Traditional stock and bond market investing provides a solid foundation to an investment portfolio. However, the addition of another low correlated asset class that we call “alternative investments” can take your asset allocation to the next level.

Alts are Next Level

Using alternatives can increase diversification, dampen volatility, provide access to non-traditional markets, and enhanced returns.

Navigating the space can be daunting for individual investors, but ETFs have now made the space more accessible, transparent, and liquid. ETFs have redefined the alternative investment markets back to what they were originally intended to provide: lower correlated investments for more effective asset allocation.

At Stringer Asset Management, we have been investing in the alternative investments space using ETFs for over a decade. Our expectation for the current market environment of relatively muted market returns with greater volatility makes this one of the best opportunities, in our opinion, to use alternative investment ETFs if done so properly.

We focus on creating a basket of alternatives to provide liquidity and diversification to the other asset classes, along with the potential for risk reduction. When done correctly, this basket can help investors achieve an attractive rate of return with potentially less volatility than the traditional equity market and less interest rate risk than traditional bond investments. Even better, the evolution of the ETF universe allows investors to access alternative investment solutions through low-cost and liquid ETFs without the tax filing headaches associated with K-1s.

Why Alternative in this Environment?

We expect slower corporate revenue and earnings growth ahead as the U.S. Federal Reserve tightens their policy through rate hikes and a balance sheet reduction, which creates uncertainties in both the equity and bond markets. Still, we believe that including alternative investments into a portfolio is one area investors should consider that may result in a more consistent return and lower volatility over time.

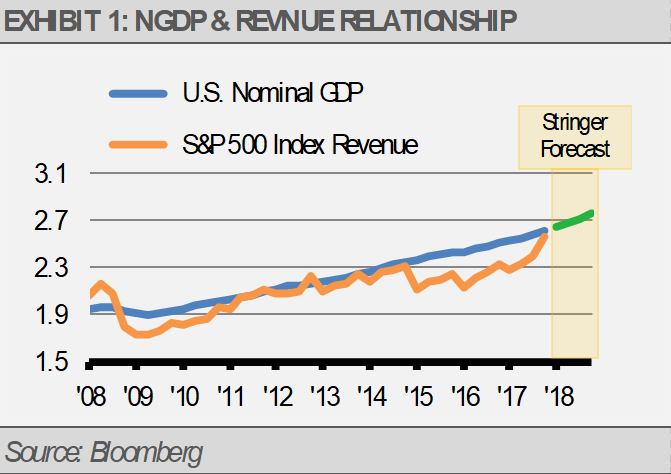

There is a long-term relationship between the nominal growth rate of the U.S. economy (NGDP) and corporate revenues. The rate of growth for the S&P 500 Index’s revenue was lagging NGDP but recently caught up with NGDP as the following graph suggests.![]()

Now that the gap has closed, combined with increased wage pressure and inflation, we think the headwinds of slower economic growth will likely squeeze corporate margins and put a ceiling on earnings growth. Though year-over-year earnings growth may decline, growth in corporate earnings still supports higher equity prices from here, however, we expect that gains will be harder to achieve.

Now that the gap has closed, combined with increased wage pressure and inflation, we think the headwinds of slower economic growth will likely squeeze corporate margins and put a ceiling on earnings growth. Though year-over-year earnings growth may decline, growth in corporate earnings still supports higher equity prices from here, however, we expect that gains will be harder to achieve.

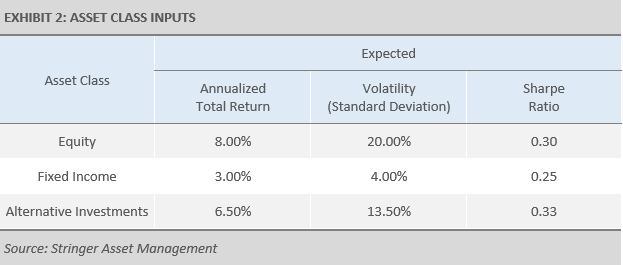

As a result, we expect an annualized total return for the global equity market in the years ahead of roughly 8%. However, we expect a significant level of volatility in the equity market as well, so we forecast a standard deviation of about 20%.

Meanwhile, interest rates have begun to rise and will likely continue doing so. As a result, we expect a total return for the broad domestic investment grade bond market of 3-4% going forward. Since bonds tend to have some level of volatility associated with their prices, we think that a standard deviation of about 4% is reasonable for bonds.

Our work suggests that a well-diversified basket of alternative investments can earn a total return of approximately 6.5% over the long-term and we anticipate a standard deviation of approximately 13.5% around that return. With those inputs in mind, we can create a risk/return matrix across the three broad asset classes as follows.

Therefore, we expect the most attractive risk-adjusted returns, as measured by the Sharpe Ratio, from the alternative investments space. In addition to attractive risk-adjusted returns, alternative investments tend to have relatively low correlation to the other two broad asset classes. This correlation benefit can also reduce overall portfolio risk. However, it is also important to think about exposures within an alternative investment basket.

What types of alternative strategies work in this environment?

We view the alternative investment universe as basically everything but traditional long-only equity securities and the core fixed income sectors as represented in the Bloomberg Barclays Aggregate Bond Index. Importantly, alternative investment strategies contain not only the risks associated with traditional equity and fixed income markets, but also many other types of unique risks that an investor should consider.

For instance, we think that the differences in U.S. yields compared to comparable yields around the world could lead to the U.S. dollar to appreciate significantly as foreign institutions purchase more U.S. dollar denominated debt.

Assets denominated in U.S. dollars are likely to come under pricing pressure as the U.S. dollar moves higher and the relative prices of these asset move lower (the stronger the U.S. dollar, the more of the asset can be purchased with each dollar all else being equal).

As a result, the prices of many precious and industrial metals as well as emerging market debt could depreciate, so investors may want to limit exposure to those areas of the alternative investments universe.