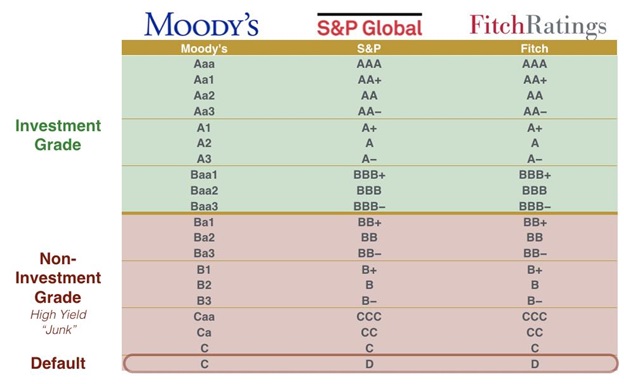

High-yield bonds, often referred to as “junk” or “speculative grade,” are corporate bonds that command a higher interest rate than other bonds. This higher yield is essentially compensation for the increased risk of default that investors assume when purchasing these securities. Credit rating agencies including Moody’s, Fitch, and Standard & Poors determine whether a bond is high-yield or investment grade.

Role of Agencies

Credit rating agencies (CRAs) have specific rating tiers. Investment-grade bonds are those with a higher credit quality, indicating a lower risk of default. These have ratings from BBB (or its equivalent) and above. The lowest threshold that would still qualify a bond as investment grade would be BBB- from S&P and Fitch, and Baa3 from Moody’s. High-yield bonds occupy the lower half of the ratings, all the way from BB+ for the most creditworthy high-yield bonds, down to C for the least (using the S&P and Fitch scale).

Ratings are not static. If a company’s financial condition changes or if macroeconomic factors shift, CRAs can upgrade or downgrade ratings. For instance, a bond can transition from investment grade to high-yield (becoming a “fallen angel”) due to a rating downgrade. The high-yield universe comprises both companies rated as non-investment grade when they first issued bonds and those that fell into that rating over time, after their bonds were on the market.

It’s worth noting that while CRAs play a pivotal role in financial markets, they have faced criticism in the past, especially during the 2007-2008 financial crisis. Ratings can be a good starting point for analyzing a bond, but should be used in conjunction with other research and not as the sole determinant in investment decisions.

Issuers

Companies whose newly issued debt is rated high-yield tend to be startups or capital-intensive firms. Startups are new businesses and often lack an established credit history. They may have negative free cash flows, high research and development expenses, and have an uncertain trajectory for future profitability. This makes it challenging for credit rating agencies to assign a high rating to them. Capital-intensive corporations often resort to debt to finance their substantial investments. As a result, these companies might have elevated debt ratios, reflecting a significant amount of debt relative to their equity.

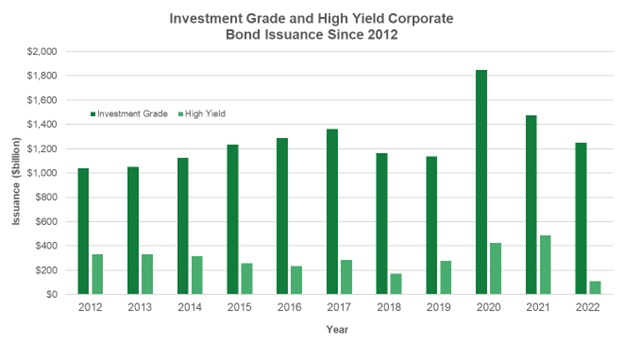

According to SIFMA, high-yield bond issuance has typically averaged between 20% and 30% of investment grade issuance since 2012. Interest rates were at all-time lows during the COVID-19 pandemic in 2020. As a result, both investment-grade and high-yield bond issuance hit record levels as companies across the risk spectrum sought to take advantage of the development. There was also a need to raise funds during a period of severe uncertainty. The story was quite different in 2022, especially for high-yield which saw just $112 billion in new issuance, the lowest in at least a decade and 77% lower year-over-year.

Source: SIFMA

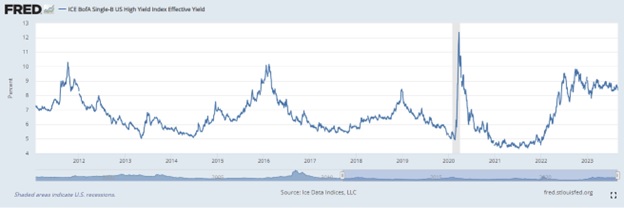

Rising interest rates have left their mark on the bond market. The average high-yield bond (based on the ICE BofA U.S. High Yield Index) in 2021 would have yielded about 4.3%, whereas today, short-dated treasuries are yielding above this point. In 2022 junk bond yields were averaging 7.4%, and in 2023 year-to-date, this has crept up to 8.4%. With the exception of temporary spikes in 2011, late 2015 to early 2016, and 2020, this is the most protracted period for yields this high since the turn of the millennium.

Source: FRED, Ice Data Indices

Components of High-Yield Bonds

The yield on a high-yield bond, commonly termed the bond’s “yield to maturity” (YTM), can be influenced by various components. The primary components include the risk-free rate (typically associated with interest rates) and credit spreads.

Typically, the yield on U.S. Treasury bonds is used as a proxy for the risk-free rate. Bonds with a longer duration are paired up with longer-dated Treasurys to determine this component. In today’s environment, the yield curve is inverted. That means short-term government bonds yield more than their longer-dated counterparts.

Credit spreads are the component of high-yield bonds that can be influenced by the issuer. If a 5-year Treasury currently yields 4.3% and a 5-year BB+ rated bond yields 7%, the credit spread is approximately the difference of these two at 2.7%.

This spread compensates investors for the additional risk they assume when buying a bond that isn’t risk-free. A wider spread, suggests greater risk for the bond. In uncertain economic times or during recessions, credit spreads tend to widen as investors demand a higher premium for taking on this risk.

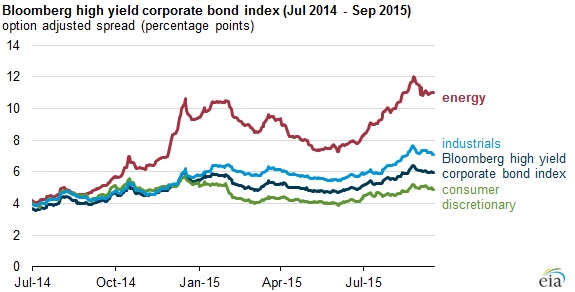

Certain sectors might have higher perceived risks at different times, leading to wider credit spreads for bonds within those sectors. For example, the spreads of oil and gas companies in 2015 widened substantially as the supply of oil became abundant across the globe.

Source: EIA

High-yield bonds have wider spreads than investment-grade bonds, meaning their return is more influenced by economic conditions. The Treasury component of yield decreases proportionally the lower a bond’s rating. For example, a CCC bond may yield 12% against a 5% Treasury rate, meaning 58% of its yield is explainable by its own risk.

Similar to Equities

This makes high-yield bonds behave much more like stocks than investment-grade. The ability of a low rated issuer to meet its debt obligations is more closely tied to its operational and financial performance. If a company performs well, the perceived risk of its high-yield bonds might decrease, leading to price appreciation. Conversely, if the company struggles, its bond prices might fall sharply.

Additionally, in the United States, high-yield bonds can be issued in subordinated form, ranking lower in the repayment priority during bankruptcy than other bonds issued by the company. This could make them much closer to equity which has little to no claim on assets in a default.

Conclusion

Navigating the high-yield bond market necessitates an understanding of the unique dynamics that define it. High-yield bonds, with their enticing higher yields, come with a heightened level of risk. This inherent risk is attributed to various factors, such as the issuer’s financial stability, macroeconomic environment, interest rate fluctuations, and credit spread dynamics.

As these bonds are more sensitive to market forces and a company’s operational performance, they exhibit a much higher correlation to the stock market than other bonds. An investor wishing to take on this additional risk could diversify into hundreds of bonds with a high yield bond ETF. These ETFs are diverse, and investors can increasingly find ones with a particular maturity or sector focus to suit their needs.

For more news, information, and strategy, visit the Financial Literacy Channel.