By Hong Xie, Senior Director, Global Research & Design for S&P Dow Jones Indices

Our fundamental credit strength strategy uses credit ratios to screen out issuers with risky credit profiles and construct corporate bond portfolios with strong credit quality (for a detailed methodology, please see our previous blog). Our research shows that a credit strength strategy can potentially reduce return volatility and improve drawdowns. Our goal in this blog is to further highlight that a credit strength strategy can offer downside protection and sector diversification.

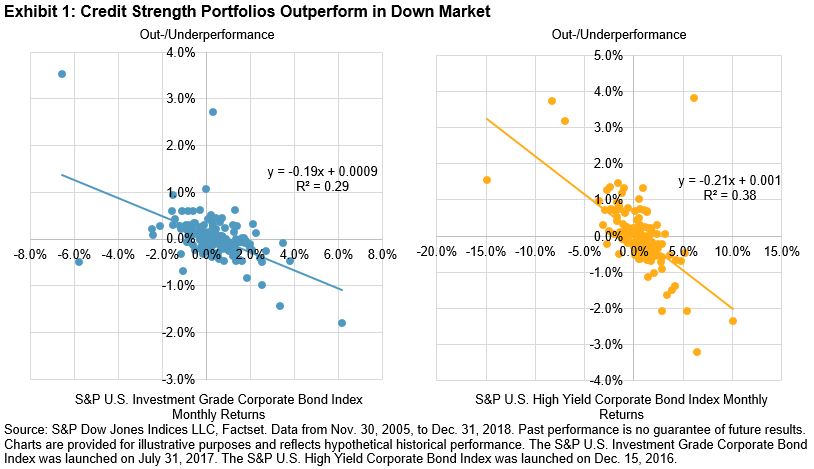

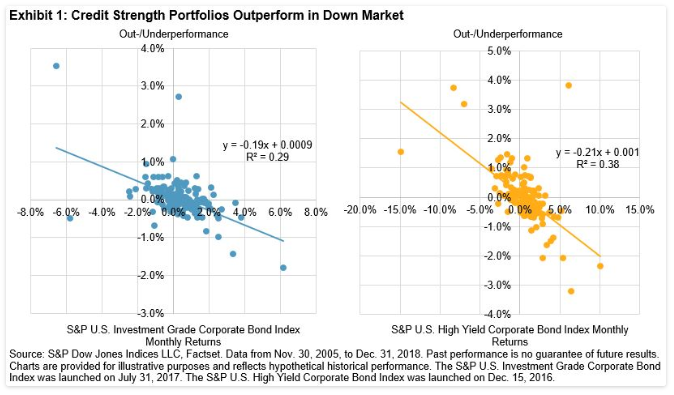

Exhibit 1 illustrates the defensiveness of the credit strength strategy. Both investment-grade and high-yield credit strength portfolios tend to outperform (underperform) the broad market when the credit market falls (rises). This observation is consistent with the reduction in return volatility and drawdown we find in our research (volatility and drawdown are reduced by 12%/16% and 25%/30% for investment-grade/high yield, respectively).[1]

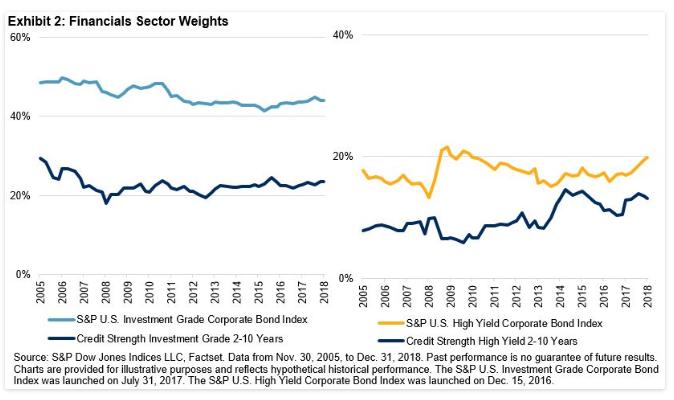

As a bottom-up fundamental credit approach, our credit strength strategy emphasizes issuer selection and weighs issuers equally, thereby reducing the overconcentration of financial issuers in the portfolio. A traditional corporate bond index weighs constituents by bond size, meaning an issuer’s weight is dictated by the amount of debt the issuer has outstanding. Therefore, a market-value-weighted corporate bond index tends to have its weight disproportionately concentrated in issuers from the Financials sector, as illustrated by the S&P U.S. Investment Grade Corporate Bond Index (see Exhibit 2).

Weighting issuers equally is one way to avoid overconcentration in issuers or sectors with the most debt, and this strategy is consistent with the goal of constructing a portfolio with better credit fundamentals. Exhibit 2 compares the Financials sector weights in our hypothetical credit strength portfolios versus traditional corporate bond indices.

The diversification effect is noticeable in both investment-grade and high-yield bonds, and it is particularly pronounced in investment-grade bonds, where the average allocation to Financials in the credit strength strategy is nearly half of the broad investment-grade corporate bond index (20% versus 40%).

Defensive portfolios with diversified sector allocation may potentially be able to offer lower return volatilities. A properly constructed credit strength portfolio can offer effective credit exposure for long-term corporate bond investors while improving risk-adjusted returns and mitigating credit risk.

[1] For more details, please see our previous blog: https://www.indexologyblog.com/2019/07/10/using-credit-ratios-to-build-defensive-corporate-bond-portfolios/