Despite facing regulatory headwinds in 2021, environmental, social, and governance (ESG) investing proliferated with more ESG bond issuance, and that strength is set to continue in 2022.

Refinitiv data shows that global green bond sales are expected to hit $1 trillion this year.

“The one trillion mark seemed unachievable still a couple of years ago,” said Julien Brune, head of DCM solutions and advisory at Societe Generale. “It is a landmark figure showing an extraordinary increase in investor and issuer awareness of the importance of ESG issues.”

The same Refinitiv data also shows that bond volume will reach $2 trillion if the ESG bond market can replicate what it did last year. That forecast is backed by banks, such as BNP Paribas, which expects volume to reach $880 billion.

“We are seeing extremely strong sustainable finance appetite from investors. The opportunity is there for 2022 to be a milestone year; over 40% of the world’s assets are onto net-zero trajectories and the evolution of the EU Taxonomy will increase the asset base eligible for green issuance,” said Constance Chalchat, global markets chief sustainability officer at BNPP, who expects “sovereign and corporate action on energy transition [to] foster the growth of new green assets.”

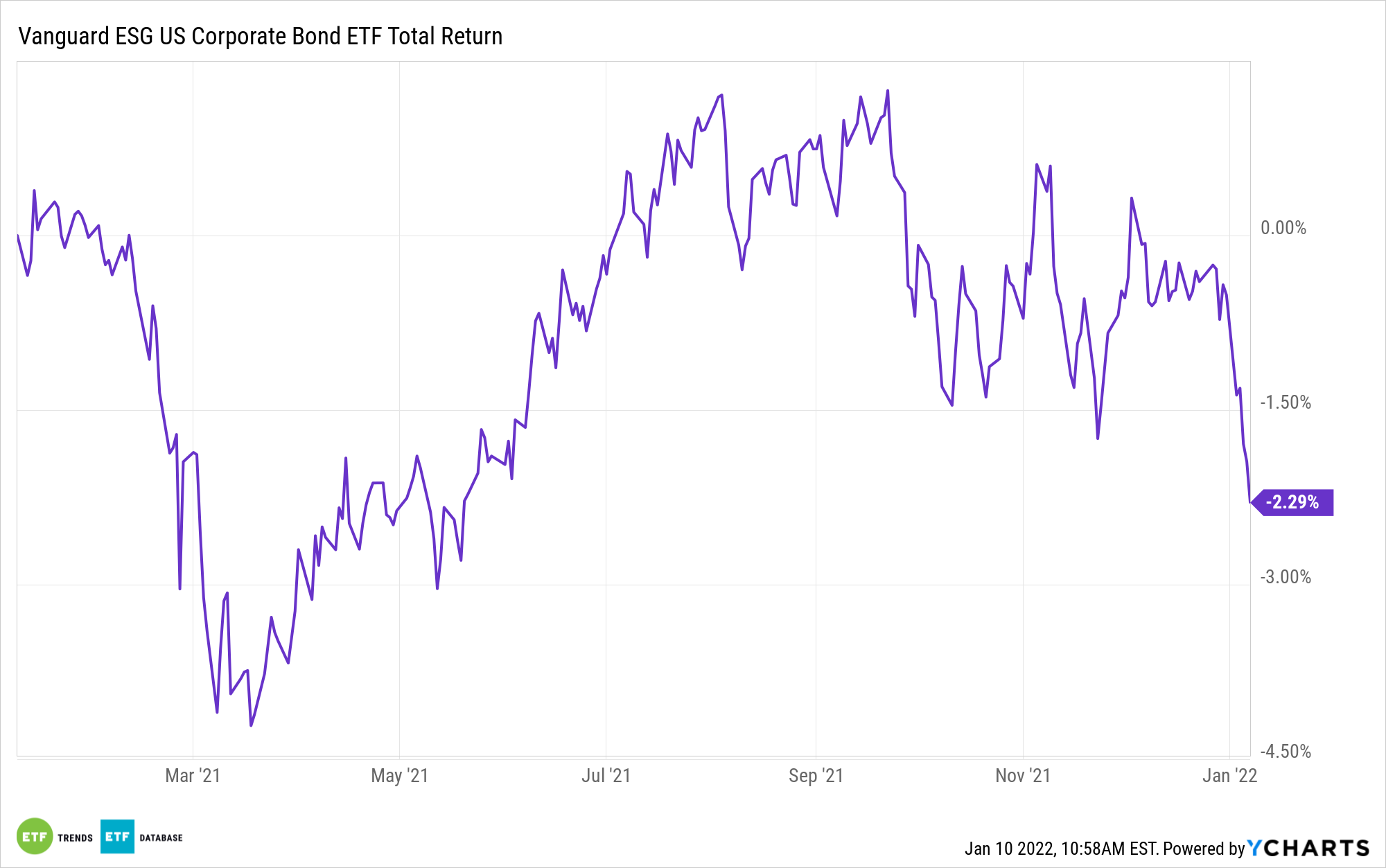

ESG Bond Exposure With a Corporate Twist

As the trend towards more green bonds by corporate America continues to push higher, bond investors can get in on the action with the Vanguard ESG U.S. Corporate Bond ETF (VCEB). Fixed income investors can combine corporate bond yield and ESG principles with VCEB.

Per its fund description, VCEB seeks to track the performance of the Bloomberg MSCI US Corporate SRI Select Index. The index excludes bonds with maturities of one year or less and with less than $750 million outstanding, and is screened for certain ESG criteria by the index provider, which is independent of Vanguard.

VCEB highlights:

- Provides debt issues screened for certain ESG criteria.

- Specifically excludes bonds of companies that the index sponsor determines are involved in and/or derive threshold amounts of revenue from certain activities or business segments related to: adult entertainment, alcohol, gambling, tobacco, nuclear weapons, controversial weapons, conventional weapons, civilian firearms, nuclear power, genetically modified organisms, or thermal coal, oil, or gas.

- Excludes bonds of companies that, as determined by the index sponsor, do not meet certain standards defined by the index sponsor’s ESG controversies assessment framework, as well as firms that fail to have at least one woman on their boards.

For more news, information, and strategy, visit the Fixed Income Channel.