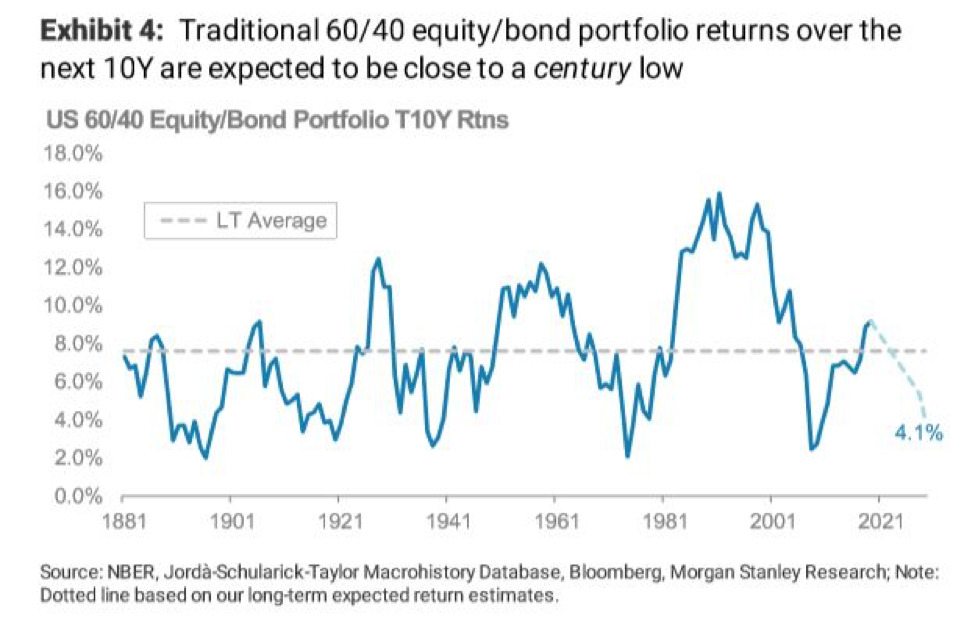

It could be a decade of underperformance for stocks and bonds, according to global investment firm Morgan Stanley. This could affect the classic 60-40 capital allocation that consists of 60% equities and 40% bonds.

“We expect U.S. stocks and U.S. Treasurys to see [returns of]4.9% and 2.8% each year, respectively, over the next decade, driving expected returns for a traditional 60/40 equity/bond USD portfolio close to a century low,” said a team of Morgan Stanley strategists.

Morgan Stanley isn’t exactly on an island with this notion. Bank of America also said that “with so many investors piling into bonds these days, to protect against an economic downturn and risk of a trade war, for one, a bubble may be forming that could pop and hurt the 60/40 crowd too.”

Bank of America’s assessment came after a wall of worry that included inverted yield curves and a U.S.-China trade war forced investors into safe haven assets like government debt.

“The return outlook over the next decade is sobering – investors face a lower and flatter frontier compared with prior decades, and especially compared with the 10 years post-[financial crisis], when risk asset prices were sustained by extraordinary monetary policies that are in the process of being unwound,” said Tang and Sheets.

Where can investors go from here if it means less-than-stellar returns for stocks and bonds in the next decade? One area is to diversify by looking at opportunities overseas and adding ETFs with a strategic component.

Where can investors go from here if it means less-than-stellar returns for stocks and bonds in the next decade? One area is to diversify by looking at opportunities overseas and adding ETFs with a strategic component.

One such product is the Natixis Seeyond International Minimum Volatility ETF (MVIN). MVIN focuses on developed markets and seeks to generate long-term capital appreciation with less volatility than typically experienced by international equity markets—the minimum volatility approach helps diminish portfolio risk.

MVIN gives investors:

- Less volatile approach to diversify internationally

- Long-term capital appreciation seeking less volatile international stocks

- Actively managed ETF with the ability to adapt over time

Even with U.S. equities rebounding from a summer sell-off via new highs in the S&P 500 and Dow Jones Industrial Average, it still makes sense to buy into a product like MVIN, which can provide investors with the duality of realizing gains during a market upswing and protect investors in a downturn.

With the potential for volatility in a market that could be running out of steam, ETFs like MVIN can address that while at the same time, realize any upward gains realized when markets rise.

For more relative market trends, visit ETFtrends.com.