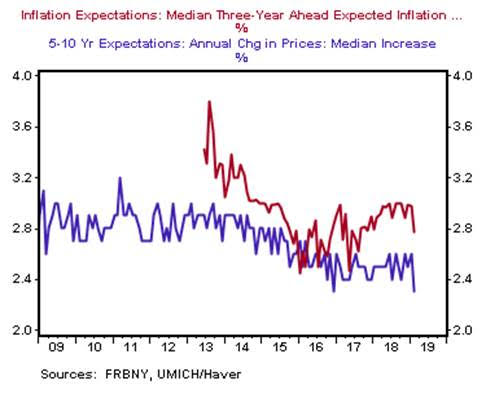

A mix of data regarding manufacturing, business confidence and consumer data have tempered growth prospects, which has prevented inflation from going past the 2 percent target the Federal Reserve set. 2018 marks the seventh year inflation hasn’t gone past this target.

Reider noted that “the key to why today’s report is interesting, but not that significant in terms of market disposition, is that the Fed is looking to see inflationary expectations rise before attempting another rate increase This Fed is willing to now let inflation, and inflationary expectations, move above its long-term target, as there is a need to see inflationary expectations move higher from here, while the near-term data suggests that prices are likely to move in the other direction, with decelerating inflation prints through mid-year.”

“Patience” has been a mainstay in Fedspeak as of late and in January, the central bank elected to keep the federal funds rate unchanged, saying that it will be patient moving forward with respect to further rate adjustments.

January’s decision to keep rates flat came as the Fed didn’t show much dynamism in 2018, obstinately sticking with a rate-hiking measure with four increases in the federal funds rate. That appears to have changed given the current economic landscape, and especially in the capital markets as Fed Chair Jerome Powell is now preaching patience and adaptability–that will likely continue to be the case moving forward.

For more market trends, visit ETF Trends.