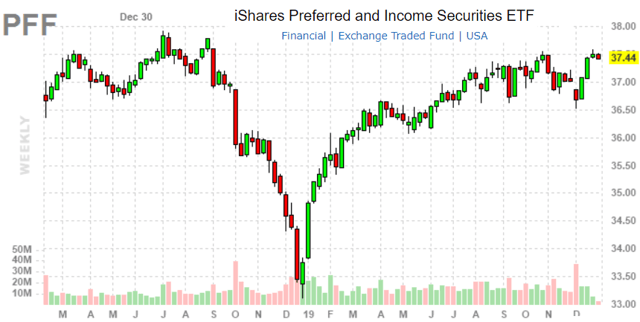

- PFF returned 15.5% in 2019 supported by broad equity market strength and a trend lower in interest rates.

- An improving global growth outlook and firming inflation expectations could support a trend higher in interest rates, pressuring preferred shares.

- We take a cautious view on PFF as the dividend yield at 5.3% is at the lowest level in a decade, suggesting the fund is relatively expensive.

The iShares Preferred & Income Securities ETF (NYSE: PFF) with $16.8 billion in assets under management provides investors exposure to a diversified portfolio of U.S. preferred stocks. PFF offers an attractive 5.3% dividend yield distributed monthly and can serve as a good portfolio diversifier. While we like the fund’s strategy and composition covering an important segment of the market, this article highlights the potential for a move higher in interest rates as a key risk for PFF to watch in the year ahead.

PFF ETF Investment Thesis

The surging stock market in recent months following favorable developments in the U.S.-China trade dispute implies a rebound of global growth expectations. The implication is that a recovery in trade and activity levels could drive inflationary pressures higher and result in a yield curve steepening. Higher rates would be negative for preferred shares which are typically sensitive to changes in interest rates. The current dividend yield of PFF also appears expensive relative to its historical average.

(source: Finviz.com)

PFF Background

The iShares Preferred & Income Securities ETF is the largest fund of its type and diversified across 484 current holdings. These securities have characteristics of a hybrid between bonds and stocks as they typically pay fixed dividends at a rate above common shares while also representing an equity position in the underlying company. Investors give up some of the appreciation potential of common shares for higher yields overall lower risk. Within the capital structure, preferred shares are senior to common stocks but below corporate bonds.