Financial literacy and education is usually only taught to kids in the confines of their homes, if at all. Still, young people need exposure to basic financial services and related products, and a case can be made that the sooner they get that knowledge, the better off they’ll be in the future.

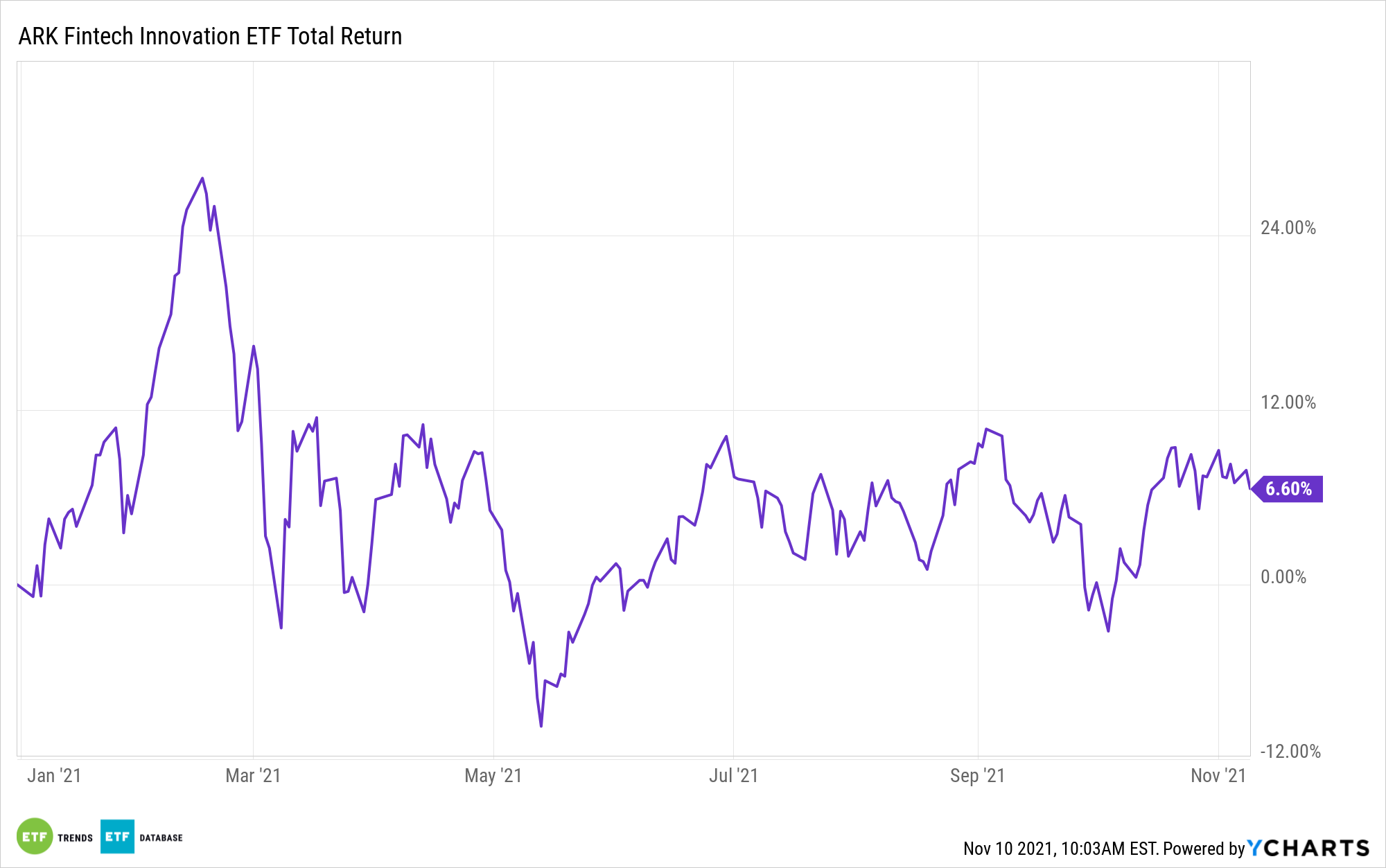

Fintech is one avenue — a strong one, at that — to better connect young people with finance, and the ARK Fintech Innovation ETF (NYSEARCA: ARKF) is an example of an exchange traded fund with leverage to that trend. Square (NYSE:SQ), ARKF’s largest component, is making efforts to become teens’ first bank.

“Last week, Cash App announced that it will offer its peer-to-peer payments, debit card, Boost and direct deposit services to teens 13 to 18 years old,” according to ARK Investment Management research.

Kids interested in that service need the permission of a parent or guardian, and it could be a boon for Square because, by CEO Jack Dorsey’s estimate, bringing teens into the fold could expand the total addressable market for the popular digital wallet by 20 million. ARKF allocates 9.41% of its weight to Square — one of the largest weights to that stock among all ETFs.

In fact, Cash App already resonates with a younger, hipper audience.

“Now embedded in urban and youth culture after years of savvy marketing including partnerships with artists, brands and e-sports teams, Cash App seems like a natural fit for teens in the US,” according to ARK.

There’s more to the story. As teens grow with a platform like Cash App, Square could potentially gain customers for other, higher-margin services, including equities and crypto trading. Square is smart to make inroads with younger customers today because other upstart fintechs are looking to do the same and are leveraging well-known personalities to accomplish that objective.

“According to app intelligence publisher SensorTower, some of these family-based strategies are struggling. Thanks in part to marketing partnerships with influencers like Charli D’Amelio, Step boosted monthly active users (MAUs) from 80,000 in August 2020 to 1.3 million in April 2021 but, since then, has lost 500,000, dropping to roughly 800,000, a base similar in size to Greenlight’s,” adds ARK.

In addition to Square, ARKF has other avenues for appealing to younger consumers, though perhaps not quite as young as teenagers. For example, crypto exchange giant Coinbase (NASDAQ:COIN) is the fund’s second-largest component at a weight of 8.36%.

Robinhood (NASDAQ:HOOD), PayPal (NASDAQ:PYPL), and DraftKings (NASDAQ:DKNG) — all names that appeal to younger investors and consumers — combine for over 8% of the ARKF roster.

For more news, information, and strategy, visit the Financial Literacy Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.