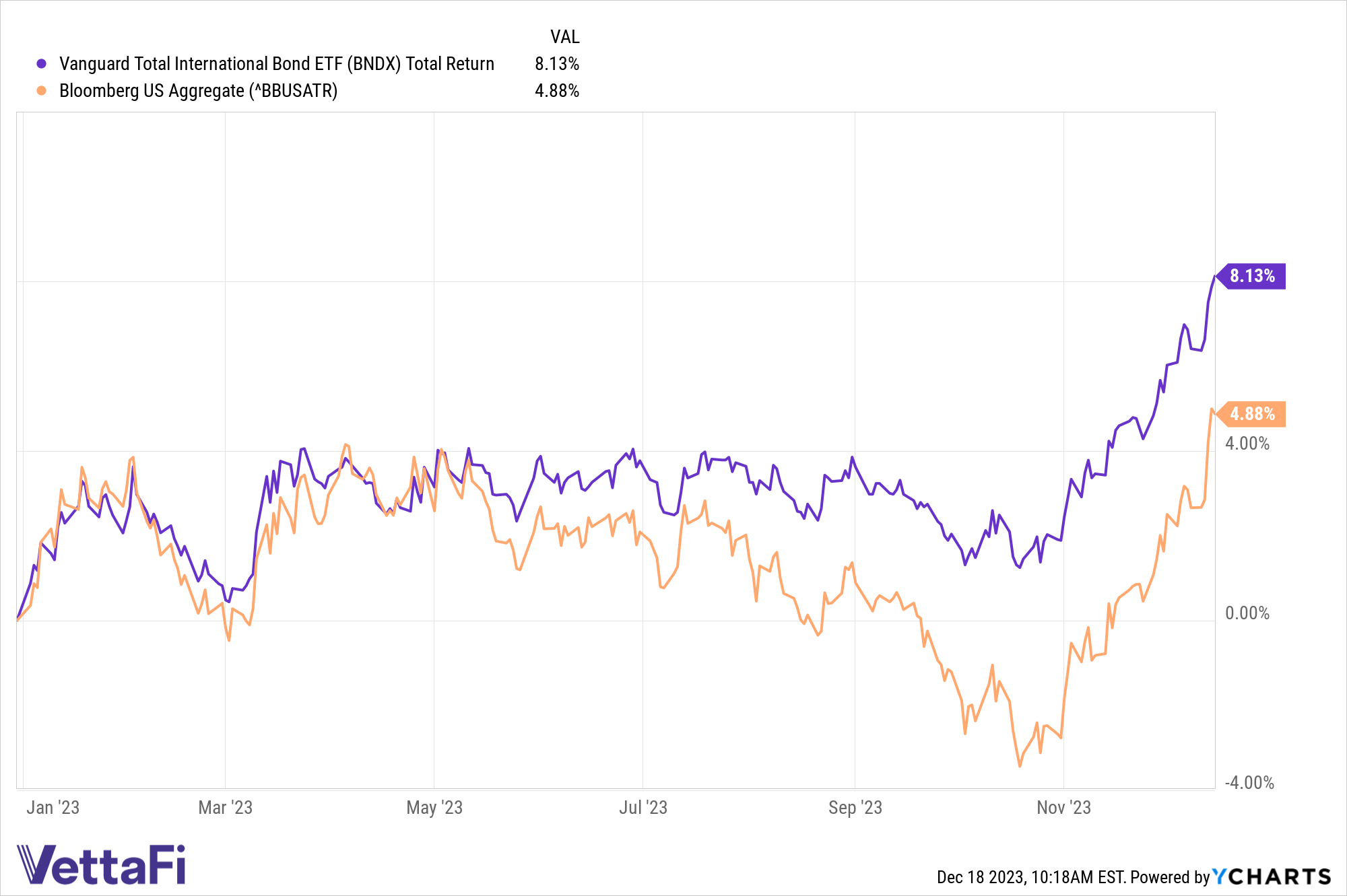

We talk a lot about high yields with U.S. fixed income. But international bond funds aren’t doing too shabby these days, either. In fact, it could be argued that international bonds are yielding better results than their domestic counterparts.

After all, check out how the Vanguard Total International Bond ETF (BNDX), is doing. The fund offers broad fixed income exposure across major bond markets outside of the U.S.

Year to date, BNDX has outperformed the Bloomberg US Aggregate by 3.25 percentage points. Not basis points. Percentage points.

See more: “Vanguard’s BND Becomes First Bond ETF to Reach $100B in Assets”

A Good Way to Enhance Risk-Adjusted Returns

There’s clearly a lot of value to be gained from international bonds. Vanguard argues that including a substantial portion of international bonds in investors’ portfolios is a good way to enhance risk-adjusted returns.

“By building a retirement portfolio that holds only familiar investments, investors may neglect one of the largest asset classes in the world: international bonds,” according to Vanguard. “Many people are unaware that international bonds make up about 24% of the liquid, investable market and 52% of the global bond market.”

Vanguard suggests that investors should allocated 30% of their total fixed income exposure to international bonds.

Delivering Low-Cost, Scalable Advice on a Digitally Enabled Platform

Vanguard continues to be “the Hoover of the ETF industry,” as VettaFi’s Vice Chairman Tom Lydon called the firm. Vanguard crossed the $2 trillion mark in U.S.-listed ETF assets under management earlier this year.

At the Exchange 2023 conference, Vanguard’s CEO Tim Buckley outlined the firm’s approach to delivering top-performing funds and ETFs.

“Our goal is to ensure we’re producing the top-performing funds and ETFs out there,” he said. “We’ll wrap it with low-cost, scalable advice and deliver them on a world-class, digitally enabled platform.”

Added Buckley: “And if you do that well and you can keep improving it, you’ll create value into the future.”

For more news, information, and analysis, visit the Fixed Income Channel.