By Komson Silapachai

In a speech on January 6, Lorie Logan, president of the Dallas Federal Reserve, mentioned the possibility of market dysfunction as the Fed balance sheet continues to shrink. Commenting on the Fed Overnight Reverse Repo Facility (ON RRP), Logan stated:

Logan oversaw the implementation of Fed policy during the post-Great Financial Crisis (GFC) era, so her focus on tapering the Fed’s quantitative tightening (QT) program holds weight for markets. It also highlights a complex issue for the FOMC: Regardless of the level of inflation and economic growth, the FOMC may have to act to prevent a liquidity drain from constricting markets. Given recent Fed signaling, it looks likely that the Fed will slow its QT program in the coming months, which on the margin eases financial conditions and is a key factor in our favorable outlook for fixed income.

History of the Overnight Reverse Repo Facility (ON RRP)

Given the spectacular increase in the Fed balance sheet post-GFC and the subsequent rise in bank reserves, the Fed began paying interest on reserves to maintain control of its ability to set rates. This was available only to large depositary institutions, so the “smaller players” in the overnight lending markets, like GSEs, smaller banks, and money market funds did not have the ability to earn interest from the Fed and had to go out and find other short-term instruments in which to invest.

This became a problem when the Fed was considering raising interest rates in 2014. Since there was so much liquidity in the system searching for yield, when the Fed raised interest rates, there was no guarantee that overnight rates would move higher, and the “smaller players” still had to park money somewhere, which would keep market rates near zero.

If the Fed couldn’t control overnight rates, then it wouldn’t have the power to conduct monetary policy, so to provide a floor for overnight rates, the Fed created the ON RRP facility. It allowed the “smaller players” to lend money to the Fed on an overnight basis through a reverse repurchase (“repo”) transaction. The mechanics of the transaction itself are less important for this report – the important thing about the ON RRP facility is that it provides a floor to short-term rates that are tied to the Fed policy rate.

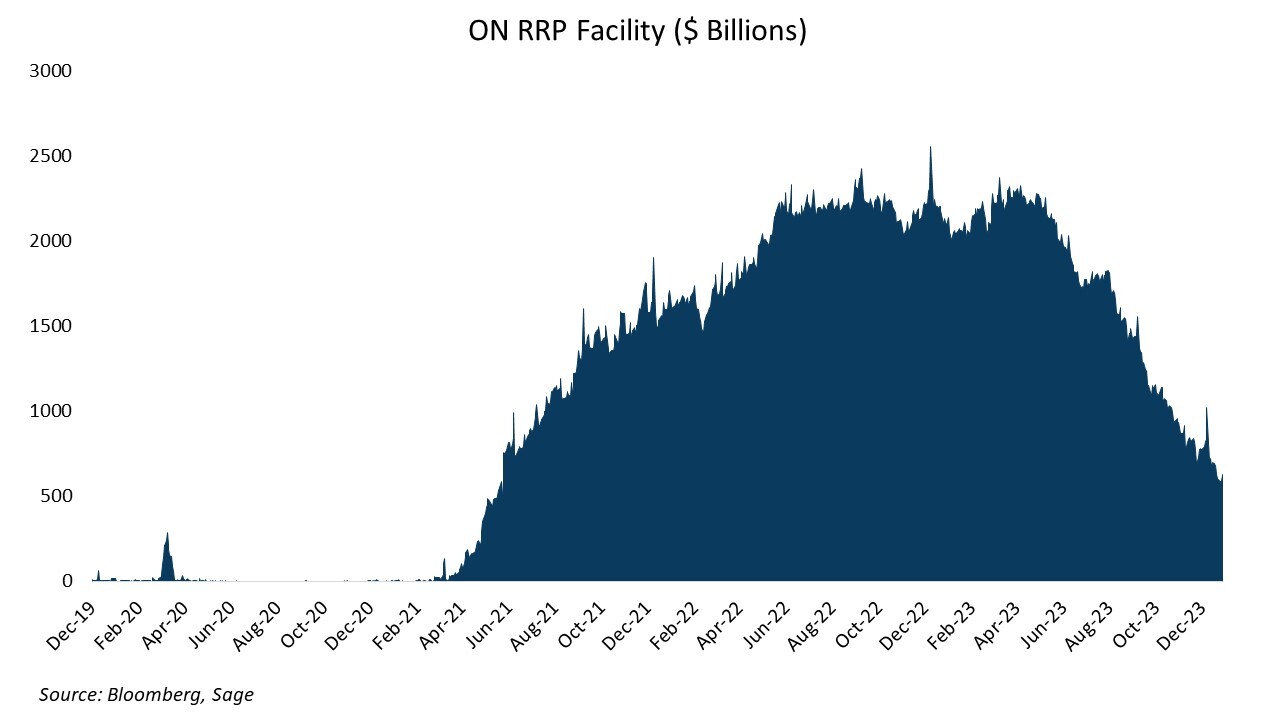

Funds Parked at ON RRP Facility Have Helped Neutralize Recent Treasury Bill Issuance

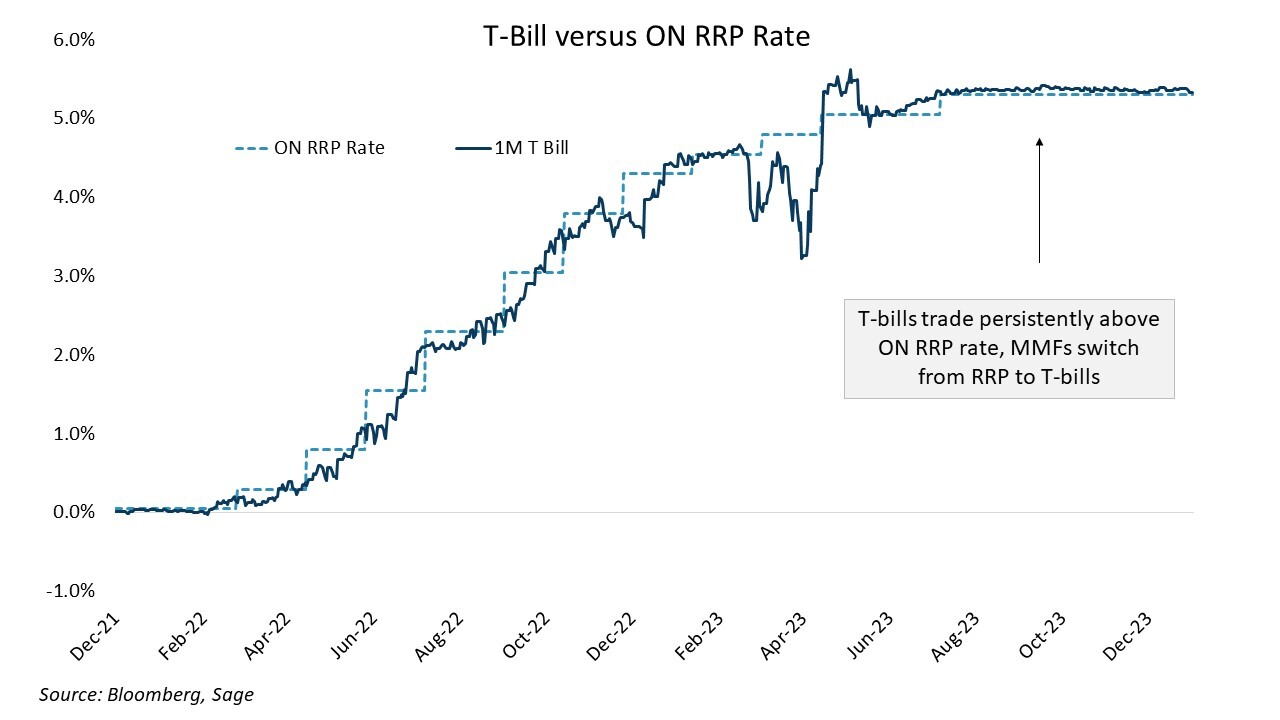

As a result of the Covid-era stimulus programs, the FOMC printed several trillion dollars through asset purchases, most of which ended up in savings vehicles, especially money market funds (MMFs). At that time, Treasury Bills yielded less than the Fed’s ON RRP rate due to a lack of issuance and money market regulation. As a result, MMFs ended up parking cash at the Fed’s ON RRP, which increased as the Fed raised interest rates. As yields rose in 2022, RRP at the Fed grew to $2.5 trillion.

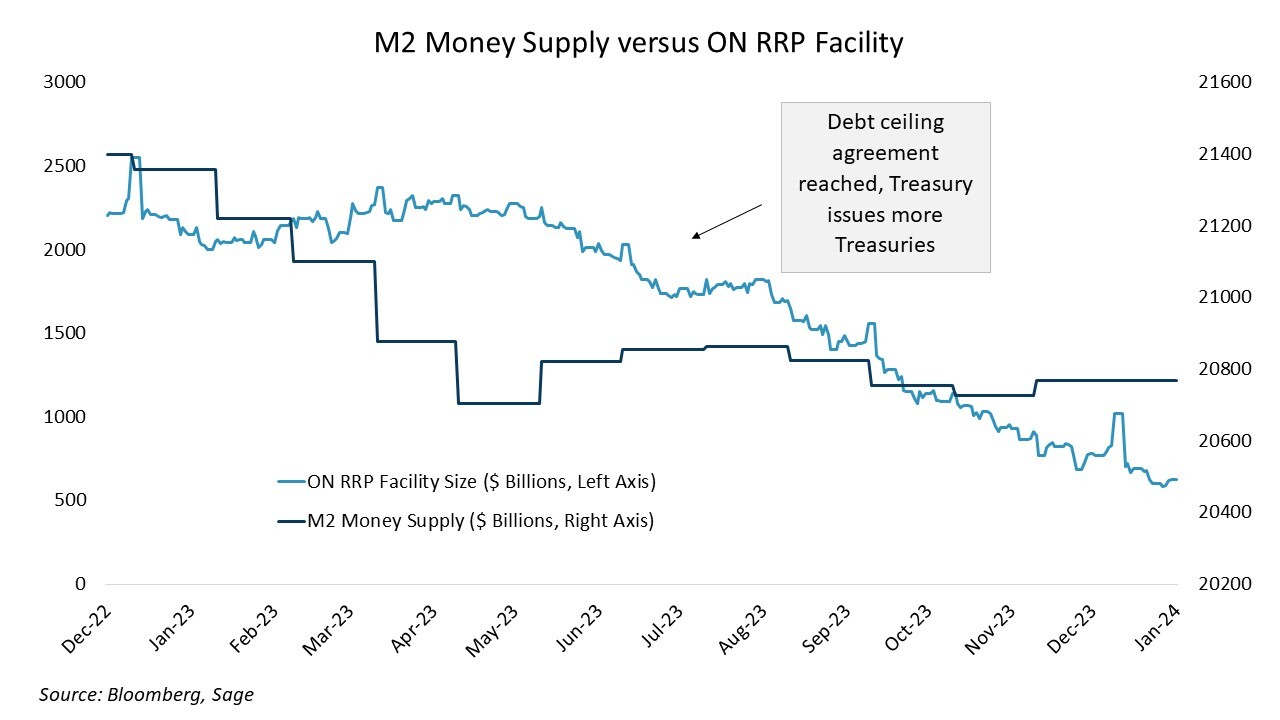

To fund government spending, the US Treasury issued more T-bills in 2023. As a result, the yield of those bills rose to above the rate of RRP, so the money market funds moved out of RRP to T-bills. The Treasury issued more bonds, but there was no drain of liquidity from the private sector, because it just came out of what the MMFs had parked at the RRP facility.

While it wasn’t stimulus or the Fed monetizing Treasury issuance, it neutralized the withdrawal of liquidity from bond issuance, so it had the same effect on markets. The best chart to illustrate this phenomenon is the size of the money supply (amid all the Treasury issuance) versus the size of the ON RRP facility. The RRP facility absorbed nearly all the supply while the money supply remained stable.

Currently, there is only about $600 billion left in the RRP, and the facility is expected to be depleted by April. After this occurs, every time the Treasury issues bills, there must be new funds to absorb the new supply, otherwise there will be a liquidity drain from the economy.

The Fed Has Taken Notice

This issue complicates the FOMC’s monetary policy decision over the next three months. Would slowing QT to preserve financial stability send a signal to markets that the Fed is reversing course and is back on the road to quantitative easing? The risk would be enacting policy that is too accommodative when inflation is still above trend.

If the FOMC does nothing, and if the Treasury continues to issue Treasuries at the current pace, then the resulting liquidity drain could weigh on markets and the real economy. Market functioning could be impaired, and the second-order effect could be an economic recession.

Given the recent tone of Fed communication – a pivot to support economic growth and preserve the “soft landing,” along with an explicit mention of slowing the pace of balance sheet runoff – the Fed looks like it is on the road to slowing QT, which is a key consideration in our outlook for rates. In this scenario, yield volatility should fall and the risk/reward for fixed income continues to look favorable.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

For more news, information, and analysis, visit the ETF Strategist Channel.