“When Hinton was interviewed on the American television show 60 Minutes, the interviewer asked whether he was angry at those who had put him in jail. He responded that he had forgiven all the people who had sent him to jail. The interviewer incredulously asked, ‘But they took thirty years of your life—how can you not be angry?’ Hinton responded, ‘If I’m angry and unforgiving, they will have taken the rest of my life.’ Unforgiveness robs us of our ability to enjoy and appreciate our life, because we are trapped in a past filled with anger and bitterness. Forgiveness allows us to move beyond the past and appreciate the present, including the drops of rain falling on our face.”

Dalai Lama, Desmond Tutu, and Douglas Carlton Abrams The Book of Joy

The View from 30,000 feet

Last week was packed with positive developments: A debt ceiling crisis was averted, which brought with it question marks about the impacts of the tidal wave of debt issuance to follow, the Fed increased messaging around the pause in June, on the back of limited signs of weakening inflation and or tightening of the labor market, and the hated narrow rally began to widen out into the broader indices. Also of interest is socialization and acceptance a twist to the soft-landing narrative. The latest narrative is centered around a rolling recession thesis, where silos of the economy such as manufacturing, tech and housing enter short, sector specific recessions, driven by wild pandemic/post-pandemic imbalances in liquidity and demand abruptly correcting, while massive cash balances buffer a whipsaw lower while liquidity is being choked off.

Although this is a plausible explanation for what is occurring on a coincident basis, the theory leaves a large question mark when cash balances supporting spending fade and the sequestering of liquidity gains traction. In the meantime, bears, attached to weak fundamentals in manufacturing and sentiment remain locked in a battle against bulls, who continue to play AI driven momentum and cling to cash balances and wage growth driving spending until it runs dry.

- Messaging from Fed and labor market report combine to create consensus view of a pause

- The battle between slowing manufacturing sector vs strong consumer and with AI frenzy

- Signals of a material slowdown taking shape in Europe and Asia come into focus

- The most Frequently Asked Question from client’s this week: With the persistent strength in the labor markets and inflation, when will the Fed cut rates?

Messaging from Fed and labor market report combine to create consensus view of a pause

- The week began with a 72% probability that the Fed would hike 25 bps to 550 bps on June 14th and ended the week with a 69% probability that the Fed would pause on June 14th.

- Jefferson, who is expected to be the next Vice Chair of the Fed, provided guidance assumed to be blessed by Powell, that the Fed intends to hold rates steady in June, which created a shift in expectations.

- Last week’s labor market data indicated fraying around the edges.

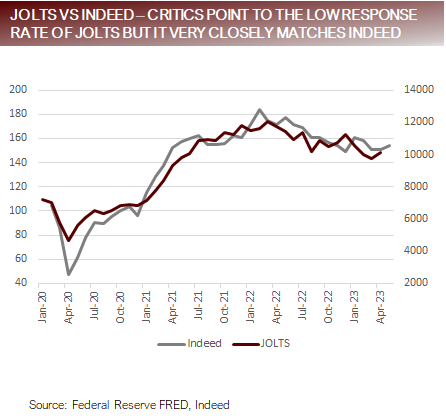

- JOLTS

- Unexpected rose to 1m openings vs expectations of a decline to 9.4m.

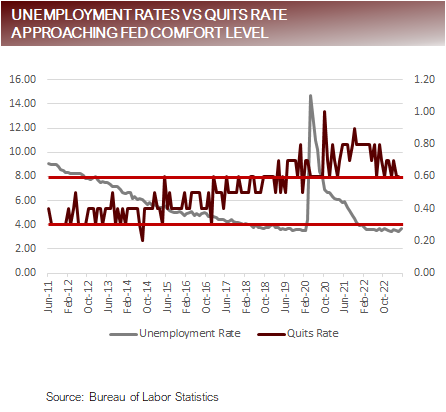

- Silver Lining: Quits rate fell to 4, bringing it back inline with pre-pandemic trends.

- Unemployment Claims

- Came in at 232k, continuing to trend lower since mid-March, signaling a leading indicator of lack of strength in labor markets.

- Payroll Report

- Nonfarm Payrolls added 339k jobs, the 14th consecutive beat of expectations, confounding even the most bullish analysts.

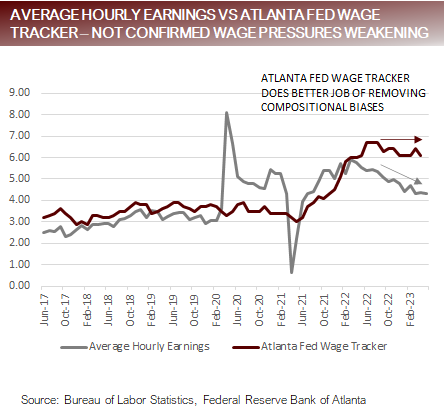

- Silver Lining: The Unemployment Rate, which climbed 2 to 3.7, Average Hourly earnings, were slightly softer than expected, and average weekly hour dropped to 34.3, which is below the pre-pandemic trend of 34.4.

- Bottom Line

- Some measures of the labor markets are beginning to show cracks, but coincident indicators are still above the Fed’s comfort level. Fed policy is clearly restrictive, and the banking crisis of March is expected to have large impacts on the availability of credit. There is a growing consensus that the Fed has gone far enough and now can afford to sit back and assess the impacts of policy and the tightening of credit conditions to see if they have hit the brakes hard enough or if they need to apply more pressure.

- JOLTS

Labor market has yet to confirm weakening consistent with achieving Fed targets

The battle between slowing manufacturing sector vs strong consumer and with AI frenzy

- Weakness in the economy has been centered around:

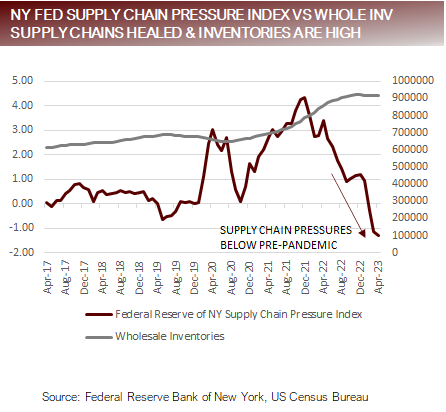

- Correcting manufacturing imbalances caused by clogged supply chains and consumers flush with cash

- A sharp slowdown in housing associated with higher rates and a lack of inventory

- Over hiring in tech that was extinguished in 2022

- Strength in the economy has been centered around:

- Resilient demand in the services sector

- Wage growth in excess of goods inflation and excess savings allowing consumers to keep spending

- AI theme that has buoyed stock market and is driving a sense of optimism about a slowdown without an equity market correction

- Because of the asymmetrical effects to manufacturing and what appears to be little rate sensitivity in the service side of the economy the Fed may be becoming reluctant to continue to hike for fear of what it might do to manufacturing and banking, while becoming cognizant of lack of transmission to the service side of the economy.

- With recent signs that housing is finding a floor and the disinflationary impulse from manufacturing is subsiding, the question for the Fed will be what happens if they don’t get the disinflationary help they need from housing and manufacturing, given that services us showing immunity from higher rates.

The help the Fed was getting from disinflationary pressures in manufacturing due to subside

Signals of a material slowdown taking shape in Europe and Asia come into focus

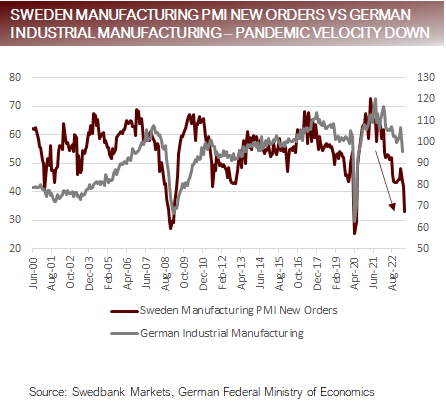

- Signs across Europe indicate a material slowdown is brewing.

- Sweden, which tends to be a good marker for industrial production in Europe reported a level of 6 for its PMI, the 3rd lowest measurement in the history of their manufacturing PMI data.

- Germany Industrial Manufacturing Orders last reading was -10.7%, the 3rd lowest measurement in the history of the

- Hopes of a Chinese reopening have fizzled and taken with other countries in Asia

- Chinese Manufacturing PMI measured 5, moving back into contraction in May.

- The Hang Seng is down 5% from its high in late January.

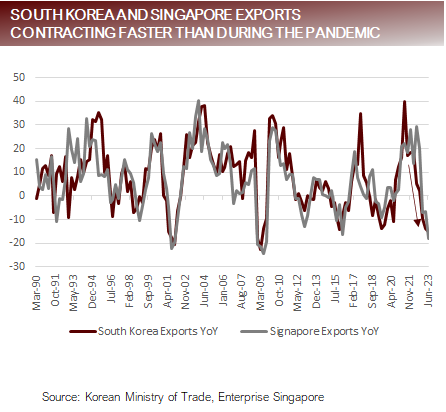

- Korea Exports were down -15.2% year over year and Singapore Exports were down -18.1% year over year in May, registering a larger retreat then during the pandemic and the 4th largest drop since 1966 for each country.

- With two out of three of the world’s largest economies flashing red and the Chinese stock market flirting with bear market territory, global growth will struggle to gain traction without policy support

- Current levels of weakness have traditionally ushered in policy support but may fail to in this cycle because of inflationary concerns by central banks.

- Saudi Arabia is attempting to get in front of what they believe will be a material global slowdown in demand by announcing another million barrel a day cut to try and balance supply with falling demand. The production cut will lower Saudi Ariba to less than 9m barrels a day, Other than the pandemic this will be Saudi Arabia’s lowest production since 2011.

European Manufacturing PMI New Orders and Asian exports falling as fast or faster than pandemic

FAQ: With the persistent strength in the labor markets and inflation, when will the Fed cut rates?

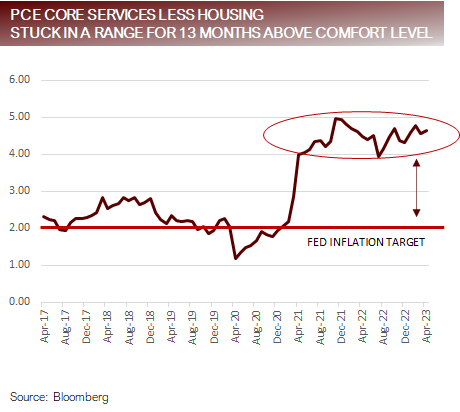

- The biggest wildcard right now is what the Fed’s reaction function looks like. Over the last decade, the Fed moved preemptively in front risks to employment and growth. They could afford to act preemptively because inflation was not a concern. That is not the case in 2023. Although, inflation has come off its high of a year ago, Core PCE has not moved appreciably in over a year and is not near the Fed’s comfort level so even if employment moves inline, the Fed may be slow to ease policy.

- The Fed has two mandates, plus

- Price Stability (PCE Target 0%)

- Full Employment (Unemployment Target 0%)

- Financial Stability (First Priority)

- Ideally, the Fed would target policy based on forecasts to balance price stability with growth, but massive imbalances driven by the flood of liquidity and crimped supply chains has created inconsistencies in data that has made historical relationships and forecasts less reliable.

- The Fed is choosing to take a wait and see approach, weighting decisions in favor of coincident data in the decision-making process, rather than rely on This leaves them prone to make errors because they are not fully considering the implications of their actions, rather they are looking at current impacts, which are measured with a lag.

- If the wildcard is when they Fed will cut rates, the biggest risk is that the markets are miscalculating the Fed’s reaction function and associating historical levels of weakness with policy shifts that may not exist when inflation is not showing coincident signs of containment.

Fed focused on coincident data that is not at levels that indicate comfort level for easing

Putting it all together

- Global manufacturing data is deteriorating rapidly, nearing levels where over the last decade it would be normal to see policy intervention because inflation was being held in check.

- The first signals of policy shifts are appearing from central banks around the world. Every central bank will have their own reaction function based on their perceived level of risk for inflation, mix of policy priorities, experience of central bankers controlling policy and political pressures.

- In recent history, economic contractions coincide with a slowdown in aggregate demand, a downdraft in stock market prices and the beginning of a weaker labor

- However, the current cycle is being propped up excess cash balances, labor shortages and the AI stock frenzy, which are supporting aggregate demand and clouding the picture for asset prices.

- The current consensus from strategists and the Fed is that a recession has been pushed out the second half of However, S&P500 earnings estimate are expected to rise in the second half of 2023. This creates a conflicting view with equity prices already discounting the analyst view is correct.

For more news, information, and analysis, visit the Fixed Income Channel.