By DeFred Folts III, Managing Partner Chief Investment Strategist, and Eric Biegeleisen, CFA®

Partner, Deputy Chief Investment Officer

Equities:

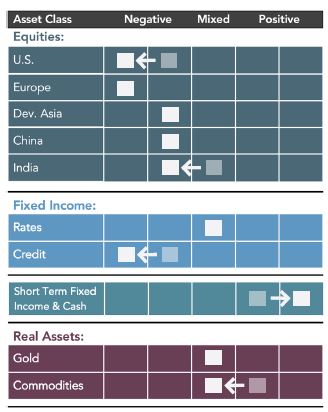

▶ U.S. Equities: U.S. equities continued to stumble in June, delivering the worst first half of year performance for the S&P 500 in over 50 years. Concerns remain regarding Fed interest rate hikes alongside quantitative tightening (balance sheet reduction). The model research is showing signs of negative investor psychology, widening credit spreads, flattening yield curves, and stubbornly high inflation. Despite the sell-off, valuation levels for U.S. equities remain uncomfortably elevated, and the model outlook remains negative.

▶ U.S. Equities: U.S. equities continued to stumble in June, delivering the worst first half of year performance for the S&P 500 in over 50 years. Concerns remain regarding Fed interest rate hikes alongside quantitative tightening (balance sheet reduction). The model research is showing signs of negative investor psychology, widening credit spreads, flattening yield curves, and stubbornly high inflation. Despite the sell-off, valuation levels for U.S. equities remain uncomfortably elevated, and the model outlook remains negative.

▶ European Equities: European equities fared poorly in June and proved to be one of the worst performing equity markets globally during the first half of 2022. Concerns regarding the strengthening U.S. dollar, i.e., weakening Euro, widening credit spreads, and fear of ECB rate hikes in the months ahead have the model’s outlook remaining negative. Additionally, inflationary pressures in Europe remain, which are likely being exacerbated by Russia’s invasion in the Ukraine.

▶ Japanese Equities: Japanese equities performed very much in line with U.S. equities for June and the first half of the year. Our model research continues to find Japanese equities unattractive due to an inverted and flattening yield curve measure, as well as widening credit spreads and negative investor psychology. In addition, Japanese equities have performed poorly despite their central bank’s continued easy monetary policy, which in turn led to the Yen’s ~15% loss in value relative to the U.S. Dollar, though investors are questioning how long that can continue.

▶ Chinese Equities: Chinese equities were one bright spot for June, returning positive single digits for the month, though the MSCI China Index is still down over 10% on the year. China’s draconian zero-COVID restrictions continue to have a negative impact on growth prospects for the economy, the outlook for the Yuan and investor psychology. Credit spreads continue to widen in the Chinese financial markets. The outlook for Chinese equities remains negative. Chinese equities are undervalued by our measure; however, there is no catalyst for reinvestment at this time.

▶ Indian Equities: India equities suffered losses in June and remain down over 14% on the year. Investors may be bracing for further tightening by the Reserve Bank of India following the initial surprise rate hike in early May and followed up with another in June to combat their elevated inflation. Indi-an equities are in a behavioral correction stage which continues to have an offsetting effect to their relatively favorable economic growth prospects. A shift to a more positive investor psychology alongside relief from inflationary pressures would likely help shift the outlook more positively.

Fixed Income:

▶ The U.S. 10yr Treasury bond yield started the month of June at 2.8%, almost touched 3.5% intramonth, and following the July 4th weekend is back to 2.8%. An investor in a fund of 7-10yr Treasuries would have lost nearly 5% by mid-month only to nearly recover it all by month end. Year-to-date, U.S. 7-10yr Treasuries are down nearly 11%. Despite the Fed’s efforts to curb inflation, the latest print ticked higher to 8.6%. Continued rate hikes alongside the Fed’s balance sheet reduction program continue to pressure interest rates higher. Therefore, our research continues to favor U.S. Treasury Inflation-Protected Securities (TIPS) as well as U.S. Treasury Floating Rate Securities, which may perform well in an inflationary and rising rate environment.

▶ The outlook for Credit is negative as the risk of a global economic slowdown from rising inflation and monetary tightening continues. Our research indicates the increased threat of continued widening in corporate credit spreads as a result.

Real Assets:

▶ Gold: Real Assets including both gold and commodities experienced losses in June, bringing gold’s year-to-date return negative, though commodities remain positive on the year. Tight monetary policy is helping to prop up the U.S. Dollar while also hurting gold in the shorter-term. In addition, real rates as indicated by the U.S. TIPS yield remain positive, another negative for the gold outlook. The outlook for gold remains mixed. Should the Federal Reserve abandon their tight policy, gold may benefit.

▶ Commodities: Similarly, the model research has a mixed outlook for commodities. While still undervalued relative to equities, shorter-term concerns with respect to widening credit spreads globally along with China’s slowdown has reduced the outlook for commodities. However, the potential for energy commodities to perform well in the short-to-intermediate term exists should energy supplies to Europe be interrupted whether due to Norway’s strikes or Russian control.

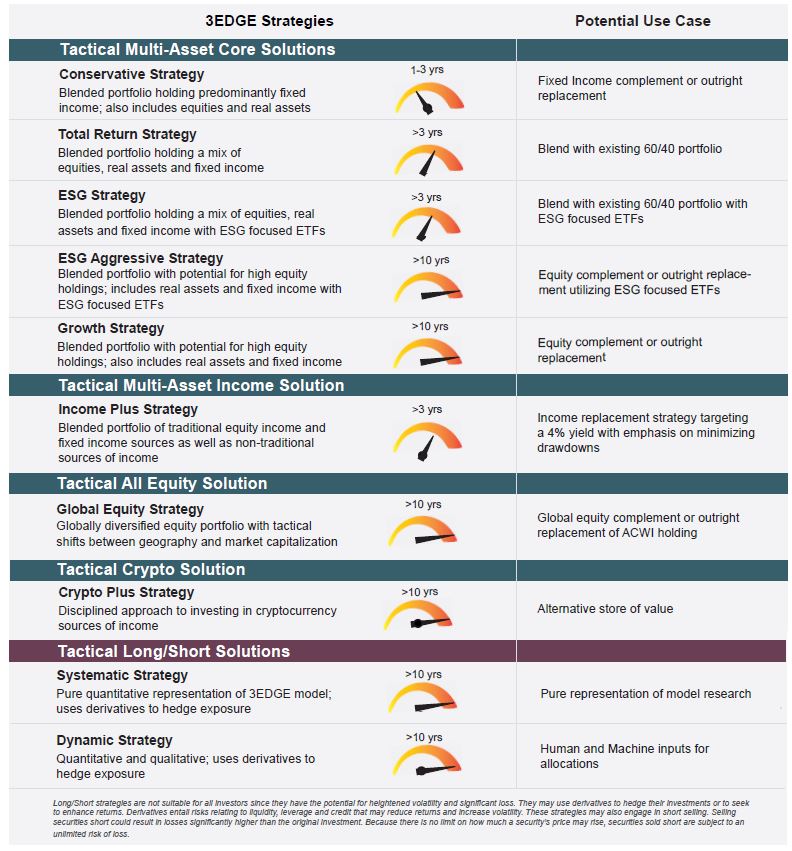

3EDGE Solutions Designed to Smooth the Ride

Seeking to manage volatility and downside risk while providing the potential to be additive to investment returns

For more information about 3EDGE Asset Management or our offerings, please visit our website at 3edgeam.com.

About 3EDGE

3EDGE Asset Management, LP, is a multi-asset investment management firm serving institutional investors and private clients. 3EDGE strategies act as tactical diversifiers, seeking to generate consistent, long-term investment returns, regardless of market conditions, while managing downside risks.

The primary investment vehicles utilized in portfolio construction are index Exchange Traded Funds (ETFs). The investment research process is driven by the firm’s proprietary global capital markets model. The model is stress-tested over 150 years of market history and translates decades of research and investment experience into a system of causal rules and algorithms to describe global capital market behavior. 3EDGE offers a full suite of solutions, each with a target rate of return and risk parameters, to meet investors’ different objectives.

DISCLOSURES: This commentary and analysis is intended for information purposes only and is as of July 8, 2022. This commentary does not constitute an offer to sell or solicitation of an offer to buy any securities. The opinions expressed in View From the EDGE® are those of Mr. Folts and Mr. Biegeleisen and are subject to change without notice in reaction to shifting market conditions. This commentary is not intended to provide personal investment advice and does not take into account the unique investment objectives and financial situation of the reader. Investors should only seek investment advice from their individual financial adviser. These observations include information from sources 3EDGE believes to be reliable, but the accuracy of such information cannot be guaranteed. Investments including common stocks, fixed income, commodities, ETNs and ETFs involve the risk of loss that investors should be prepared to bear. Investment in the 3EDGE investment strategies entails substantial risks and there can be no assurance that the strategies’ investment objectives will be achieved. The regions included in our Equities category are measured based on the S&P 500 and MSCI indices. U.S. equity markets are represented by the S&P 500 index, unless we state otherwise. Japanese equities are represented by the Nikkei 225 equity index. European equities are represented by the MSCI Europe Index. India equities are represented by the S&P BSE SEN-SEX equity index, and Chinese equities are represented by the MSCI China index. Real Assets (Gold & Commodities) includes precious metals such as gold as well as investments that operate and derive much of their revenue in real assets, e.g., MLPs, metals and mining corporations, etc. Intermediate-Term Fixed Income includes fixed income funds with an average duration of greater than 2 years and less than 10 years. Short-Term Fixed Income and Cash includes cash, cash equivalents, money market funds, and fixed income funds with an average duration of 2 years or less. Past performance is not indicative of future results. View From the EDGE® is a registered trademark of 3EDGE Asset Management, LP.