Technology stocks and sector-related exchange traded funds are an important component in any long-term investment portfolio, enhancing overall returns and providing exposure to some of the fastest growing names in the economy.

During the recent annual ETF Trends Virtual Summit (available On Demand for CE Credit), an online virtual conference environment where financial advisors learned about current ETF issues, Dave Gedeon, Head of Research and Product Development for Nasdaq Global Indexes, highlighted the importance of technology companies in a diversified investment portfolio.

On the panel ‘Innovative Industries Leading ETF Strategies and the Technology Revolution,” Gedeon discussed the tech-heavy Nasdaq-100 Index, which has been a go-to for investors seeking broad market exposure with a big emphasis on the U.S. technology segment.

The underlying Nasdaq-100 includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization, with a 61.1% tilt toward information technology names and even its 22.3% weight in consumer discretionary includes innovators like Amazon 9.4%, Netflix 1.8% and Tesla 0.7%.

![]()

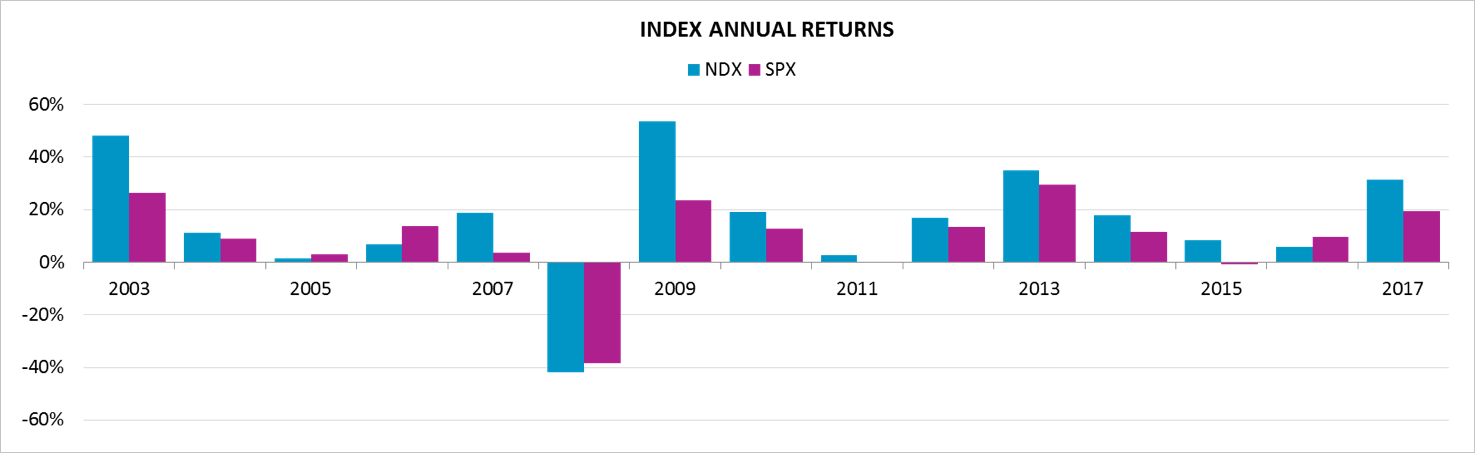

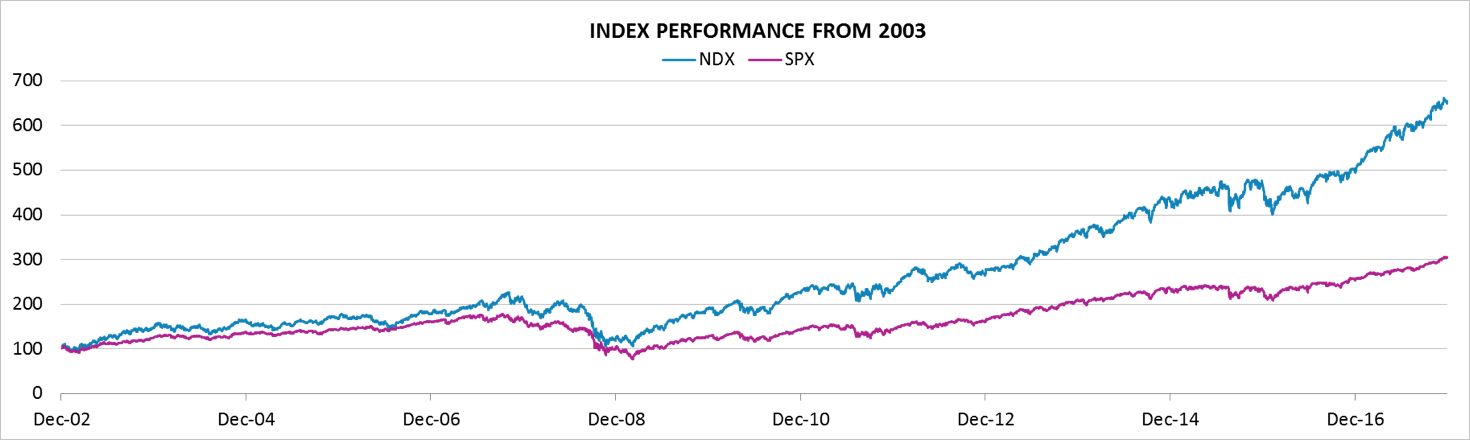

Gedeon pointed to the long-term outperformance of these tech names that has contributed to the ongoing rally in U.S. equities.

For instance, looking at the past five-year returns, the clouding-computing theme has returned 129.3%, the Nasdaq-100 returned 145.7%, cybersecurity stocks returned 116.2%, Nasdaq technology companies returned 179.1%, internet stocks returned 195.0% and robotics returned 124.6%.

In contrast, the S&P 500 returned 76.4% over the period.