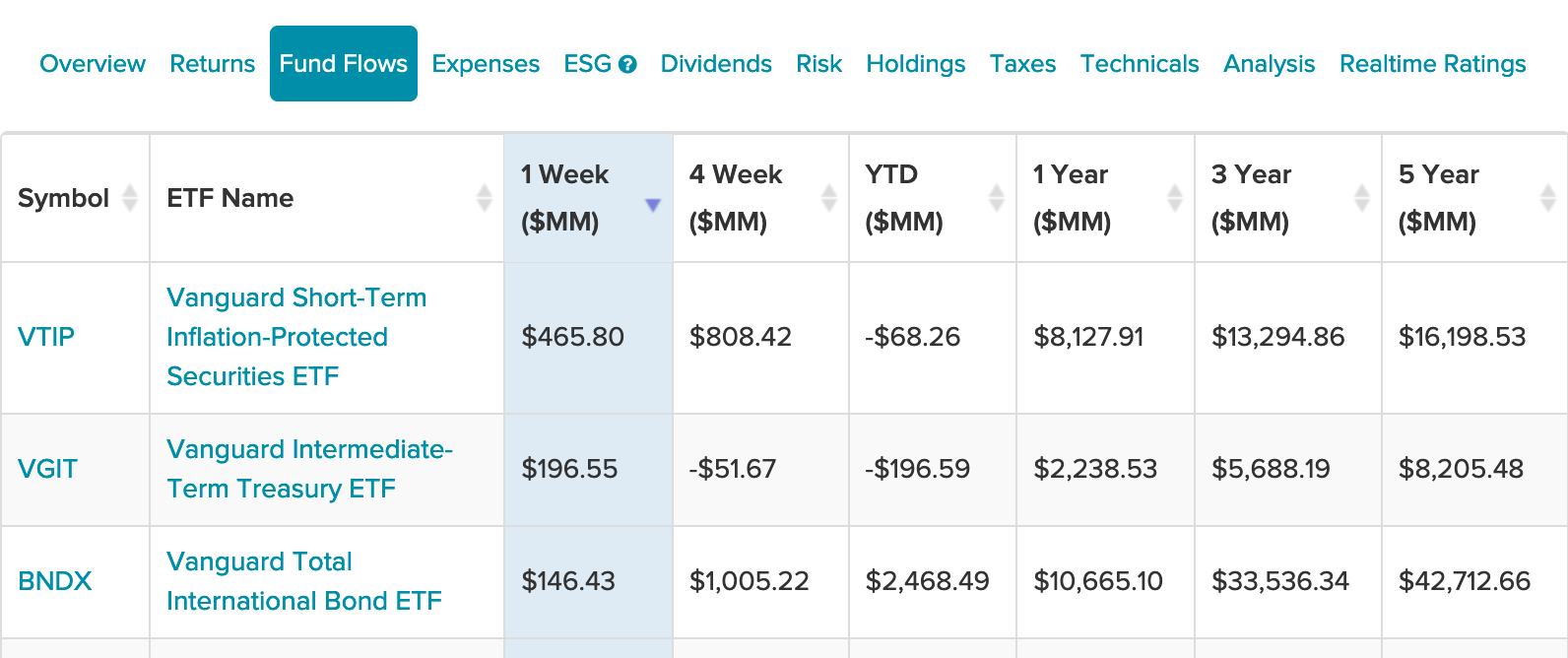

While Russia’s invasion of Ukraine is captivating the world at the moment, the capital markets continue to fixate on inflation. That’s evident in the inflows into Vanguard bond exchange traded funds (ETFs) over the past week, which highlight inflation protection.

Topping inflows is the Vanguard Short-Term Inflation-Protected Securities Index Fund ETF Shares (VTIP). The fund specifically tracks the performance of the Bloomberg U.S. Treasury Inflation-Protected Securities (TIPS) 0-5 Year Index, which is a market capitalization-weighted index that includes all inflation-protected public obligations issued by the U.S. Treasury with remaining maturities of less than five years.

Of course, yield is also a prime factor with bond investors, and the Vanguard Intermediate-Term Treasury Index Fund ETF Shares (VGIT) straddles the line between obtaining yield while limiting duration. It’s an ideal option for bond investors who want more than what a short-duration bond ETF can offer in terms of yield, but not the rate risk that goes with stepping out further into the yield curve.

Per the fund description, VGIT seeks to track the performance of a market-weighted Treasury index with an intermediate-term dollar-weighted average maturity. The fund employs an indexing investment approach designed to track the performance of the Bloomberg U.S. Treasury 3-10 Year Bond Index, which includes fixed income securities issued by the U.S. Treasury (not including inflation-protected bonds) with maturities between three and 10 years.

Bond Exposure Overseas

For more diversified debt exposure, investors can look to opportunities overseas. Rounding out the top three in inflows over the past week is the Vanguard Total International Bond Index Fund ETF Shares (BNDX).

BNDX seeks to track the performance of a benchmark index that measures the investment return of non-U.S. dollar-denominated investment-grade bonds. As mentioned, international bonds can provide a diversification tool for fixed income investors looking to supplement their current core portfolios.

The ETF employs an indexing investment approach designed to track the performance of the Bloomberg Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged). The index provides a broad-based measure of the global, investment-grade, fixed-rate debt markets.

For more news, information, and strategy, visit the Fixed Income Channel.