broad exposure to the taxable investment-grade U.S. dollar-denominated bond market, excluding inflation-protected and tax-exempt bonds.

- Offers relatively high potential for investment income; share value tends to rise and fall modestly.

- May be more appropriate for medium- or long-term goals where investors are looking for a reliable income stream.

- Is appropriate for diversifying the risks of stocks in a portfolio.

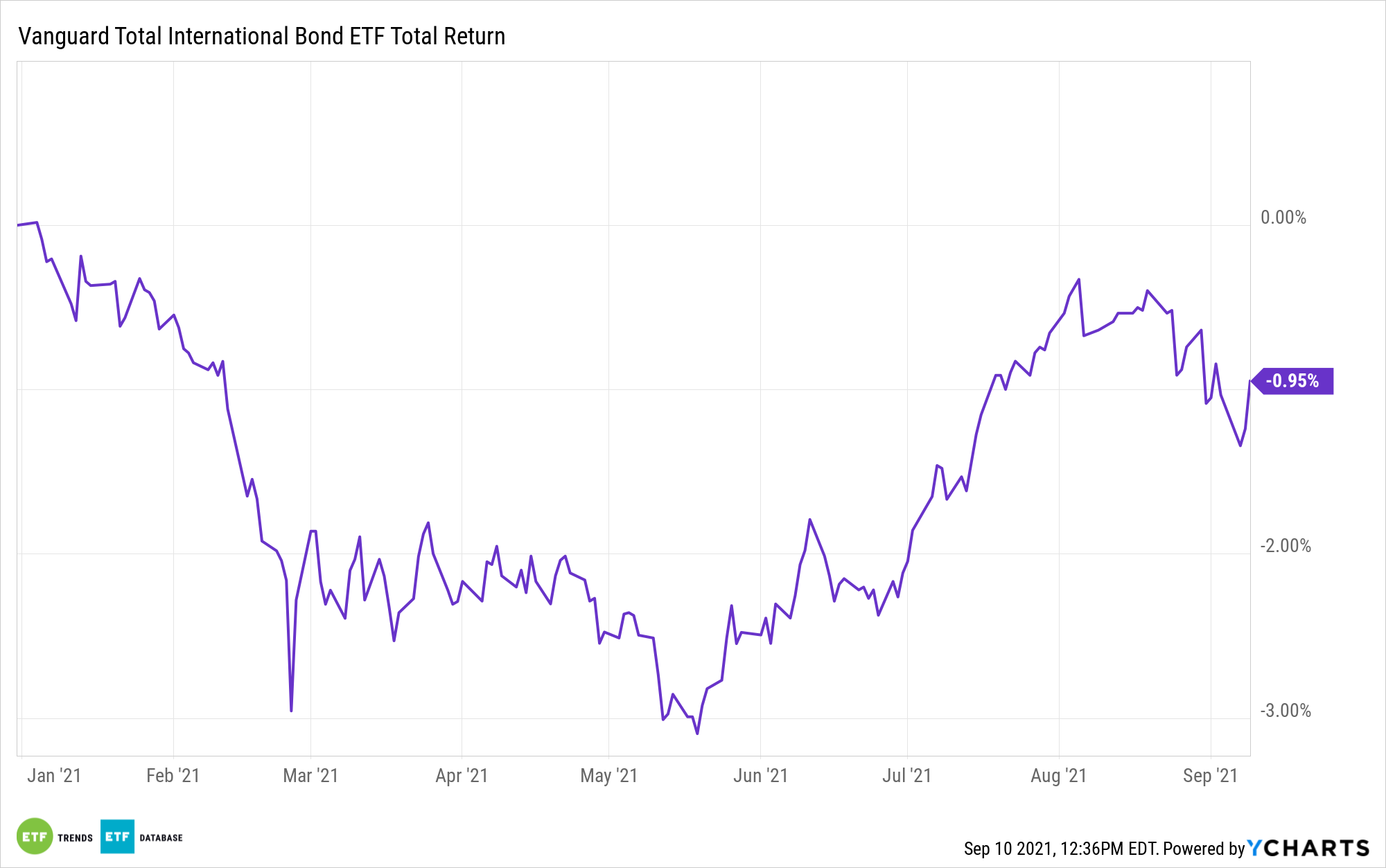

Investment-Grade International Exposure

Getting bond diversification overseas is an ideal strategy to complement a domestic bond portfolio, but it could be a slippery slope. Different countries can be in various economic phases, so an all-encompassing approach that focuses on investment-grade debt makes BNDX a prime option.

BNDX seeks to track the performance of a benchmark index that measures the investment return of non-U.S. dollar-denominated investment-grade bonds. International bonds can provide a diversification tool for fixed income investors looking to supplement their current core portfolio.

The ETF employs an indexing investment approach designed to track the performance of the Bloomberg Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged), which provides a broad-based measure of the global, investment-grade, fixed-rate debt markets.

In summary, BNDX:

- Seeks to track the performance of the Bloomberg Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged).

- Employs hedging strategies that seek to protect against uncertainty in exchange rates.

- Is passively managed, using index sampling.

- Remains fully invested.

- Offers broad exposure across major bond markets outside of the United States.

- Has low expenses that minimize net tracking error.

For more news, information, and strategy, visit the Fixed Income Channel.