Do shares of non-U.S. companies deserve a place in your portfolio?

More importantly, owning a stake in those international equities may be a good way to add diversification and potential risk management benefits to an all-U.S. portfolio.

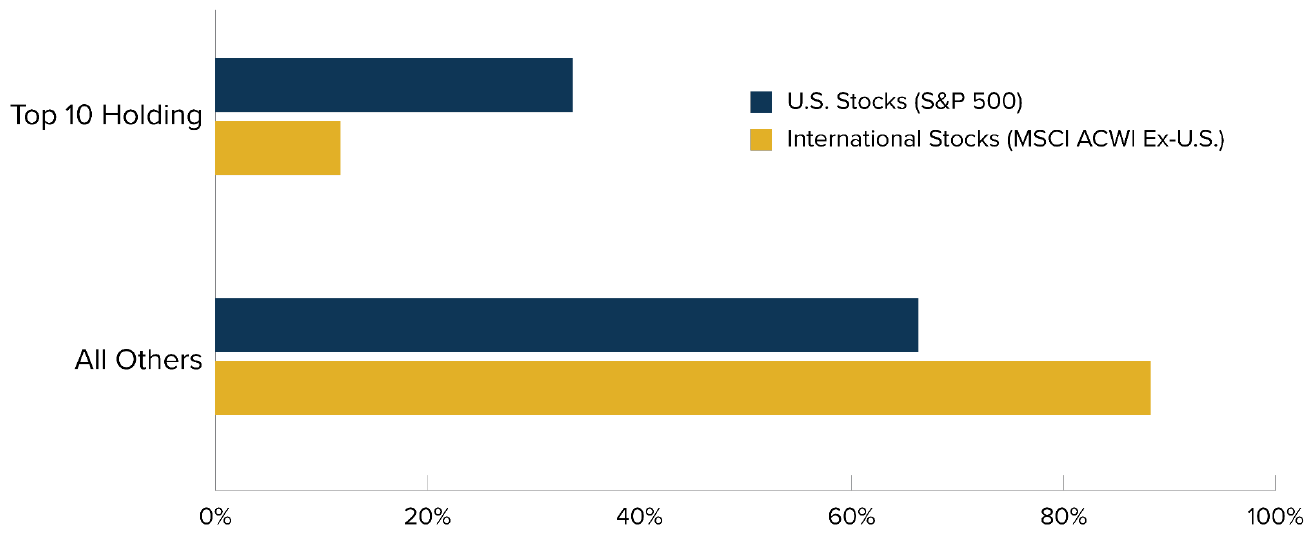

One big reason: International stock indices are often less concentrated and “top heavy” compared to their U.S. peers. While the S&P 500’s 10 top performers now make up 33.7% of that index, the top 10 stocks in the MSCI ACWI ex-USA index—which tracks large and mid-cap stocks of non-U.S. firms—represent just 11.8% of that index (see the chart below).

This more even distribution in the international index could help make it less volatile overall.

Less Concentration Among Popular International Stock Index Vs. S&P 500

Another plus: The two indices’ respective sector weightings differ significantly. For example, tech stocks make up 30% of the S&P 500 but just 13% of the MSCI ACWI Ex-USA—while financials stocks have a larger footprint in the international index (21% versus 13% for the S&P 500). Therefore, an international allocation may help to better diversify U.S.-centric portfolios.

Ultimately, we think the potential benefits of international equities mean the asset class deserves consideration for many investors’ portfolios—even if the U.S. market’s current momentum keeps getting all the attention.

This commentary is written by Horizon Investments’ asset management team. Past performance is not indicative of future results. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves the risk of loss.

The S&P 500 or Standard & Poor’s 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The MSCI ACWI ex-U.S. captures large and mid-cap representation across 22 Developed Markets and 24 Emerging Markets countries, excluding the U.S. Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. An index’s composition may not reflect how a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Individuals cannot invest directly in any index. Indices are unmanaged and do not have fees or expense charges, which would lower returns. The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. The opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed. Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2024 Horizon Investments, LLC.

For more news, information, and analysis, visit the ETF Strategist Channel.