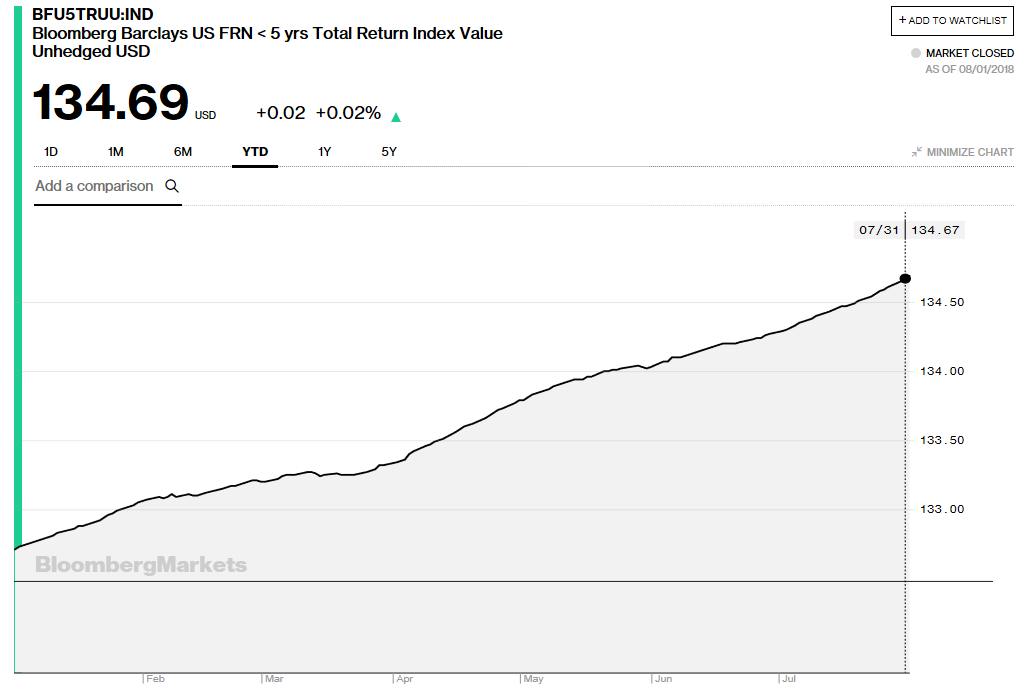

As such, one ETF to watch is the iShares Floating Rate Bond ETF (BATS: FLOT), which tracks the investment results of the Bloomberg Barclays US Floating Rate Note < 5 Years Index. The ETF focuses on investment-grade floating rate notes that track the underlying index, which has been on an upward trajectory looking at its year-to-date chart.

![]()

The floating rate component will allow investors to capture any gains from short-term rate adjustments that the Fed will most likely make. Based on performance provided by Yahoo! Finance, FLOT has generated trailing returns of 1.18% year-to-date, 1.90% the past year and 1.44% the past three years. Versus similar benchmarks in its category, FLOT is outperforming its peers by 10.28% year-to-date and 68.14% the past year.

The floating rate component will allow investors to capture any gains from short-term rate adjustments that the Fed will most likely make. Based on performance provided by Yahoo! Finance, FLOT has generated trailing returns of 1.18% year-to-date, 1.90% the past year and 1.44% the past three years. Versus similar benchmarks in its category, FLOT is outperforming its peers by 10.28% year-to-date and 68.14% the past year.

Like FLOT, the SPDR Blmbg Barclays Inv Grd Flt Rt ETF (NYSEArca: FLRN) features a floating rate component that will be beneficial in hedging interest rate risk. FLRN also seeks to provide investment results that correlate with the price and yield performance of the Bloomberg Barclays U.S. Dollar Floating Rate Note < 5 Years Index. FLRN limits duration exposure with investments in debt securities with maturities that don’t exceed five years. In addition, at least 80% of its assets will be allocated towards securities comprising the index, such as U.S. dollar-denominated, investment grade floating rate notes.

For more fixed-income trends, visit the Fixed Income Channel.