With the threat of rising interest rates looming on fixed income investors, sometimes the best way to counteract that risk is to get active with exchange traded funds (ETFs).

Consumer prices have reached decade highs, giving the U.S. Federal Reserve more reason to start getting aggressive with interest rate policy. While its narrative suggests that inflation is transitory, other market experts predict that it could be more persistent.

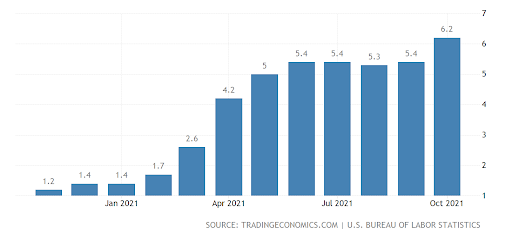

“Consumer prices posted their biggest annual gain in more than 30 years in November, moving up 6.2% over the trailing 12-month period, thanks to surges in the cost of gasoline and other goods,” Dividend.com says. “Despite rising inflation levels, fixed-income assets continue to offer low interest rates, putting pressure on investors who require consistent income.”

While investors can get broad exposure to the bond markets via an ETF that follows a conventional passive index, an actively managed fund offers a dynamic approach. Run by a team of management professionals, active ETFs can flex with the market when the environment warrants adjustments.

“These funds have more flexibility than conventional or smart-beta funds, with a team of experts sorting through different opportunities to capitalize on current market conditions,” Dividend.com adds.

Mitigate Rate Risk With Short Duration

One way to mitigate rate risk is to opt for short-duration bonds to lessen exposure to rate fluctuations over time. This is available via the Vanguard Ultra-Short Bond ETF (VUSB) at a low 0.10% expense ratio.

The fund invests in a diversified portfolio of high-quality and, to a lesser extent, medium-quality fixed income securities. It offers a dollar-weighted average maturity of 0–2 years. The fund is designed to give investors low-cost exposure to money market instruments and short-term high-quality bonds, including asset-backed, government, and investment-grade corporate securities.

“The Vanguard Ultra-Short Bond ETF is an actively managed fund that aims to bolster income while minimizing volatility,” an ETF Database analysis says. “The fund invests in short-term fixed income securities with maturities of up to two years, and is designed for those with an investment time horizon of six to 18 months.”

“The portfolio includes asset-backed debt, government issued bonds, and investment-grade corporates,” the analysis adds. “While VUSB skews toward securities issued by high-quality borrowers, the fund also invests in some riskier medium-quality fixed income assets.”

For more news, information, and strategy, visit the Fixed Income Channel.