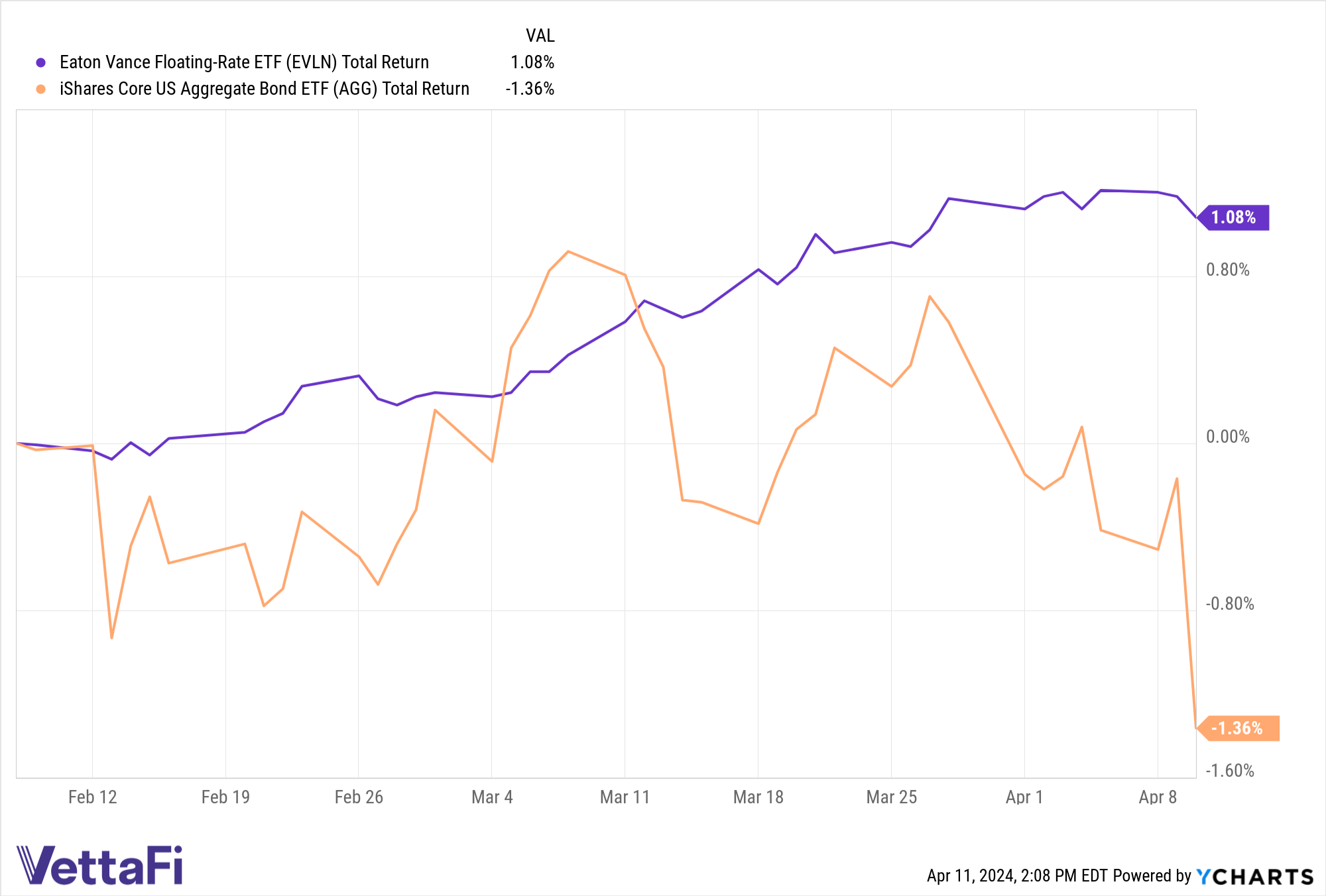

After March’s hot CPI print, markets now weigh the possibility of fewer or no interest rate cuts this year. In an uncertain rate environment, floating-rate ETFs eliminate the need to try and time bond exposure. Additionally, it prevents investors from becoming stuck in unfavorable positions should rates rise.

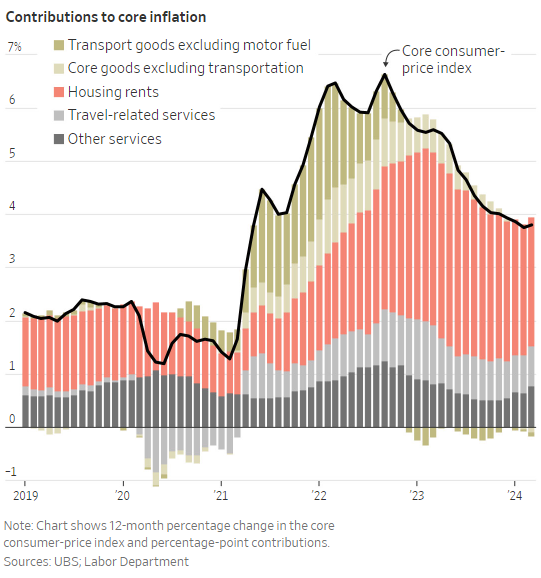

“Underlying inflation is down. We have made progress. Frankly, we’ve made more progress than I would have expected a year ago,” Jason Furman, an economist at Harvard University told the WSJ. “But we’ve made less progress than anyone was hoping for three months ago.”

High broad and core inflation in March alongside a healthy jobs market cast doubts over if, and when, rate cuts happen this year. Markets entered the year priced for upwards of six rate cuts. The Fed forecasts called for three rate cuts as recently as last month. Persistent, rising inflation challenges those narratives, increasing rate risk and market volatility.

Image source: WSJ

Capture Yields and Mitigate Interest Rate Risk With EVLN

Trying to time the bond market and weighing duration exposures remains an ongoing challenge for investors. Floating-rate strategies adapt to the changing rate narrative, an attractive feature in uncertain times.

The Eaton Vance Floating-Rate ETF (EVLN) is an actively managed senior loan ETF. The fund seeks high current income by investing in floating-rate credit securities, primarily corporate term loans. EVLN also invests in collateralized securitized bonds and high-yield bonds.

“The uncertainty of when the Fed will make its next rate move has made active management more meaningful,” said Todd Rosenbluth, head of research at VettaFi. “EVLN has an experienced team sorting through the loan market.”

Since the fund’s launch by Eaton Vance and Morgan Stanley Investment Management at the beginning of February this year, EVLN has amassed $778 million in AUM as of 04/10/2024. The fund applies a systematic risk-weighted investment strategy to analyze the risk and return of securities.

An issuer’s operating history, financial resources, and sensitivity to the economic macro environment and trends are considered when determining quality. The fund’s managers also look at a company’s management capabilities, and relative values using expected cash flow, earnings potential, and more.

The interest rate on the senior loans invested is reset periodically using a base lending rate as a reference, plus a premium. Senior loan strategies offer exposure to potentially elevated yields in below-investment-grade quality loans while mitigating risk. In the event of bankruptcy, senior loans are repaid first. Almost the entirety of the fund’s bond holdings (70.34%) rated B in quality as of the end of March.

EVLN seeks diversified senior loan exposure by investing across a range of industries and borrowers. Software (16.41%), hotels, restaurants, and leisure (9.5%), and capital markets (6.28%) made up the largest exposures by weight as of 03/31/2024.

EVLN carries an expense ratio of 0.60%.

For more news, information, and analysis visit The ETF Yield Channel.