In the financial toolbox for everyday consumers, a credit card represents a potent double-edged sword. On the one hand, it can be a powerful tool for building credit scores, earning rewards, and managing cash flows throughout the month. On the other hand, irresponsible use can make it a dangerous trap leading to spiraling debt and financial ruin.

The key to harnessing the positive aspects of credit cards lies in using them responsibly and strategically to maximize rewards. This guide delves into how to use credit cards wisely, avoid common pitfalls, and make the most of the rewards and benefits they offer.

More Than Just a Piece of Plastic

Credit cards are essentially a type of loan. When you use a credit card, you are borrowing money from the card issuer, up to a certain limit, to make purchases or withdraw cash. You then pay back this borrowed amount, either in full by the due date or over time with interest. Understanding this fundamental concept is crucial because it underscores the importance of managing credit card use to avoid excessive debt.

Unlike secured loans, which are backed by collateral, credit card loans are granted based on your creditworthiness – a measure of how likely you are to repay the borrowed amount. This is why credit card applications often involve credit checks and assessments of your financial history.

This is also why not missing a payment is of paramount importance. Payment history is the single most critical factor in calculating credit scores, accounting for 35% of the score in major models like FICO. Even one missed payment can lead to a substantial drop in your credit score. A lower score can have far-reaching consequences, reducing your chances of being approved for future loans or credit cards and potentially leading to higher interest rates on loans you do qualify for.

The Responsible Use of Credit Cards

The golden rule of credit card use is to pay off any balances in full every month. This helps you avoid interest charges and late fees. Beyond just making the minimum, keeping a low utilization rate (the amount owed divided by the credit limit) is another component in securing a good credit score. Below 30% is considered to be an optimal utilization. For example, with a $5,000 credit limit, not owing more than $1,500 at any point in time is advisable.

To keep balances low, use credit cards as a tool for convenience and rewards, not as a means to live beyond your means. If you find yourself consistently carrying a balance because you’re buying more than you can afford, your spending habits may need to be reevaluated. The cost of the borrowed money will almost always outweigh the benefits of any rewards earned.

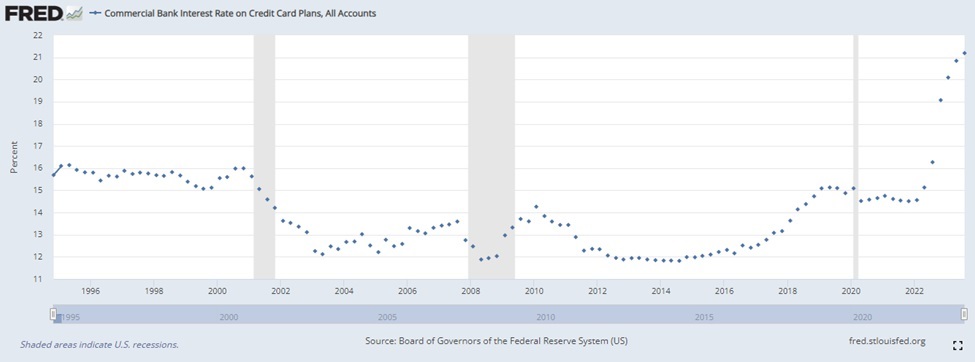

According to the St. Louis Fed, the average interest rate on credit card plans exceeded 20% for the first time in at least three decades this year. This is a steep price to pay. On a $1,000 carried balance, interest payments would exceed $200 annually. That’s significantly more than what can be gained from even the most lucrative rewards programs.

Source: Federal Reserve Bank of St. Louis

The detachment from physical money changing hands can make it easier to spend without considering the real impact on your finances. Consider setting up alerts or limits on your card to notify you when you’re approaching your budgeted spending limit. Many credit card companies offer tools and apps to help you track and categorize your spending. They make it easier to stay on top of your finances.

Maximizing Credit Card Rewards

With that being said, maximizing credit card rewards is an art. When mastered, it can significantly enhance the value you derive from your credit card usage. The journey to maximizing rewards begins with selecting the right credit card. Different cards offer different types of rewards. Some focus on travel rewards, others offer cash back, and some provide points that can be redeemed for a variety of goods and services.

The trick is to align your credit card choice with your spending patterns and lifestyle. For instance, if you travel frequently, a card that offers travel points and benefits like airport lounge access might be more beneficial than one that offers cash back on groceries. You should also consider the rate at which you earn rewards and any caps or limits on those rewards. Some cards may offer higher reward rates on certain categories of spending, like dining or entertainment. That can be particularly lucrative if they align with where you spend the most.

Once you’ve chosen an appropriate card, the next step is to understand the card’s rewards program in depth. This means not just knowing how points are earned, but also how they can be redeemed. The value of points can vary greatly depending on how they are used. Some rewards programs offer a higher redemption value for travel-related expenses compared to cash back or gift cards. Combining multiple cards to maximize rewards across spending categories is known as “churning.”

Be Wary of Credit Card Fees

Be aware of the annual fee common to most of the top cards. Signup bonuses can be appealing. After all, they’re frequently in the realm of 40,000 – 100,000 points (with 100 points roughly translating to $1). However, these cards can also carry annual fees between $100 and $600. Make sure that your spending and point accumulation exceeds the fee, without spending beyond your means to accomplish this

Signing bonuses also require consumers to meet a certain spending requirement. The window for spending is typically in the first three months after receiving the credit card. It’s also not uncommon to have a minimum spend of $4,000 or more over this period to unlock these points. Again, do not overspend to hit these bonuses, to avoid debt spiraling out of control.

Ultimately, the cards that provide the highest rewards within their category are those that have more stringent application requirements. Exercising prudent diligence with your credit today will allow you to apply for the best cards in the future.

Conclusion

Maximizing credit card rewards requires a thoughtful and strategic approach, deeply rooted in understanding your card’s rewards program and aligning your spending habits accordingly. By choosing the right card, being savvy about point redemption, taking advantage of sign-up bonuses without overspending, using the card strategically for everyday purchases, and leveraging promotions, you can significantly enhance the benefits you receive from your credit card. However, the golden rule remains – the benefits of reward maximization only hold true if you are disciplined about paying off your balance in full each month to avoid interest charges that can quickly outweigh the rewards earned.

For more news, information, and analysis, visit the Financial Literacy Channel.