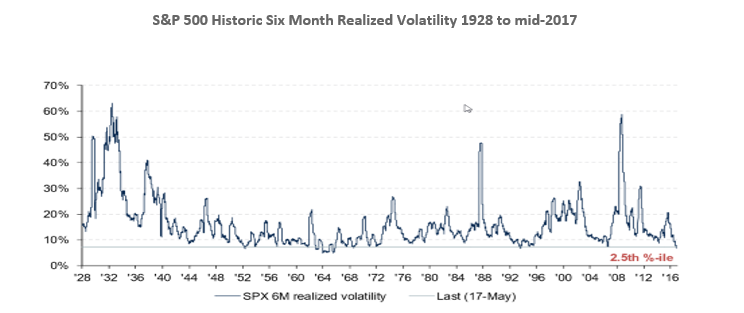

Going back to 1928, comparable low volatility (historical) periods have had a median length of 15–16 months (Goldman Sachs, 2017), and there were several periods that lasted more than three years, so it is plausible that the current volatility regime extends further in time.

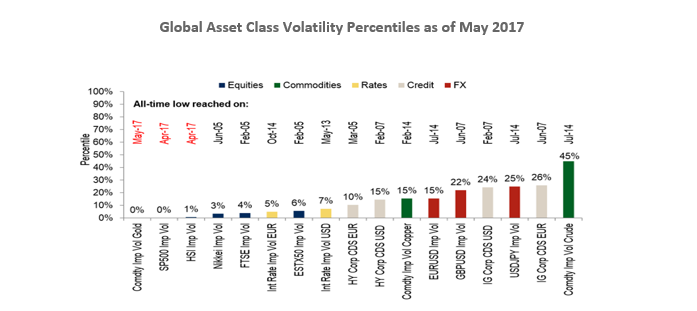

In addition, not only is US equity volatility extremely low, global volatility, including commodities and currencies, has followed suit.

A break from this “new normal” may be driven by increasing leverage and interest rates or a reduction of central bank balance sheets, or a big geopolitical shock. With the 2017 year behind us, the monthly average of the VIX is on pace to be the lowest in 15 years.

Why Is Volatility So Low?

There are many theories as to why volatility has declined to these levels despite the current political and cultural climate. In complex, open-ended systems like financial markets, it is hard to pin outcomes to a single variable.

Long-Term Volatility & Structural Shifts

When analyzing volatility, it is unfitting to equate short-term volatility movement with long-term volatility movements. While the VIX can be very reactive in the short-term, long-term volatility is less sensitive to short-term events and more susceptive to structural shifts. These structural shifts can occur because of different phases in the business cycle—such as weakness in the economy or a slowdown in corporate earnings—or, as in the case today, asset correlations dropping. Index volatility is a function of single stock volatility, and if single stock correlations remain muted, this translates into lower index volatility.

Trend to Passive Investing

Over the past year, Bloomberg data shows over $700 billion has flowed into broad-based passive funds/ETFs while active mutual funds have suffered redemptions of $240 billion. In theory, if this increase in passive inflows was the principal catalyst for rising equity prices, S&P 500 correlation levels should rise in lockstep, but the opposite has happened, with index correlations near record lows. This means that passive flows into broad-based indices are not uniformly raising all stocks.

Reduction in Hedging Activity

With volatility so low, the cost of hedging a portfolio has been reduced to at or near ten -year lows. Even so, many portfolio managers are electing to forego hedging in a feeble attempt to add “alpha,” ignoring the possibility of systematic market declines. The decision to not hedge has had an impact on volatility simply because there are fewer buyers of option premium.

Other elements contributing to subdued volatility are the impact of risk parity funds, the proliferation of systematic volatility premium harvesting programs, and macro decorrelation.

Prepare for the Unpredictable

It is difficult to determine what exactly is causing this extended low-volatility environment or to predict how long it will last. Even if high correlations are discovered, they rarely remain constant. Without being able to pinpoint a specific cause, it is virtually impossible to predict what will result in a spike or when the low volatility will end. This, coupled with the frailties of human nature, presents a low probability expectation for market timing strategies.

So, what is the best way to handle the unpredictable and uncertain low volatility environment? To remain always invested and always hedged.

Chris Hausman, CMT, is Director of Risk Management and Chief Technical Strategist for Swan Global Investments, a participant in the ETF Strategist Channel.