2021 was already a strong year, and it’s going to be another busy year in 2022 for municipal bonds with record issuance in the already $4 trillion dollar market.

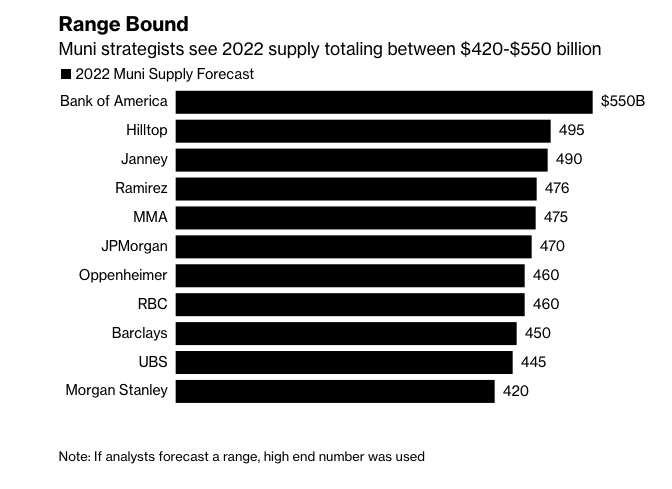

According to a Bloomberg article, sales predictions based on data “collected from almost a dozen firms range from about $420 billion to $495 billion. A notable outlier is the projection from researchers at Bank of America, the market’s largest underwriter, who expect a record year of sales totaling $550 billion.”

Those projections come after the trillion-dollar infrastructure package was signed into law this year. The expectation is that local governments will issue a record number of bonds to help fund a wide swathe of infrastructure packages.

“States and local governments have sold about $422 billion of long-term debt so far this year, plus another $20 billion sold with corporate identifiers with about three weeks left before the winter holidays,” the Bloomberg article mentions. “Including municipal-backed corporates, long-term sales are running at a pace about 5% below 2020, data compiled by Bloomberg show.”

In addition to the infrastructure package, driving issuance in 2021 was the expectation of higher taxes, especially since the trillion-dollar plan would add more federal government spending. Municipal bonds offer tax benefits, particularly for the well-to-do when it comes to fixed income alternatives.

“Governments will want to piggy back their own priorities onto projects being funded with federal dollars, and assuming the federal spending stabilizes or improves areas, it will encourage development, and development brings municipal bonds,” said Matt Fabian, a partner at Municipal Market Analytics, who estimates that 2022 will see an issuance between $450 and $475 billion.

Getting Municipal Bond Exposure

One place to get tax-free municipal bond exposure is via an ETF wrapper with funds like the Vanguard Tax-Exempt Bond ETF (VTEB). With a 0.06% expense ratio, the fund offers low-cost exposure to municipal debt.

VTEB tracks the Standard & Poor’s National AMT-Free Municipal Bond Index, which measures the performance of the investment-grade segment of the U.S. municipal bond market. This index includes municipal bonds from issuers that are primarily state or local governments or agencies whose interests are exempt from U.S. federal income taxes and the federal alternative minimum tax (AMT).

“Vanguard provides us with some very critical factors when evaluating a bond fund. With over 6000 bonds, individual bond risk is basically non-existent. This is also reflected in that the Top 50 holdings are only 13% of the ETF,” a Seeking Alpha article by Retired Investor notes.

For more news, information, and strategy, visit the Fixed Income Channel.