The Federal Reserve has been on cruise control thus far in 2019 with respect to interest rate policy, opting to keep the federal funds rate untouched. However, the bond markets are screaming for a rate cut, according to Sevens Report Research.

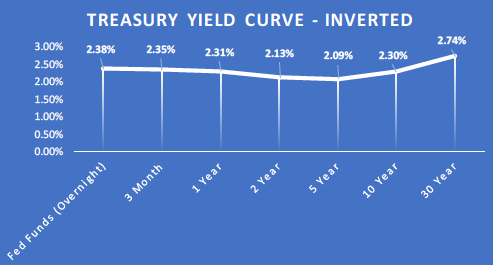

The bond markets threw a curve ball at fixed income investors earlier this year with an inverted yield curve, sending the capital markets overall on another volatile ride–something they may or may not have been accustomed to during the fourth quarter of 2018. The short-term 3-month and longer-term 10-year yield curve inverted–an event that hasn’t been seen since 2007–just ahead of the financial crisis.

The spread between the 3-month and 10-year notes fell below 10 basis points for the first time in over a decade. This strong recession indicator contrasted a more upbeat central bank, but the bond markets are saying otherwise.

“There can be no clearer message than that to the Fed: Rates are too high,” according to Sevens Report Research. “This is the bond market’s equivalent of a bullhorn screaming it in Powell’s face.”

Furthermore, Sevens Report Research delved into exactly why this inverted yield curve phenomenon exists and why it matters to the bond markets in the first place.

“Understanding why yield curves invert is often over complicated,” they noted. “Here’s why yield curves invert: Investors fear the future so much, that return of capital becomes more important than return on capital. More specifically, bond investors become so concerned about future economic growth and inflation, that they simply want the best guaranteed return they can get. So, they sell out of lower-yielding, shorter-dated Treasury maturities (which causes those yields to go up) and those investors pile into the longest-dated Treasuries (which pushes those yields lower) for the max yield in a safe investment.”

Trade War Impact

Given this latest obstacle, fixed income investors now have to get strategic when it comes to the bond markets as well. It’s not just inverted yield curves that are presenting challenges for fixed income investors. Kristina Hooper, Chief Global Market Strategist at Invesco identified trade wars as one of the major trends that could affect the bond markets in the long run.

Investors are well aware of the impact of trade wars by now. Hooper cited two positive developments, however, according to Hooper:

- The Trump administration will postpone applying auto tariffs on imports from the European Union and Japan for as much as six months.

- The Trump administration is eliminating steel tariffs for Canada and Mexico.

“Stocks moved up on the news, as it seemed to indicate that the Trump administration is willing to negotiate and be flexible when it comes to trade negotiations,” Hooper noted. “However, I believe that is a misreading of these developments. I think the US is desperate to take attention away from the deterioration in trade relations between the US and China by providing some positive news flow vis-a-vis trade. In addition, I believe that the US may now realize that traditional allies could help it place pressure on China, and is now trying to win them over after alienating them with trade conflicts of their own.”

For more market trends, visit ETF Trends.