Ah, credit scores. The mysterious three-digit number can have a big impact on your financial life. These scores dictate everything from what credit cards you can be approved for, to whether you’ll be able to take a mortgage out to buy your first home at a manageable rate. But what goes into generating your credit score, and are there any ways to influence this process positively?

Your credit score is a number that’s calculated based on your credit history. It’s essentially a measure of how trustworthy you are as a borrower. If you have a high credit score, that means lenders are more likely to trust you to repay your debts on time. Conversely, having a low credit score may make lenders more hesitant to extend a loan to you, or they may charge you higher interest rates to compensate for the added risk.

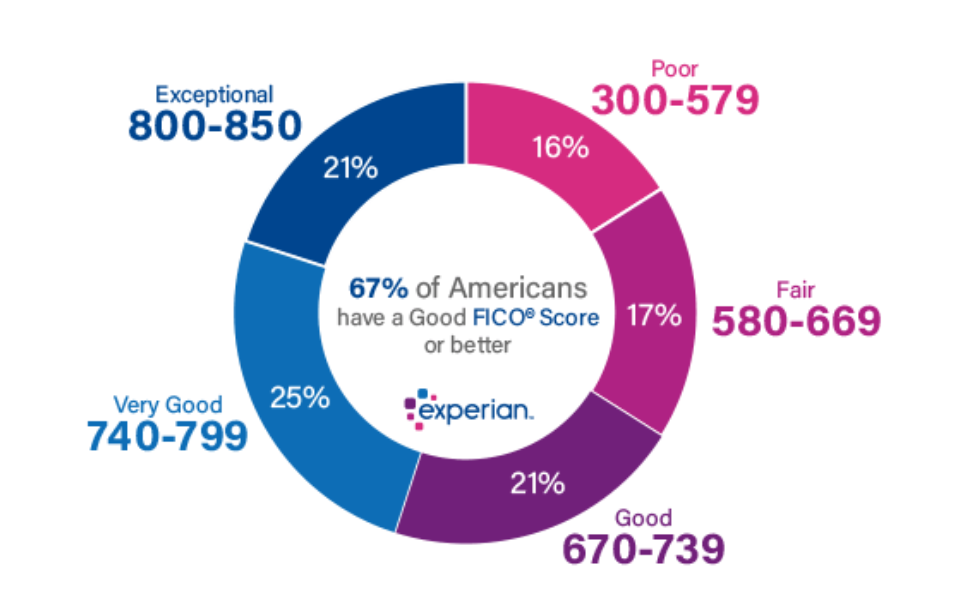

There are multiple credit scoring models that aggregate all the details about your history to spit out a single number, reflecting your strength as a borrower at a given point in time. The two most popular in the U.S. are the FICO, which is the industry standard, and the VantageScore, which is usually more accessible. People can check out their VantageScore for free using popular apps like CreditKarma or Credit Sesame, but FICO is generally gated behind a paywall (though some credit card providers like American Express offer users the score for free). The basic FICO score ranges between 300 to 850, and the latest VantageScore models use the same range as well.

-

Source: Experian

Adding another wrinkle to the process are the three credit bureaus, which lenders pull from to gauge your worthiness as a borrower. While almost all lenders ask for a FICO score, they can ask one of the three major credit bureaus in the U.S. – Equifax, Experian, and TransUnion.

These three may have different information on file for your underlying profile. For example, you may have opened up a credit card a few years ago, but the account opening was only picked up by two of the three. So while your FICO will be close between the trio, it won’t always be identical.

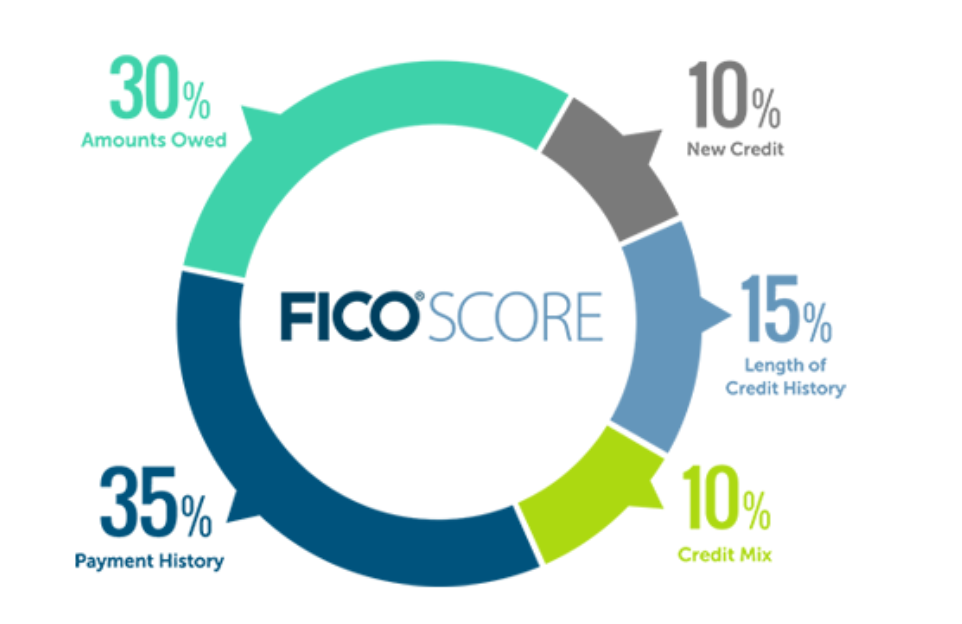

As stated earlier, your credit score is measured at a given point in time. This frequency is monthly, meaning if you look at your app of choice once a month on the same date, your score will rise or fall depending on how your profile recently changed. If you made a late payment between polling periods, your score will fall in a big way. Payment timeliness is one of the biggest components of your credit score (35% of the current FICO model), so it’s important to stay on top of your bills.

-

Source: MyFico.com

-

The second most important part of your FICO score is the amount you owe, i.e. the amount of credit you’re using compared to your credit limit. If you’re using a lot of your available credit, that can hurt your score. Aim to keep your credit utilization rate below 30% if possible. This means if the limit across all of your credit cards is $10,000, not owing more than $3,000 at the time your credit is reported to the bureaus is more favorable.

Rounding out the components are your new credit, the length of your credit history, and your credit mix, which constitute about a third of your FICO score. New credit is the amount of loans you’ve taken out and credit cards you’ve opened over the last two years, though it only impacts your actual score for 12 months. Credit mix is the diversity of your credit, and if you owe multiple types of loans such as student loans, mortgages, credit cards, etc., you have a higher credit score assuming you’re paying them all on time and keeping utilization low. Lastly, the length of your credit history measures how long your credit accounts have been opened. This takes three forms – the age of your oldest account, the average of all the accounts’ lengths, and how long it’s been since you have used those accounts. These last three components cannot be controlled as easily as the former two, but luckily they make up a smaller part of your score.

It’s vital to check your credit report regularly to make sure there aren’t any errors or fraudulent accounts that could be hurting your score. You are entitled to one free credit report from each of the three major credit bureaus every year, so take advantage of this benefit when you know lenders will be pulling your score, and the score has to be above a certain threshold.

AnnualCreditReport.com is the best place to do this, and the website is authorized by the Federal Government to provide the service.

Improving your credit score takes time and effort, but the process is well worth it in the long run. A higher credit score can open up more opportunities and save you money on interest rates and fees. The best real-world example of your potential savings can be realized within mortgages.

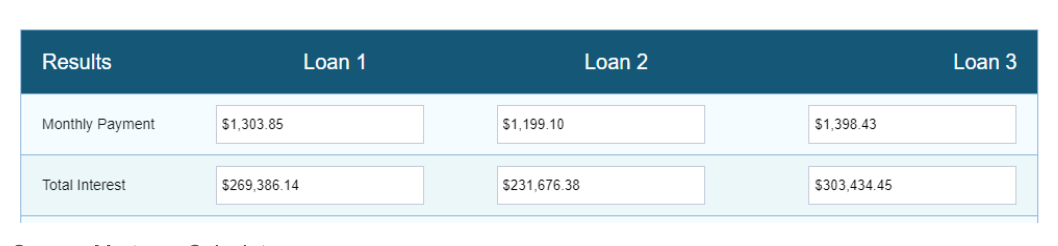

Take a 30-year mortgage for example with a $200,000 principal. Loan 1 below is at a 6.8% APR, the current national average. Loan 2 is at a 6% APR, which might be offered to the most creditworthy of loanees. Lastly, Loan 3 is offered at a hypothetical 7.5% APR, which borrowers with a lower credit score may have to accept.

-

Source: MortgageCalculator.org

- The difference is staggering. All three borrowers have to repay the $200,000 in principal, but the borrower taking out Loan 2 pays about $38,000 less in interest than the first and $72,000 less than the third. This real-world example is the same when dealing with auto lenders, private student loan companies, and credit card issuers using networks like Mastercard, Visa, and American Express. While you can’t control the length of your credit history as a first-time borrower, you can immediately start making positive choices that will save you many thousands of dollars over your lifetime.

- By Mario Stefanidis, CFA

For more news, information, and analysis, visit the Financial Literacy Channel.