What is a bond? Depending on who you ask, the word bond can either refer to a specific type of financial instrument, or when capitalized, your favorite British Secret Service agent. For this guide, we’ll be talking about the lowercase version, which represents one of the largest financial markets in existence. While fixed income, debt, or credit don’t have the same ring to them, they all refer to the same thing – money borrowed by some entity for a definite period of time, and owed to another party. These parties are known as the debtor and creditor, respectively.

Bond Market vs. Stock Market

The bond market operates differently from the stock market. The stock market involves the exchange of shares of a company, representing ownership in that company. The bond market, however, involves lending money to the issuer for a certain period, up until the maturity date. Along the way the issuer pays out interest, the bond’s “coupon.” Almost all coupons pay out every six months for the life of the bond. Most bonds also are quoted in $100s or $1000s, a term called “par value.” In contrast, the major stock exchanges today allow investors to buy a small fraction of a share.

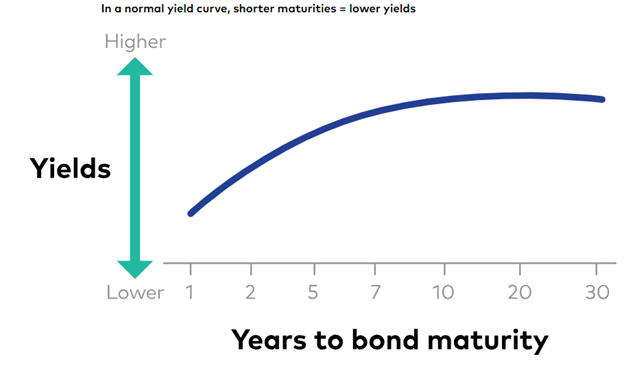

Generally, most consider bonds less risky than the stock market. This is because bondholders have a higher claim on company assets than shareholders if the company goes bankrupt. Furthermore, most bonds offer fixed interest payments, providing a steady income stream. On the other hand, while many stocks offer dividends, these can fluctuate based on the company’s performance. Typically bonds that have longer maturities offer higher payments over time, to compensate holders for locking up their money for longer.

Source: Vanguard

The reason many understand the stock market better than the bond market is due to the streamlined way in which individual investors, like you or me, can transact in them. In the U.S., there are about 6,000 international and domestic stocks listed on the New York Stock Exchange (NYSE) and NASDAQ, the two main exchanges in the United States. There are also over 10,000 stocks that trade “over the counter,” or off of a major exchange.

Stocks represent fractional ownership in a company at a certain price. The only thing that can really vary with common stock is its dividend yield, and your voting rights on company issues as a shareholder. Bonds on the other hand come in all different kinds of flavors.

Bond Trades and Ratings

There are hundreds of thousands of unique bonds for sale at any given moment. They also mostly trade over the counter, with very few trading on major exchanges (though this proportion is steadily increasing). This means that most bond trading is done over the phone the old-fashioned way. It also means that pricing, especially for large bond lots, is negotiable.

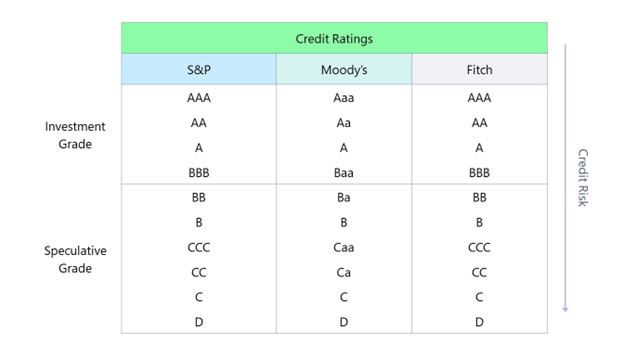

The major differentiating factor between bonds are their ratings. Three credit agencies – Moody’s, Fitch, and S&P, hold 95% market share in the bond rating industry. Issuers who are more able to fulfill their financial obligations recieve higher ratings. All three, or even two of the three, agencies do not rate every bond, but for the bonds that are, a composite rating is used. This is typically the lower if two are involved or median if all three assign a rating.

S&P and Fitch use the same convention ranging from AAA for the safest bonds to D. Moody’s ratings range from Aaa to D, but all three have the same number of notches in their scale. Furthermore, bonds can carry a plus or a minus rating to fine tune them further. An A+ bond from Fitch is more creditworthy than an A or A- bond, but less so than a AA- one. It even gets more granular than this, as a bond of any rating can be placed on a positive or negative watch, meaning the agency is inclined to upgrade or downgrade its rating if trends continue.

Bonds rated below a certain threshold are known as “junk bonds,” or “high yield” in more cordial terms. As you may imagine, riskier bonds typically command higher returns with the tradeoff of additional risk. This cutoff is below BBB for S&P and Fitch and Baa for Moody’s.

Source: Wall Street Prep

There are many more considerations, but here are a few main ones. Some bonds are “callable,” meaning the entity issuing the bond can buy it back from you at a later date. This typically occurs when interest rates fall and the issuer wants to sell new bonds with more attractive terms. Others are putable, providing the holders with the right, but never the obligation, to redeem the bond before it matures. An investor may “put” the bond back to the issuer when rates rise and they want to invest in higher yielding options. Some bonds even have the ability to convert into stock at a later date. Most think bonds with more attractive terms, like those that are putable, carry less risk and therefore usually offer lower returns.

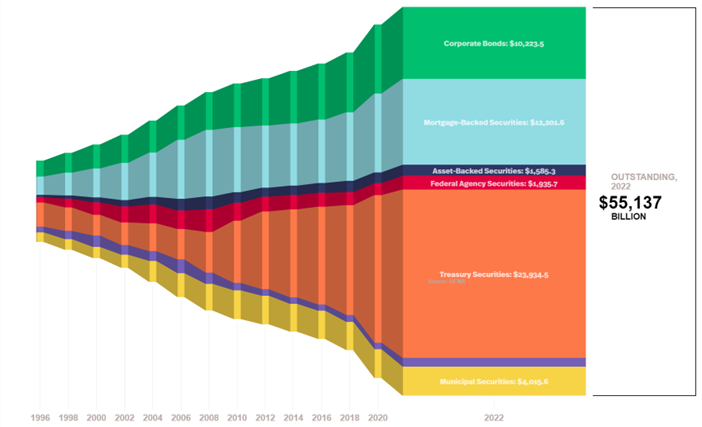

There are four main issuers of bonds in the $55 trillion U.S. bond market. We divide the bonds they issue into the following categories: Treasury, Mortgage-Backed, Corporate, and Municipal. We will discuss them in brief below, and expanded upon them in future blog posts.

Source: SIFMA

Treasury Bonds

As the name implies, the U.S. Department of the Treasury issues these bonds to fund government spending beyond collected taxes. There are a number of ways the Treasury does this, but the primary way is through bills (0 – 1 year maturity), notes (1 – 10 year maturity), and bonds (10 – 30 year maturity). While it sounds confusing that only longest maturity issuances are called “bonds,” all three of these indeed are bonds.

Notes and bonds pay semiannual coupons while bills offer at a “discount” to the principal value. For example, the Treasury last sold 26-week bills for $97.65 with no interest along the way, but in half a year’s time, the buyer would receive $100, a profit of $2.35. Individuals and institutions bid on Treasury issuances through scheduled auctions.

U.S. Treasurys currently bear a rating of AAA from Fitch and Aaa from Moody’s, but AA+ from S&P, who downgraded the United States on August 5th, 2011. This was a major-market moving event. The “full faith and credit” of the nation back Treasurys, and investors consider them to be the benchmark for the entire bond market. These bonds are still AAA rated by composite, but Fitch currently has its rating on negative watch due uncertainty stemming from the debt ceiling standoff.

Mortgage-Backed Securities

Also known as MBS, mortgage-backed securities are financial instruments that represent an ownership interest in a pool of mortgage loans. These loans are typically residential mortgages, such as home loans taken out by individuals to finance the purchase of homes. There are two main categories of mortgage-backed securities: agency and non-agency.

Government-sponsored entities (GSEs) guarantee or back mortgage-based securities, called Agency MBS. These entities provide a guarantee of principal and interest payments on the MBS, reducing the risk for investors. Most consider Agency MBS safer investments than their non-agency counterpart due to implicit or explicit backing by the U.S. government.

GSEs do not guarantee non-agency mortgage-backed securities. Instead, financial institutions such as banks assemble and issue them, and they do not carry the same level of guarantee as agency MBS. The risk associated with non-agency MBS is typically higher, as they depend on the performance of the mortgages in the pool without the backing of a government guarantee. These instruments became less popular after the 2008 Global Financial Crisis, and now comprise less than one-fifth of the MBS market.

Corporate Bonds

Corporations or companies issue debt securities called corporate bonds to raise capital. When a company needs to finance its operations, expansion, or other financial needs, it can issue bonds as a way to borrow money from investors. Investors who purchase corporate bonds effectively lend money to the issuing company and become creditors.

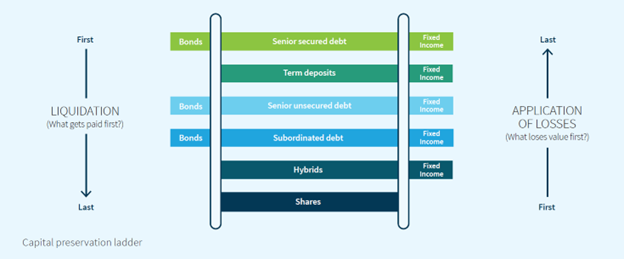

Corporates are the most diverse category of the bond market. Corporations can have anywhere from AAA for the most financially stable companies to D for those that defaulted, or fell beyond on any payment in the bond’s life. Bonds always rank above stock in terms of repayment priority if the company defaults or goes bankrupt, but within corporates there is an internal hierarchy. Senior secured bonds pay out first. Subordinated (junior) debt pay out lower on the repayment pyramid.

Source: FIIG Securities

Municipal Bonds

Lastly but not least are municipal bonds, or “munis” for short. Munis enable states, cities, counties, and other governmental entities to fund public projects. Some of these include the construction of schools, highways, hospitals, sewer systems, and many other infrastructure-related projects.

The primary appeal of municipal bonds for investors is their tax advantages. Federal income taxes typically exempt the interest income generated by these bonds. If the investor resides in the state where the bond is issued, state and local income taxes may exempt interest income as well. This makes them particularly attractive to investors in high tax brackets. However, like all bonds, munis carry risk, including the risk that the issuer may default on its obligations.

Final Thoughts on the Bond Market

Diversity is the spice of life, and bonds are particularly spicy. The significantly greater magnitude of outstanding bonds versus stocks arises from the need to accommodate the unique financing requirements of issuers, cater to different investor preferences, and provide a range of investment options for various industries, sectors, and risk profiles.

Stocks represent ownership in a company. Bonds involve lending money to the issuer for a specific period, with interest payments made along the way. Many investors consider bonds less risky than stocks, because bondholders have a higher claim on company assets in the event of bankruptcy.

The streamlined nature of stock market transactions has contributed to its better understanding among the masses. In contrast, the bond market involves a larger number of unique bonds, which can make it less accessible. While this blog provides a glimpse into the world of bonds, there is much more to explore and understand about each bond type and their nuances.

For more news, information, and analysis, visit the Financial Literacy Channel.