U.S. Senate Republicans unveiled legislation last week that seeks to replace the Affordable Care Act (ACA), also known as Obamacare. While controversial, the new Republican healthcare effort did not derail healthcare stocks and exchange traded funds.

In fact, many healthcare ETFs jumped last week with plenty hitting record highs. Among the most vulnerable to a shake up in the status quo, the hospital industry could be among the worst hit from the proposed changes, which could cause millions to lose health coverage. Looking at ETF options, the iShares U.S. Healthcare Providers ETF (NYSEArca: IHF) would be among the worst off in case of a sell off in the health industry. However, IHF climbed 2.4% last week, extending its year-to-date to 19%.

“Notable differences in the Senate’s Better Care Reconciliation Act of 2017 (BCRA), announced (last week), are more generous tax credits for individuals designed to replace ACA subsidies, a one-year extension of the phase-out date for the current Medicaid funding mechanism, and different Medicaid inflation adjusters. Additionally, the Senate bill does not contain clauses that would let individual states waive community rating regulations,” according to Fitch Ratings.

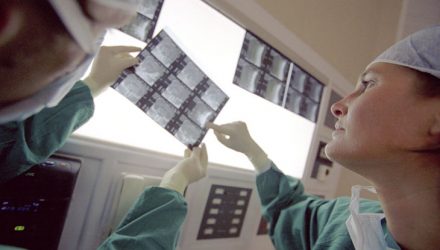

Hospital stocks were seen as big winners under Obamacare because with more Americans having access to health insurance, hospital operators would be able to be compensated for more procedures and services while providing fewer services for free.