With the rally in U.S. equities growing long in the tooth, exchange traded fund investors should look into other markets to diversify their portfolios.

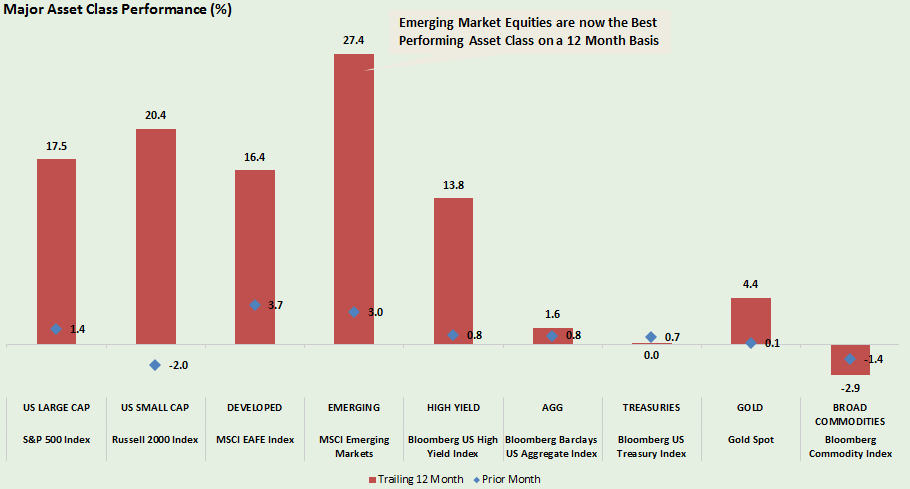

On the recent webcast (available on-demand for CE Credit), ‘CARPe Diem’ Tactical & Strategic Positions Outside the U.S., Jared Rowley, Senior Investment Strategist at SPDR ETFs State Street Global Advisors, and David Garff, President and Chief Investment Officer of Accuvest Global Advisors, pointed out that international markets have outperformed this year, with the benchmark MSCI Emerging Markets Index leading the charge – emerging market equities are now the best performing asset class on a 12 month basis.

“In just five months, EM markets have more than doubled the return of the U.S.,” Garff said.

Investors have also become more receptive of international exposure, funneling over $60 billion to international funds to date as sentiment rebounded and geopolitical risks receded post-French election.

Looking ahead, Rowley said that State Street Global Advisors predicts emerging markets to lead in the equities space and U.S. high-yield debt to outperform in the fixed-income space over the next year.

As investors look to various markets to diversify their equity portfolio, international stocks also look more attractive. For instance, based on price-to-book, emerging markets are the only areas trading below their 10-year average while U.S. large-caps are trading at 10-year highs.

“Despite attractive valuations and compelling arguments over the past five-, three- and one-years, international has underperformed,” Joe Mallen, Chief Investment Officer at Helios Quantitative Research, said.