CONSUMER AND HOUSING STRENGTH REINFORCES OUR POSITIVE OUTLOOK

Often it can feel as though folks on Wall Street view the world differently than folks on Main Street. Today, fears around the coronavirus have raised doubts about the level of economic growth around the world. Markets often swing back and forth based on perception, only to reverse as more facts are known. Our views have not significantly changed since our coronavirus piece back on February 3, though our team continues to monitor risks closely. While pandemics can have sharp near-term effects on the global economy, history suggests markets eventually look through the impact as infection cases start to slow – which we may be seeing early signs of deceleration in China.

It may be difficult to quantify the impact of headlines, especially the risks of a pandemic, so we continue to focus on data points that we believe can provide more meaningful measures of the state of the economy. Over the past year, the data around the consumer has been some of the most encouraging and January report from The Conference Board was no exception. The Conference Board is a non-profit organization that conducts economic and business management research. Not only did the Present Situations Index increase, but so did The Expectations Index which is generated based on responses to questions about the outlook for income and business conditions. Judging by these standards, Main Street views the world optimistically. Perhaps, the strongest evidence of consumer strength has been appearing in the US housing market. We believe the information we can glean from housing data may be an important “intersection” for Wall Street and Main Street.

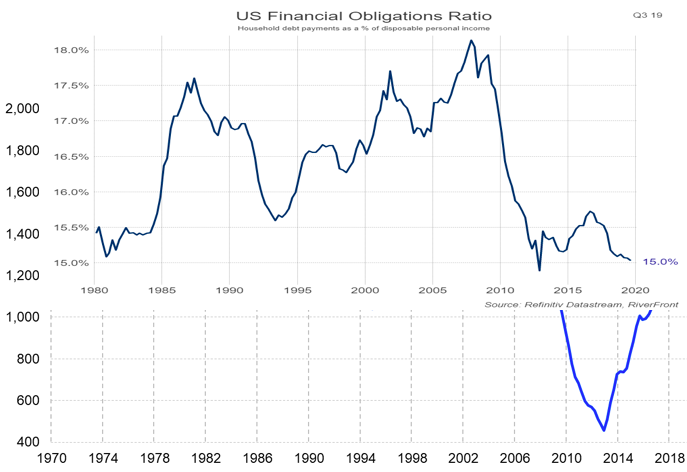

The questions surrounding the relationship between the housing market and the stock market are longstanding. While some economists can argue that correlations are minimal, we believe that common factors can account for price appreciation (or depreciation) in both. In more recent history, most agree that the real estate bubble in 2007 led to the stock market crash, but it is also widely accepted that lending conditions and consumer balance sheets were too loose and too levered, respectively. Today, the Dodd Frank Act calls for increased scrutiny around lending standards and, rather than being highly levered, households are less levered now than during the recession as the chart (right) illustrates.

Source: Refinitiv Datastream, RiverFront. Past performance is no guarantee of future results. Shown for illustrative purposes.

HOUSING CONTINUES TO STRENGTHEN

Housing related data has continued to trend higher. New home sales, existing home sales, and home prices are just some of the data series that have shown improvement over the past year. Against a backdrop of an accommodative Federal Reserve Bank, we expect mortgage rates to remain relatively low which also adds to the attractiveness of home ownership. Most recently, the National Association of Home Builders’ (NAHB) monthly confidence index moved to the highest level since 1999. We view this as particularly encouraging given the pressure builders have faced in finding skilled laborers. The continued optimism reflected in the index, despite those pressures, suggests demand remains healthy.

Recent data released by the US Census Bureau reaffirmed the strong trends for the housing market. The chart above illustrates the continued increases in US household formation. The report noted that homeownership continues to climb and is back to the highest level since 2013. As we discussed in our Weekly View on February 10th, millennials are now at an age where many are purchasing homes. The ownership rate for the under-35 age group has climbed to over 37%, which is the highest level since 2011. Even more encouraging is the idea that Generation Z, the demographic group that follows the Millennials, ranks home ownership as an important goal. According to a survey from Freddie Mac, 86% want to own a home someday which could provide longevity in the bull market for housing. In addition to the positive demographic trends, there is also evidence that strength in the housing market can translate into a higher levels of consumer spending and investments. Economic studies have shown consumers who purchase homes also spend money on home-related durable goods such as appliances. There are also increased expenditures on home improvements and maintenance. Add in the increased employment opportunities afforded by new home construction, and it is natural to conclude that a robust housing market is good for the economy.

WHY HOUSING MATTERS TO THE ECONOMY

It is not an exaggeration to refer to housing as one of the single most impactful parts of the US economy. According to the NAHB, housing’s combined contribution to US GDP averages between 15-18%, including impacts from construction, remodeling, and consumption spending on housing services. Furthermore, as the “ultimate” long term purchase, buying a new home signals a consumer that is confident about their current financial condition and their expectations for stability in terms of employment and financial security.

Trends in the housing market may not be perfectly tied to equity markets, but we believe that what is good for housing is generally good for the economy. In our 2020 Outlook, we assigned a high probability of a positive scenario for the equity markets as well as the US economy. The low unemployment levels, steady wage growth, and an accommodative Federal Reserve are positive drivers for the economy in general and the housing market in particular. We have all heard the real estate adage “location, location, location.” We believe that to be true here as well in that the intersection of Wall Street and Main Street remains attractive.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns like those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

In a rising interest rate environment, the value of fixed-income securities generally declines.

The monthly Consumer Confidence Survey®, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The cutoff date for the preliminary results was January 15. The Present Situation Index is based on consumers’ assessment of current business and labor market conditions. The Expectations Index is based on consumers’ short-term outlook for income, business and labor market conditions.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared with the portfolios’ composite benchmarks. For more information on our composite benchmarks, please visit our website: www.riverfrontig.com.

Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or expertise. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations.

RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated (“Baird”), a registered broker/dealer and investment adviser.

Copyright ©2020 RiverFront Investment Group. All Rights Reserved. 1098673