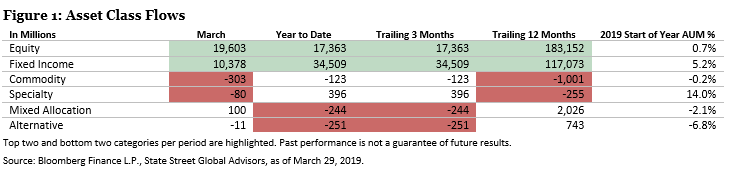

It’s no doubt that the volatility-laden fourth quarter of 2018 spurred an investor move to bonds, but that trend persisted in the first quarter of 2019 with $34.5 billion going into fixed income exchange-traded funds (ETFs), according to a US-Listed Flash Flows Report from State Street Global Advisors.

It provided more evidence that investors are picking themselves up in 2019 after a tumultuous way to end 2018. The Dow Jones Industrial Average fell 5.6 percent, while the S&P 500 was down 6.2 percent and the Nasdaq Composite declined 4 percent.

2018 marked the worst year for stocks since 2008 and only the second year the Dow and S&P 500 fell in the past decade. In 2019, investors are no doubt reassessing their strategies for how to distribute their capital through the rest of the year.

That said, more investors began to add fixed income products to their portfolios.

“While equity funds took in the most flows last month, bond funds are now breaking records and making headlines,” wrote Matt Bartolini, Head of SPDR Americas Research at State Street Global Advisors. “Fixed income ETFs have taken in $34.5 billion to start the year, the highest flow total ever for a first quarter, narrowly beating out the hot start to 2016.

“The $34.5 billion represents an increase of 5.2% of fixed income ETFs start-of-year assets. If bond funds are able to maintain this pace, it would lead to over $130 billion of fund flows–a figure that would represent new all-time record and likely push total assets over $800 billion for the first time.”

That being said, which fund has stood head and shoulders above the rest thus far in 2019?

Turning Up the Dial on Yield

Domestically, seeking opportunities within high yield might seem like an arcane idea given the serendipitous bull run came to a crashing halt in the volatility-laden fourth quarter of 2018. The risk-on sentiment that fueled three-fourths of 2018 may have gone asunder as the massive sell-offs took place to end 2018.

Nonetheless, investors are still on the hunt for high-yielding income despite the challenges that loom in the debt market. One of those is the Federal Reserve’s policy regarding interest rates.

One ETF worth looking at is the Invesco BulletShares 2026 High Yield Corporate Bond ETF. BSJQ seeks to track the investment results of the Nasdaq BulletShares® USD High Yield Corporate Bond 2026 Index, which measures the performance of a portfolio of U.S. dollar-denominated high yield corporate bonds with maturities or, in some cases, “effective maturities” in the year 2026.

As of April 25, BSJQ is up over 10 percent despite the current challenges in the bond markets. It can provide a high-yield complement to broad exposure to the bond markets via the iShares Core US Aggregate Bond ETF (NYSEArca: AGG).

Of course, the continued challenge for BSJQ and other high-yield ETFs will be the forthcoming action of the central bank for the rest of the year.

Following the central bank’s decision to keep interest rates unchanged last month, there’s been a recurring theme of “patience” in Fedspeak as of late. Federal Reserve Chairman Jerome Powell reiterated patience during last month’s press conference following the rate announcement and also mentioned that the U.S. economy is in a “good place.”

In move that was widely anticipated by most market experts, the Federal Reserve last month elected to keep rates unchanged, holding its policy rate in a range between 2.25 percent and 2.5 percent. In addition, the central bank alluded to no more rate hikes for the rest of 2019 after initially forecasting two.

For more market trends, visit ETF Trends.