Valuations for muni bonds are currently attractive, trading at levels not seen since the global financial crisis. And with munis posting 5.9% total returns last month, this asset class offers investors the opportunity to enjoy high rewards with low risk.

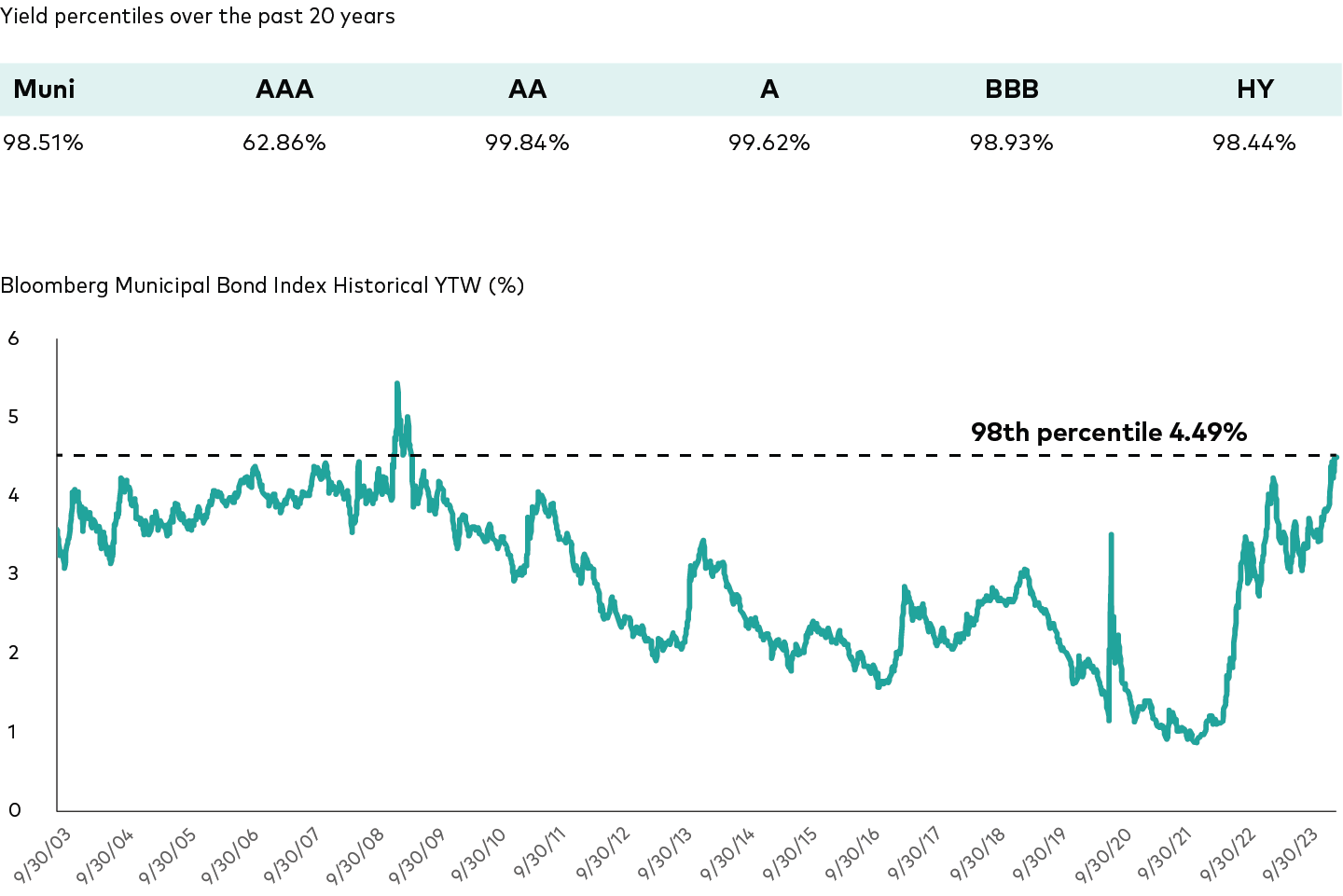

According to Vanguard, muni yields are at the highest absolute levels in a decade, with the top-line yield for the broad market trading above the 98th percentile over the last 20 years.

“While muni yields are robust, fundamentals remain strong,” Vanguard wrote. “Our credit analysts believe state balance sheets are on firm footing and there are plenty of high-quality credit opportunities within revenue sectors.”

See more: “Consider This Tax-Efficient Way to Increase Your Fixed Income Allocation”

Source: Bloomberg and Vanguard calculations, as of November 1, 2003, to October 31, 2023.

Capturing Low-Risk Yield Through VTES & VTEB

The Vanguard Short-Term Tax Exempt Bond ETF (VTES) invests in investment-grade muni bonds with maturities between zero and seven years. It seeks to track the S&P 0-7 Year National AMT-Free Municipal Bond Index.

Vanguard’s head of fixed income product Jeff Johnson told VettaFi that VTES was designed “for tax-sensitive investors who have a preference for taking on less interest rate risk than the overall municipal market.”

Janet Jackson, head of ETF capital markets, added that Vanguard saw investor demand for short-duration munis. Considering VTES has brought in $390.5 million in investor capital since it launched in March, clearly there’s a demand.

Vanguard’s other municipal bond ETF, the Vanguard Tax-Exempt Bond ETF (VTEB), targets munis with a duration of roughly five and a half years.

Vanguard CEO Tim Buckley said that the goal is to produce “the top-performing funds and ETFs out there.”

“We’ll wrap it with low-cost, scalable advice and deliver them on a world-class, digitally enabled platform,” he said. “And if you do that well and you can keep improving it, you’ll create value into the future.”

For more news, information, and analysis, visit the Fixed Income Channel.