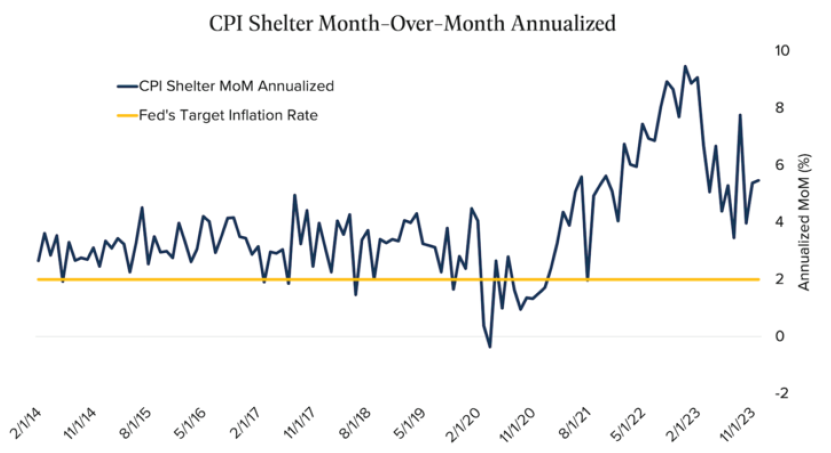

“Sticky” shelter costs could keep overall prices uncomfortably high.

The reason: Stubbornly high housing costs are keeping inflation in the services sector (as opposed to the goods sector) elevated. Broadly, the Consumer Price Index (CPI) rose by 3.6%* in December—but a closer look reveals that the cost of shelter jumped by a much larger 5.5%* (see the chart). That matters because the shelter category—a component of the services sector—accounts for a whopping 35% of the total calculated weight for the headline core inflation number.

Source: Bloomberg, as of 12/29/23

In short, high housing costs could make it much tougher for overall inflation to fall back to the Fed’s

target rate of 2%.

Housing costs remain high in part because of the sector’s natural lag time. Since rent prices are typically

locked in for an extended period—12 months, for example—housing costs in aggregate haven’t kept

pace with the lower prices we’re seeing for, say, eggs and gas.

This commentary is written by Horizon Investments’ asset management team. Past performance is not indicative of future results. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves the risk of loss. Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. An index’s composition may not reflect how a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Individuals cannot invest directly in any index. Indices are unmanaged and do not have fees or expense charges which would lower returns. The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed. Other disclosure information is available at www.horizoninvestments.com.