The funds will be overseen by a team of experienced factor ETF experts led by Peter Hubbard, Director, ETF Portfolio Management, and Jeff Kernagis, Senior ETF Portfolio Manager for Fixed Income. The two Investment Grade style bond ETFs are the first of a kind in the factor space.

![]()

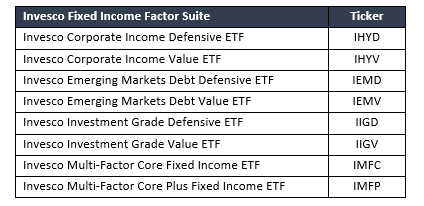

With the addition of these funds, Invesco now has a total of 84 ETFs in its factor line-up. This robust suite of factor ETFs, the largest from any ETF provider, offers investors access to factor exposures that expand portfolio construction opportunities.

The new Fixed Income Factor ETFs represent the first instance of Invesco directly leveraging investment ideas from Invesco Fixed Income’s Multi-Sector & Global Strategies team into a rules-based strategy that emphasizes consistency. Invesco’s Fixed Income team shared its unique perspective and specialized background so that Invesco Indexing could capture the team’s proficiency within fixed income factor indexes. These strategies seek to take advantage of recurring market risk premia found in fixed income to deliver key outcomes across a variety of fixed income asset classes.

Related: PowerShares by Invesco Finalizes Guggenheim ETF Deal

Invesco’s Fixed Income team has more than 34 years of experience in fixed income investing and fixed income active management. Invesco offers fixed income products across the firm in various types of investment vehicles including a robust fixed income ETF suite. Additionally, Invesco also has the largest platform of smart beta fixed income ETFs, both in terms of number of products (nine) and assets under management (AUM) of $6.5 billion (as of June 29, 2018).

For more new ETFs, click here.