The VettaFi voices have gathered around the hydration station to discuss the SPDR S&P 500 ETF Trust (SPY) entering its 30s. Milestone birthdays are, of course, a time of reflection. With SPY leaving its wild twenties behind, the VettaFi crew ponders the following questions: When you think of SPY, what are some of the key moments of its history that come to mind? How has the ETF industry evolved since SPY’s inception? Finally, when SPY celebrates its 60th anniversary thirty years from now, what stories from today will we be bringing up?

Todd Rosenbluth, head of research: Lately I’ve been writing and talking a lot about SPY, the granddaddy of the ETF industry with 3,000 offspring. many that are clearly connected, like the low volatility version, Invesco S&P 500® Low Volatility ETF (SPLV); and many that look nothing like large-cap equities, like the high yield corporate bond fund, SPDR Bloomberg High Yield Bond ETF (JNK). So I don’t want to give too much away here.

But this stat is mind blowing to me: Every hour, 14.5 million shares of SPY are traded. Every minute, 242,000 shares are traded, and every second, 4,000 shares are traded. All while many advisors aren’t necessarily buying and selling ETFs in any given day, because they invest for the long term and benefit from ETFs’ low costs and tax efficiency relative to mutual funds. But the fact that they can trade, with such ease and clarity, whenever they want is something we all take for granted. At some point SPY may stop being the largest ETF based on assets, but I can’t imagine something trading more frequently in my lifetime.

Now more than a decade later we get to celebrate SPY turning 30 at Exchange, where advisors — some younger than SPY itself! — will get to learn from peers and industry experts.

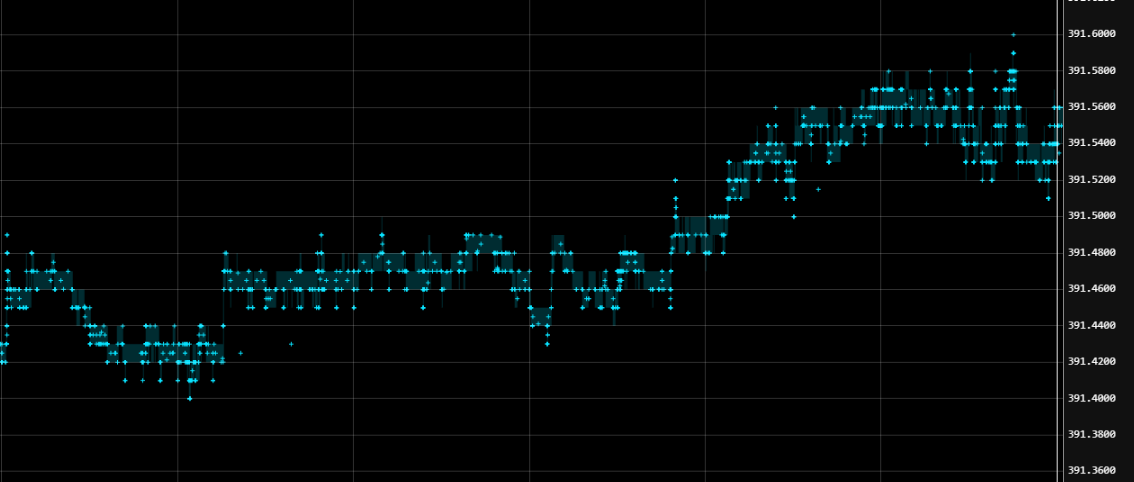

Dave Nadig, financial futurist: Liquidity really matters. I’ve spent far more hours than I care to admit looking at the actual tape of SPY. Since Reg NMS in 2005 volumes and quotes have exploded and SPY remains the most actively traded and quoted security in the world. I mean, just look at this chart from Tuesday’s close:

That is literally just the last 10 milliseconds of trading in SPY. Millions and millions of dollars changing hands, in hundreds of individual trades before the closing auction strikes. SPY is arguably the most “live” security in the world.

Ecosystems really do matter. Part of SPY’s success in the decades after launch was due to how quickly it became embedded in an ecosystem of derivatives, other pooled vehicles, and hedge funds. We can argue about a basis point of expense or a nuance of structure, but bottom line, SPY’s dominance will continue for the foreseeable future because it’s hard to shake a standard out of an ecosystem, and SPY is a standard. Like railroad track width.

Rosenbluth: I’ll take Dave’s railroad analogy and run with it. Every ETF that came after SPY has benefited from the hard work State Street Global Advisors, Amex, the lawyers, and many others did to bring it to life. We now have an ETF Rule that makes it easier to launch an ETF, asset managers lining up to bring these products to market, and a generation of investors that think in terms of ETFs, not mutual funds. This was all possible because of the ETF pioneers tied to SPY.

Nadig: Execution really is everything. SPY first and foremost got done, and I think we forget how hard it is to do something truly novel and unique in the world, especially in finance. The teams in the 1990s who cracked open the ETF industry just jumped. From the sales folks trying to convince institutions to use SPY as a replacement for other cash equitization strategies to the indefatigable lawyers. Just think how long it took something like the fairly minor tweak of “active ETF” to get approval. Those early teams drank a lot of coffee.

Lara Crigger, editor-in-chief: Something else to keep in mind: SPY wasn’t a surefire success. Although in the rearview mirror, SPY’s dominance as the first-ever ETF seems inevitable, at the time of its launch, the idea of a unit investment trust (UIT) trading intraday on an exchange was kind of a wacky idea. The concept was innovative and relatively untested — and definitely a gamble.

SPY made a splash at launch; on its first day, it traded $1m in volume and within months it had cracked $250 million in AUM. However, within 12 months of inception, SPY was seeing net outflows, not inflows. Not what you want to see out of the gate for an entirely new, genre-defining technology.

And ETFs really were a new technology. SPY — and ETFs in general — are children of the dotcom boom. Conceptually, SPY was designed by and for institutions; while it was available to everyone to purchase, of course, the thought was that only institutions would actually care. But then the internet became mainstream, with an AOL dial-up in everyone’s home by the late ‘90s. As a result, online brokerages became A Big Thing. Suddenly, folks didn’t need to dial their advisor to buy investments — they could just go to eTrade or so on, and do it themselves. And ETFs were available on these brokerage platforms. If you wanted access to the S&P 500 in an all-in-one package? SPY was right there. And it was cheap. And you didn’t have to call a mutual fund broker to buy.

Rosenbluth: The funny thing, Lara, is for retail investors, SPY was the “anti-active” mutual fund and was priced similar to the Vanguard 500 Index mutual fund. Fast forward 30 years, and we now have low cost, actively managed mutual funds from Avantis and Dimensional Funds that are priced comparable to SPY. When Goldman launched the Goldman Sachs ActiveBeta U.S. Large Cap Equity ETF (GSLC), a smart beta ETF, they used SPY’s fee as the reference point.

It all comes back to SPY.

Crigger: Exactly. It’s an ouroboros of low fees.

Rosenbluth: I remember the first time I was aware of what an ETF was. It was early 1999, so 6 years after SPY started trading. I was talking to a mutual fund manager who was explaining that he used the Invesco QQQ Trust (QQQ) to invest his cash equivalents in an ETF, because the fund owned the same growth stocks he owned but kept him invested rather than earning nothing in cash.

I started to dig and discovered some of the benefits of ETFs. I circled back to ETFs as a career in 2009, coincidentally when the ETF industry was about to go more mainstream, both with product development and broader adoption among retail investors/advisors. It’s hard to believe how far we have come in just 3 decades and how it all started with SPY.

Crigger: Speaking of how far we come, I have to point out that SPY is a unit investment trust (UIT), which is basically a nearly extinct form of the ETF. Among other quirks, a UIT must replicate its underlying index exactly, no substitutions or omissions allowed. Also, it can’t reinvest any dividends from its holdings. That makes a UIT behave a lot like index futures – except without the downsides of having to go into the futures market – which to Dave’s point upthread is in large part why SPY is still so favored by institutions and deeply embedded in the derivatives ecosystem. (Also puts some things in context: if you think of SPY as kind of like S&P futures, then you can see why a 9 bps price tag isn’t as big of a deal, compared to the iShares Core S&P 500 ETF (IVV) and the Vanguard S&P 500 ETF (VOO)‘s 3 bps, because futures — and futures-like investments — aren’t meant to be buy forever kinds of investments.)

Also, since you mentioned the ETF Rule, Todd — for what it’s worth, UITs are exempt from the ETF Rule! So, if SSGA were to try to bring SPY to life today, they’d still have to file for an exemptive relief, as they did in the olden days.

What will you be looking forward to in 30 years, Dave & Todd?

Nadig: Tokenized asset management. It’s a technological inevitability, where the only barrier is regulation and inertia.

Rosenbluth: Thirty years from now, I look forward to being in my retirement and telling my grandkids about how even 30 years ago, ETFs still represented a small share of the equity and fixed income markets. This asset base will continue to climb, the products will continue to proliferate, and there will still be a need for education about what makes similar-sounding ETFs different from one another. For example, take the SPDR Portfolio S&P 500 High Dividend ETF (SPYD) and the ProShares S&P 500 Dividend Aristocrats ETF (NOBL), both dividend grandchildren of SPY but with much different exposures: SPYD is heavily slanted to defensive sectors, like real estate and utilities, while NOBL has a more cyclical slant to industrials and materials.

What about you?

Crigger: When I think about what we’ll be covering on the 60th anniversary of SPY, I can’t wait to read the “where are they now?” features about the 11 people whose lives are literally entertwined with SPY’s.

There’s a clause in SPY’s trust documentation that says the fund will close on Jan. 22, 2118, or twenty years after the last survivor dies out of this “SPY 11” group, whichever comes first. The 11 are mostly kids of the people involved in the making of SPY, I believe. There was a great story back in 2019 that Bloomberg did tracing who they were and where they were now.

Todd Rosenbluth: Also, I hope us VettaFi Voices meet up for an early bird special and toast SPY at 60. My treat!

Lara Crigger: it’ll be like the Golden Girls, but with more scotch!

Be sure to catch the VettaFi Voices, as well as a host of experts, at Exchange, on February 5–8, 2023, in sunny Miami, Florida. To learn more about the event and register, please visit the Exchange website.

For more news, strategy, and information, please visit VettaFi | ETF Trends.