Summary

-

The massive US trade deficit amid accelerating deglobalization provides a powerful investment theme.

-

US infrastructure needs to be modernized and expanded because the US will likely be forced to regain its economic independence.

-

The market is already rewarding the beneficiaries of this capital reallocation, but we expect years, if not decades, of further performance from this critical investment theme.

Politicians, CEOs, and investors understand the US’s national security risk of being dependent on the rest of the world for semiconductors, but they don’t seem to understand the US’s national security risk of being dependent on the rest of the world for virtually everything.

The reindustrialization of America, the American industrial renaissance, the rebuilding of the American capital stock, reshoring, near-shoring, friend-shoring, or infrastructure are all synonymous names for what might be THE most important secular investment theme.

Deglobalization is becoming a powerful secular global economic force, and in order for the US economy to persevere, let alone thrive, through such an environment, it will require tremendous manufacturing and infrastructure investment.

Deglobalization is accelerating…

The US industrial renaissance is not a new theme for RBA. We first wrote about it in 2012 when we argued that US corporations had moved operations overseas because they were too focused on labor costs, and were ignoring transportation, governmental, geopolitical, and supply chain risks.

Those risks have grown substantially since that original report. The pandemic revealed the fragility of supply chains in many industries and geopolitical and governmental issues seem to be multiplying. Governments’ efforts to limit globalization have increased substantially since we wrote our initial report.

Nationalistic political parties are gaining strength in many countries, and nationalism is the polar opposite of globalization. Whereas world trade expanded as globalization became more popular, nationalism’s goals typically tend to protect domestic production and restrict competitive world trade.

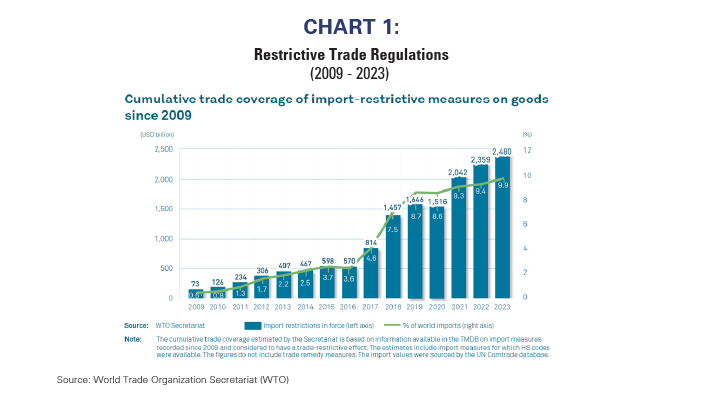

Chart 1, from the World Trade Organization (WTO), shows the increase in restrictive trade regulations using two different measures. Actual import restrictions, such as tariffs, have increased six-fold since we wrote our original report a decade ago. Similarly, the proportion of world imports affected by such actions has quadrupled.

As nationalism and restrictive trade provisions have been put in place, general uncertainty regarding trade has been growing. Chart 2 shows the impact of major changes in trade legislation on uncertainty. There was a significant increase in uncertainty surrounding the emergence of globalization and NAFTA in the early-1990s. More recently, uncertainty has again been increasing because of restrictions and tariffs. NAFTA signaled the beginning of this era’s globalization, whereas more recent legislation and political sentiment has apparently signaled the end. The latest surges in trade uncertainty are among the largest in the 40-year history of the data.

…but the US is increasingly dependent on the world

If the US had enough productive capacity to be increasingly economically independent, then contracting globalization wouldn’t be an important issue, but that is unfortunately not the case. Rather, the US has become increasingly dependent on the rest of the world for goods and services.

Chart 3 shows the US trade deficit through time. The ballooning trade deficit demonstrates that US production lost market share through time as globalization expanded and production moved to where it was most efficient.

Many economists have been concerned about the US trade imbalance for decades, but the trade deficit didn’t matter much so long as globalization was expanding. However, maintaining a massive trade deficit while globalization is contracting is a toxic combination that is now revealing an underlying structural weakness in the US economy.

We think the key investment theme of the next 5-10 years or more will be the necessary rebuilding of US production and US economic independence.

Government policies need to change to support economic independence

We have repeatedly emphasized that Washington’s policies have hugely contributed to the demise of US economic independence. Both parties are equally to blame for this as both have lost sight of the country’s need to focus on return-on-investment.

Keynesian economics centers on the use of debt and deficits to fund long-lived assets that benefit the economy and society for longer than the maturity of the debt used to finance projects. However, Democrats have chosen to finance short-term spending with longer-term debt, which is similar to going on a vacation using a home equity loan. The return-on-investment might be worthwhile, but it is fleeting, and the ongoing debt obligation hinders future economic growth.

Some Republicans adhere to an economic model that became increasingly outdated as globalization expanded, namely the Laffer Curve and supply-side economics. Whereas one could argue such theories might prove beneficial in a closed economy, tax cut programs were never adjusted to account for increasingly global capital flows. For example, corporations received tax cuts, but then used those tax advantages to build factories outside the US. US tax policy, therefore, contributed to a US government deficit, but stimulated emerging economies instead of the US’s.

We expect both Democrats and Republicans to finally wake up to their misguided tactics. Democrats will likely argue for spending on longer-lived assets (there is some evidence this may be starting), whereas Republicans might shift to a tax reward system for good behavior (e.g., build a production facility in the US and then receive tax benefits) rather than blanket tax cuts whose benefits can “leak” abroad.

Various themes within re-industrialization

There are many sub-themes within the overall theme of US economic independence and the reindustrialization of the American economy. Some of our favorites include:

-

Energy Infrastructure – The US is NOT energy independent. Emphasize both “brown” and “green” energy.

-

Utility Infrastructure – The US electric grid is antiquated and notoriously unreliable.

-

Transportation – The US ranks last among major economies in transportation investment. (See Chart 4)

-

Real Estate – Current real estate investments are very service-oriented. Manufacturing-related real estate might provide better investment opportunities.

-

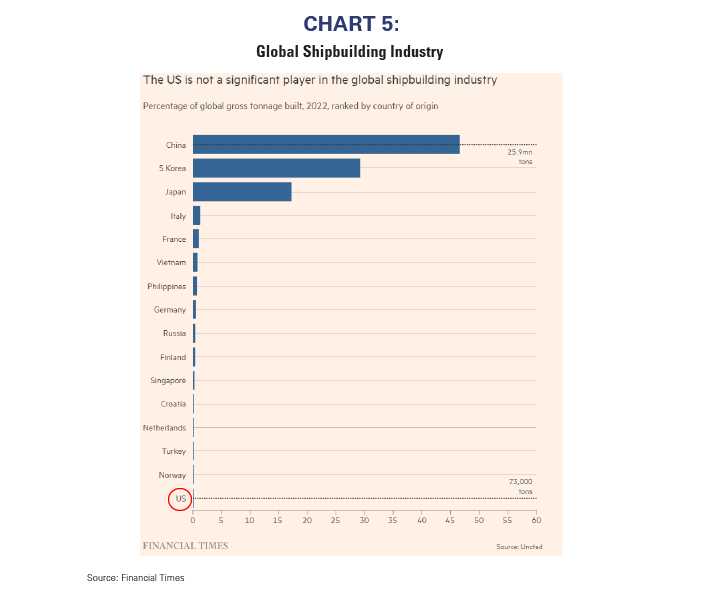

Steel and Shipbuilding – The US is last among major economies in shipbuilding which questions the future preparedness of the Navy. (See Chart 5)

The markets are already rewarding re-industrialization

The market has already recognized the re-industrialization investment theme despite investors’ myopia with respect to more exciting technology-related themes, like artificial intelligence. In fact, domestically focused industrial stocks have outperformed the overall market during the past decade.

Chart 6 shows the total return performance of the S&P MidCap 400® Capital Goods Industry Group Index and the S&P SmallCap 600® Capital Goods Industry Group Index versus the S&P 500®. Since the end of 2014, both small and midcap capital goods have handily outperformed the S&P 500®.

Re-industrialization is not only a viable investment theme, it is a necessary one

The US economy is facing a significant challenge. The combination of a massive trade deficit and deglobalization is a poor one at best.

We believe the capital markets will be smart enough to reallocate capital to where it is needed the most and the potential returns are underappreciated. Investors should shift their priorities from sexy, technology laden themes that seem to be a dime-a-dozen to themes based on real productive assets and the rebuilding of the American capital stock.

Although one might be skeptical, it’s important to remember the stock market has been on to this theme for a decade. We think there is still years, if not decades, of performance left in this critical investment theme.

For more news, information, and analysis, visit the ETF Strategist Channel.