By Tay Jun Hao LLB

While there has been much discussion on the background of the Astrea IV bond issuance and the Class A-1 bonds available for the retail public, less discussion is available on the structural safeguards built into the bond issuance in general.

Flipping through the Astrea IV prospectus, we note that there are five key structural safeguards:

- Reserves accounts;

- Sponsor sharing;

- Maximum loan-to-value ratio;

- Liquidity facility; and

- Capital call facility

In order to have a better understanding as to how these safeguards can secure investors’ interests, let us take a deeper look at each safeguard and what they mean.

Related: Vanguard to Move Big Bond ETF to Nasdaq from NYSE

1. Reserves Accounts

The reserves accounts are specially earmarked accounts which are meant to accumulate cash specifically for the purposes of redeeming the Class A-1 and Class A-2 bonds on 14 June 2023.

Explanation: Think of the reserves account as a specially designated cash account that will accumulate cash from the proceeds of the private equity funds distributed to Astrea IV. This specially designated cash account is there specifically to redeem the bonds from bondholders when the bond matures.

Where Does the Cash for the Reserves Account Come From?

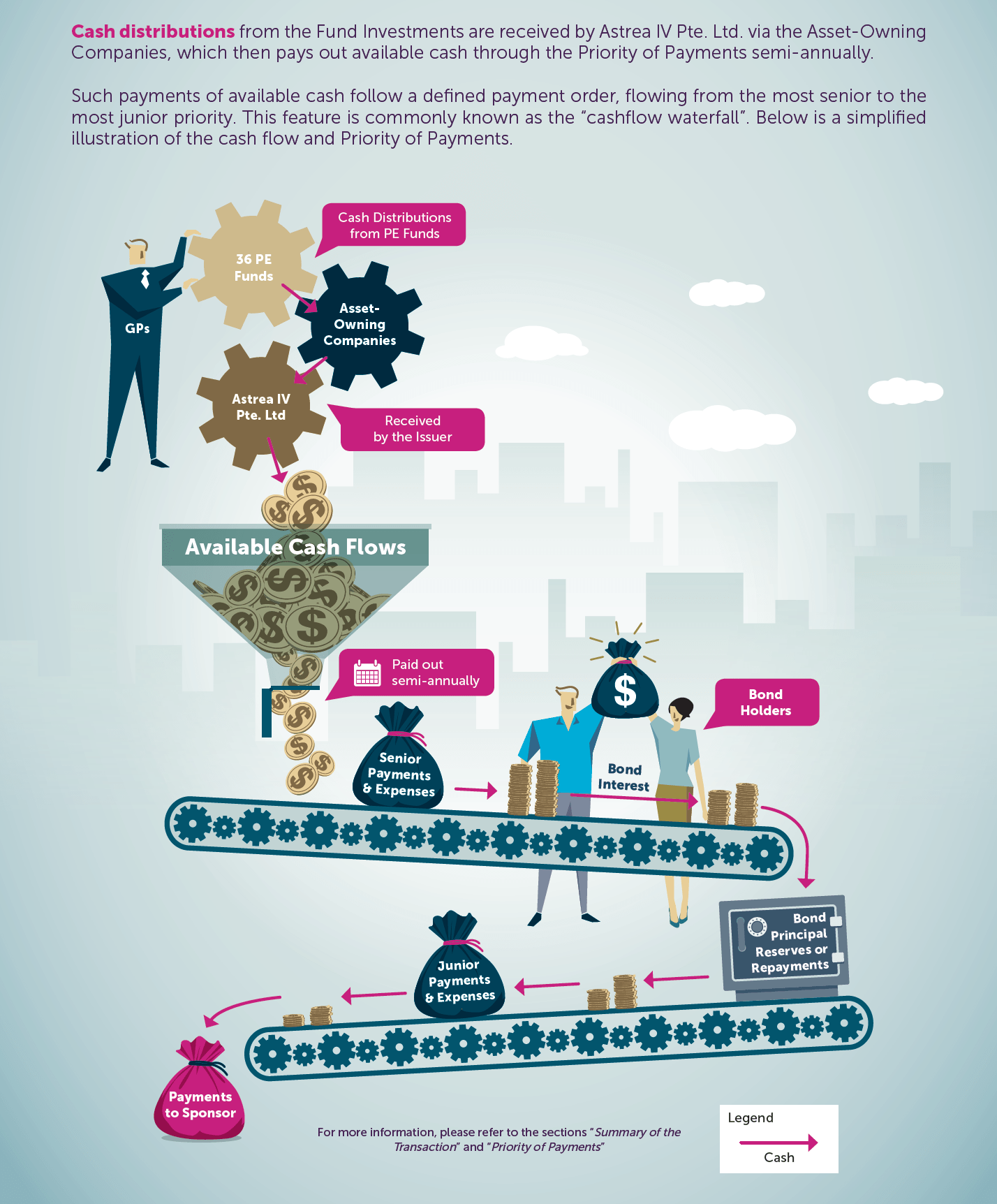

When the underlying assets of Astrea IV provides returns, usually in the form of cash distribution from the private equity (PE) funds, Astrea IV would have to redistribute these returns according to the Priority of Payment as stipulated in the prospectus.

After the payments for taxes, expenses and operations, the returns will be used to pay off the interest payment for the bonds and also to deposit some cash into the reserves account. The sum of money accumulated in the reserves account will be used to redeem the relevant bonds when they mature.

Explanation: When Astrea IV receives money from the distribution of proceeds from the private equity funds, the cash is distributed according to a ‘cashflow waterfall’. In simple terms, it just means that the cash is distributed according to different priorities as dictated by the offer document.

For example, if you were to sell your house which is still under mortgage, the bank would first collect the money owed to it and any interest still owed before you receive the remaining amount from the sale.

In this case, the interest payment for the bonds and the cash deposited in the reserves account rank near the top when any cash distributions from the private equity funds are made to Astrea IV.

![]()

2. Sponsor Sharing

The sponsor sharing feature is a new feature which was not available for the Astrea III bonds issued earlier. The feature accelerates the amount deposited into the reserves account if a performance threshold is met.

If the performance threshold of US $313 million (constituting 50% of Astrea IV’s equity) is returned to the sponsor, 50% of the subsequent cash flows available to the sponsor will be diverted to the reserves account to allow an accelerated build-up of capital in the reserves account for bond redemption.

Explanation: This means that after certain KPIs are met, the sponsor will divert more cash from fund distributions to the reserves account to ensure a much higher likelihood that the bondholders are paid off at redemption.

3. Maximum Loan-to-Value Ratio

The Astrea IV bonds have a maximum loan-to-value ratio of 50%. If the loan-to-value ratio exceeds 50%, the collateral cash flows would have to be diverted towards the reserves account until the pre-determined reserves account cap is met.