Contributing the rapid growth of technology companies, the tech theme has broadened and is prevalent in many aspects of our daily lives and the wider economy.

“From day to day tasks to social interaction, each has an important influence on everyday life,” Gedeon said.

“Tech stocks have evolved from creating new and niche consumer products to a group of companies upon which every industry and sector have become dependent,” Gedeon added.

![]()

For instance, Gedeon singled out companies like Apple, Amazon, Intel and Microsoft as global leaders in the technology sector that have produced high-demand consumer products.

The rapid growth has also contributed to the technology segment’s bigger prominence in the U.S. equity market. The Nasdaq-100 from year-end 2012 to 2017 has substantially increased in market capitalization to $6.5 trillion from $3.1 trillion and saw earnings expand to $204 billion from $137 billion.

As the technology names mature, many are beginning to grow dividend payouts to loyal investors. The Nasdaq-100 has increased yields most years between 2003 and 2017. QQQ shows a 0.78% 12-month yield.

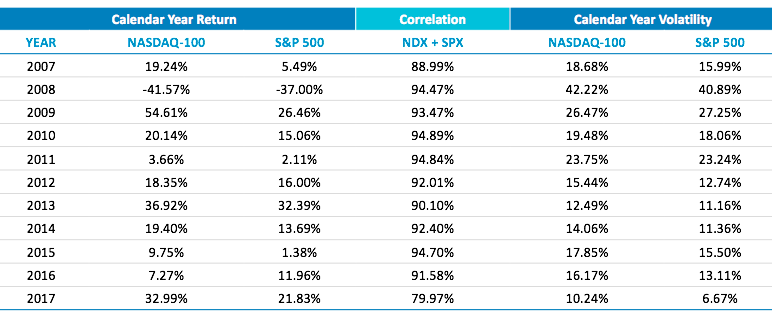

Investors, though, are probably more interested in this growth-themed segment’s performance. Since 2007, the Nasdaq-100 has outperformed the S&P 500 by 150% cumulatively with a +1.3% risk.

Click here to watch the ‘Innovative Industries Leading ETF Strategies and the Technology Revolution’ Virtual Summit panel On Demand (CE Credit available to financial advisors).