Valuations for municipal bonds are very attractive right now. And as yields remain strong, so do their fundamentals.

“Only during the credit and liquidity strain of the global financial crisis have we seen muni bonds trade at these yield levels,” according to Vanguard. “Our credit analysts believe state balance sheets are on firm footing and there are plenty of high-quality credit opportunities within revenue sectors.”

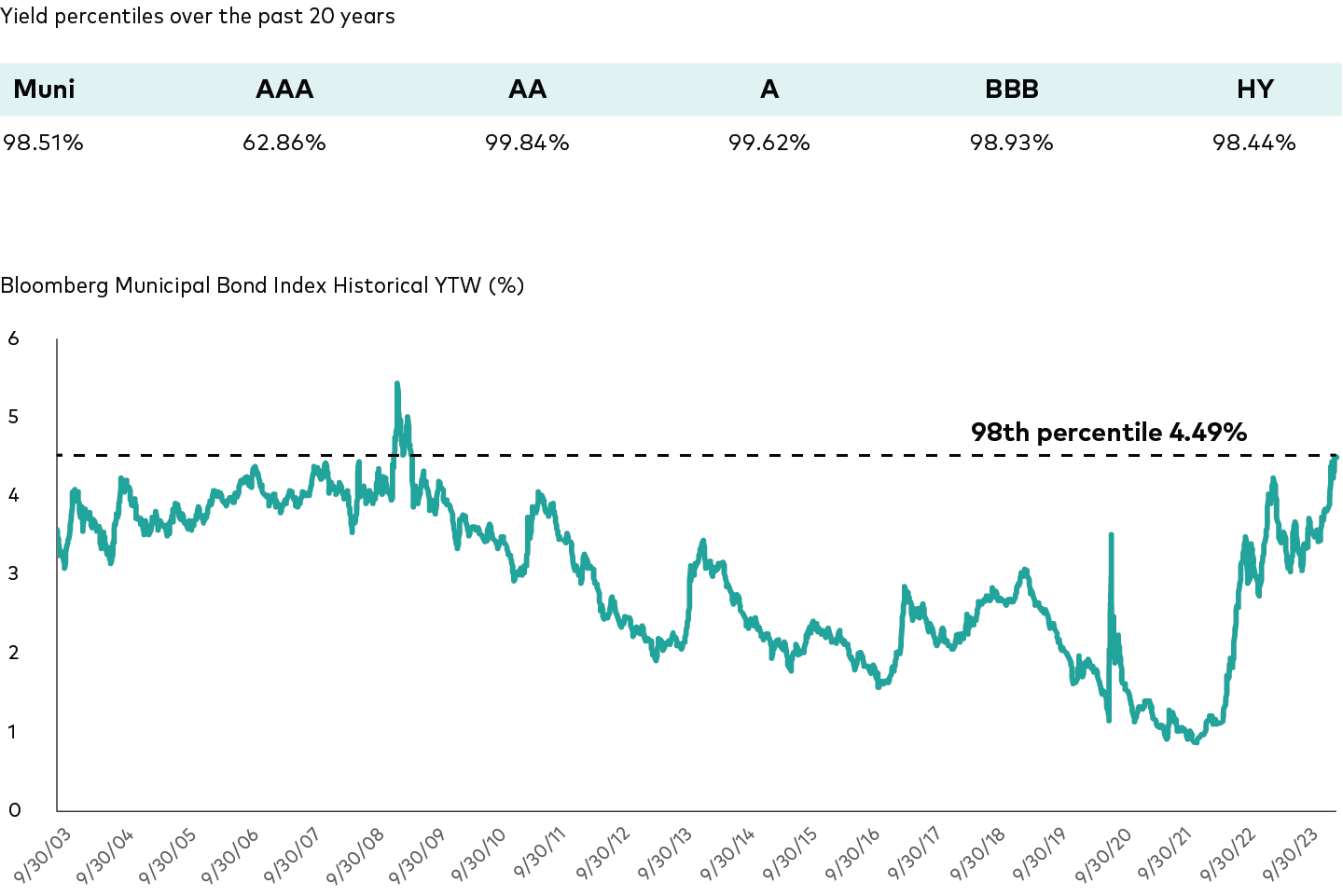

Per Vanguard, the top-line yield for the broad market has been trading above the 98th percentile for the past two decades.

Source: Bloomberg and Vanguard calculations, as of November 1, 2003, to October 31, 2023. Past performance is not a guarantee of future returns.

See more: “Munis on Track to Having a Strong Year”

Target Munis With VTES & VTEB

And with tax-equivalent yields for munis being so compelling, investors in higher tax brackets may want to give muni bonds a closer look. Two examples to gain exposure are muni ETFs like the Vanguard Short-Term Tax-Exempt Bond ETF (VTES) and the Vanguard Tax-Exempt Bond ETF (VTEB).

VTES targets investment-grade U.S. muni bonds with remaining maturities between one month and seven years.

Vanguard designed VTES to balance the need for tax efficiency with the need for tax-exempt yield. This balance can translate to potentially higher yields for an appropriate level of duration risk. The asset manager launched the fund for investors seeking tax-exempt yield for their portfolios while minimizing interest rate sensitivity.

“VTES is designed for tax-sensitive investors who have a preference for taking on less interest rate risk than the overall municipal market,” Vanguard’s Head of Fixed Income Product Jeff Johnson told VettaFi.

In the same interview, Janel Jackson, Vanguard’s head of ETF capital markets, said, “We saw an opportunity for investors who have an interest rate preference that’s on the shorter end of the curve.”

VTES has an expense ratio of 7 basis points.

VTEB targets investment-grade U.S. muni bonds by tracking the Standard & Poor’s National AMT-Free Municipal Bond Index. Its holdings have an average duration of 5.8 years.

“We’ve seen growing demand for fixed income ETFs in general,” Johnson said. “But within fixed income, there’s been particular excitement and greater demand for munis.”

VTEB has an expense ratio of 5 basis points.

For more news, information, and analysis, visit the Fixed Income Channel.