Inflation is running hot while the Federal Reserve is looking to taper its stimulus measures, but this could all be of benefit to mortgage-backed securities (MBS).

The consumer price index hit a three-decade high in October, and the real estate market isn’t getting cheaper. Mortgage rates dipped lower, but the current market environment could still sway in the favor of MBS investors.

“This week’s rates are a welcome relief for homebuyers still navigating limited inventory and higher prices among homes for sale,” Realtor.com said. “Data show that from last year, active inventory is down more than 20% and there are less than half as many homes for sale now compared to the same time in 2019.”

“Going forward, our expectation is that despite recent moves lower, mortgage rates will begin to climb as the Fed reduces its purchase of mortgage-backed securities by $5 billion per month in November and December,” Realtor.com said further. “While rising home prices and mortgage rates mean higher overall housing costs, homebuyers can prepare by rate-proofing their budgets. Buyers can use online tools like mortgage affordability calculators to know how rate increases will impact monthly costs and adjust their expectations and plans accordingly.”

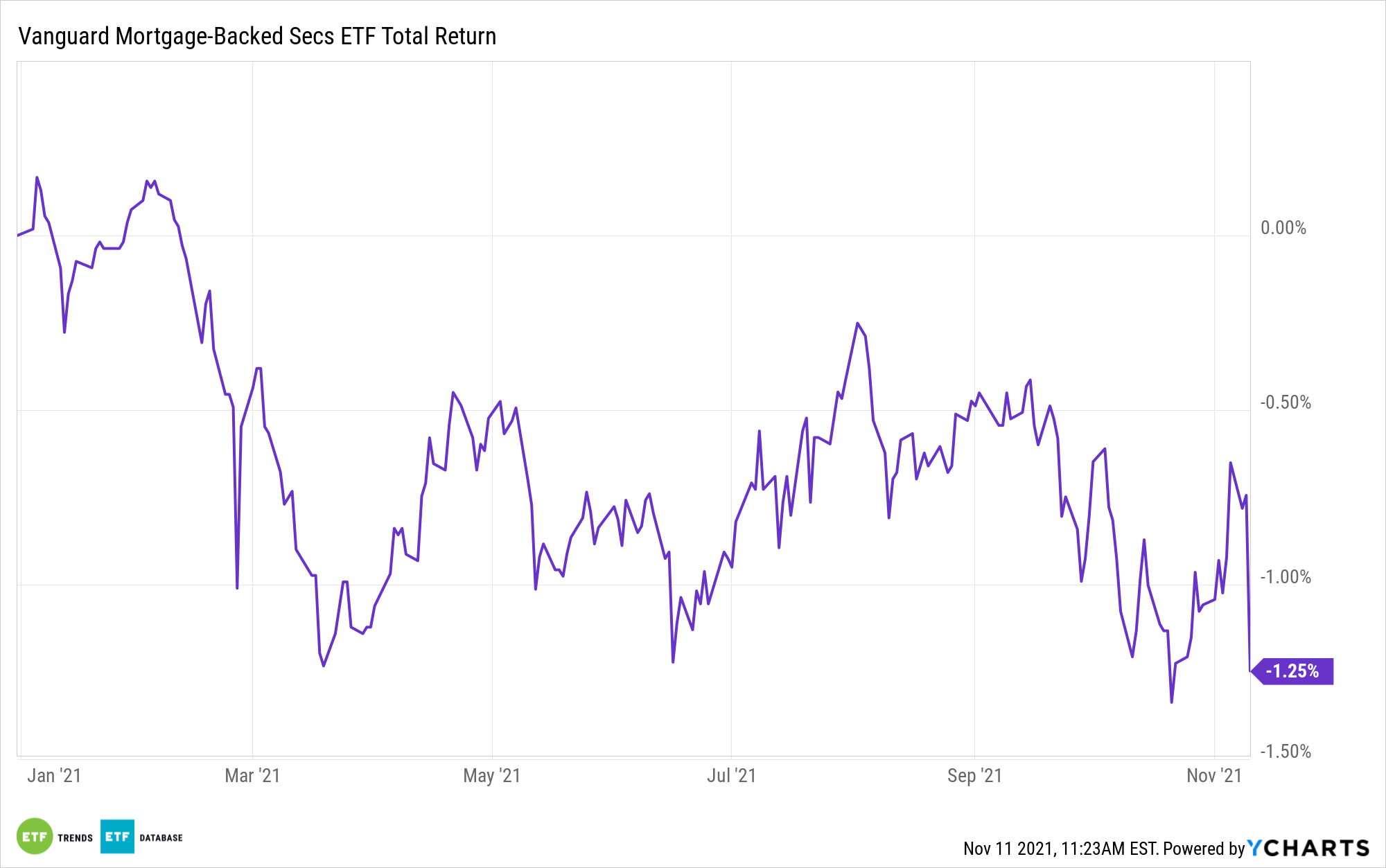

One way to get MBS exposure in an ETF wrapper is the Vanguard Mortgage-Backed Securities Index Fund ETF Shares (VMBS). VMBS seeks to track the performance of a market-weighted mortgage-backed securities index, which is designed to track the performance of the Bloomberg U.S. MBS Float Adjusted Index, which covers U.S. agency mortgage-backed pass-through securities.

To be included in the index, pool aggregates must have at least $250 million currently outstanding and a weighted average maturity of at least one year. All of the fund’s investments will be selected through the sampling process, and under normal circumstances, at least 80% of the fund’s assets will be invested in bonds included in the index.

Extracting Income From Higher Rates

Even if the Fed decides to tighten up monetary policy and raise rates in 2022, VMBS can also rise in tandem since it derives its income from higher rates in mortgages. With debt holdings backed by the government, VMBS gives fixed income investors that extra layer of security.

Highlights of VMBS:

- Seeks to provide a moderate and sustainable level of current income.

- Invests primarily in U.S. agency mortgage-backed pass-through securities issued by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC).

- Moderate interest rate risk, with a dollar-weighted average maturity of three to 10 years.

For more news, information, and strategy, visit the Fixed Income Channel.