Investors often use index-based style-driven ETFs to support their asset allocation. Despite my efforts, expense ratio is often the most important factor used when choosing an ETF. However, what’s inside is a bigger driver of returns, as we will see with small-cap value ETFs.

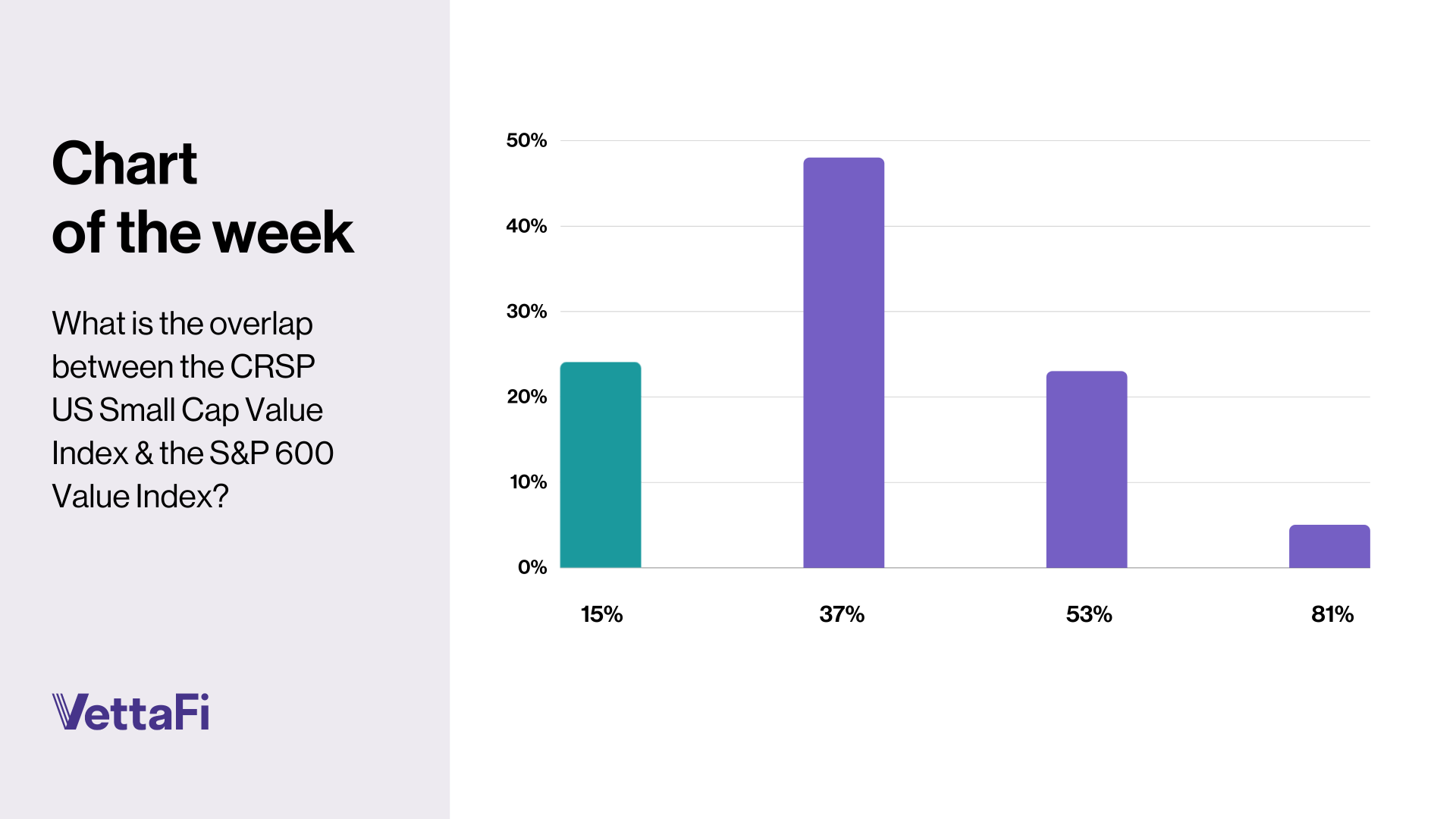

We recently discussed how large-cap value ETFs were gaining traction with advisors, but what they owned was not the same. This is just as notable with small-caps. During a webcast in mid-May with American Century, VettaFi asked advisors, “What is the overlap between the CRSP US Small Cap Value Index & the S&P 600 Small Cap Value Index?” The CRSP index is tracked by the Vanguard Small Cap Value ETF (VBR), while the iShares S&P 600 Small Cap Value ETF (IJS) seeks to replicate the S&P style benchmark. While the two ETFs sound the same, there’s shockingly just a 15% overlap in the two ETFs. Just under one in four advisor respondents answered correctly when given four choices, with nearly half selecting a 37% overlap.

What’s Inside Popular Small-Cap Value ETFs?

What’s Inside Popular Small-Cap Value ETFs?

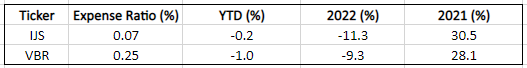

VBR is a $23 billion ETF that has nearly 850 holdings with a median $5.4 billion market capitalization. These include top-10 stakes in Atmos Energy, Builders FirstSource, Bunge, IDEX, and Reliance Steel & Aluminum. Likely aided by its low 0.07% expense ratio, the popular Vanguard ETF gathered approximately $200 million in assets despite losing 1.0% in value year-to-date as of May 19.

Meanwhile, IJS has $6.5 billion in assets spread across 455 positions that have a median market cap of $1.3 billion. None of VBR’s top-10 positions can be found in IJS. However, the iShares ETF has top-10 positions in companies such as Group 1 Automotive, Insight Enterprises, Meritage Homes, and Signet Jewelers. IJS has a 0.25% net expense ratio, higher than VBR’s, and yet it has been the stronger performer of the pair in 2023. IJS was down only 0.2% thus far at time of writing. In 2023, IJS has incurred approximately $100 million in net outflows.

From a sector perspective, IJS was more exposed to consumer discretionary stocks (19% vs. 15% for VBR) and information technology (8.8% vs. 5.7%). In contrast, IJS had a lower stake in financials (17% vs. 20%) and industrials (17% vs. 23%).

Small-Cap Value ETFs Perform Differently

The approximately 80 basis point gap between the two ETFs thus far in 2023 is nothing new. In 2022, VBR was the stronger performer, declining 9.3%, or less than 200 basis points more than VBR. However, in 2021, IJS rose 31%, approximately 250 basis points more than VBR. Going further back in time, these two ETFs demonstrate relative success.

Key Stats on Select ETFs

Source: VettaFi. As of May 19, 2023

While it is not always clear which small-cap value ETF will outperform each year, the gap between the funds has consistently been much wider than the 18 basis point expense ratio differential. With ETFs, it remains important for advisors to go beyond expense ratios and look inside.

For more news, information, and analysis, visit the Financial Literacy Channel.