By RiverFront Investment Group

AS THE TRADE WAR ESCALATES, GLOBAL DEMAND SLOWS

For a year now, global stocks have been highly sensitive to the US/China trade negotiations. This year the US/China trade saga has gone from looking optimistic through the 1st quarter, to an escalation of tariffs in May and, most recently, to a further hardening of attitudes to any agreement from both sides. It is this last development, coupled with the recent proposal of tariffs on Mexico, that caused us to reduce international stocks last week. US and Chinese leaders are determined not to show weakness, which is why the recent breakdown in talks is alarming. Someone is going to have to blink for progress to resume, and both leaders seem to have entrenched their hardline positions. Not surprisingly, global stock markets have fallen around 7% from their recent peak and have fallen below meaningful support levels, in our view (see chart, below).

From a fundamental perspective, economic data is softening all over the world as uncertainty over global trade is causing both consumers and businesses to reduce spending. This is especially true in Europe and Japan, where the major public companies are very sensitive to demand from China and the US.

Fundamental uncertainty is reflected in global stocks (as measured by the MSCI World Stock Index), which has broken below the 200-day moving average. The 1st quarter of this year saw the index recoup all of the losses from the 4th quarter and return to the highs of last September. Until the trade talks soured, it looked like the index might make it above the September high, but now it has broken below support at the bottom of our indicated decision box (blue horizontal lines, chart below), suggesting the recent weakness could persist. We think the next support for global stocks is around 480 (dotted line, chart below).

GLOBAL STOCKS BREAK BELOW THE BOTTOM OF A TRADING BAND

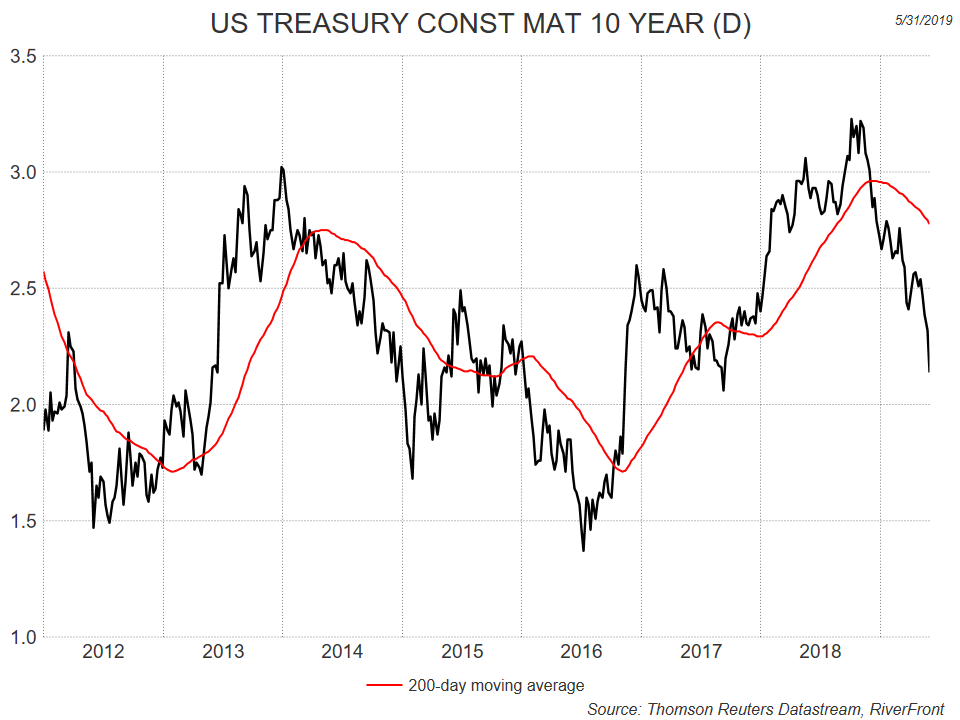

It’s not just the stock market that is worried about growth. Around the world, bond yields have been falling. Ten- year government bond yields in Germany and Japan are negative, and the yield on the 10-year US Treasury note has fallen by more than one percentage point, from 3.2% to 2.1% since last October, with half of that coming in just the last few months.

US 10-YEAR BOND YIELDS AT LOWEST LEVELS IN 18 MONTHS

The fixed income markets are telling the Fed that rate cuts are needed, because the yield on 3-month interest rates – which are highly dependent on expectations about Federal Reserve policy – are now slightly higher than 10-year yields.

RIVERFRONT REDUCING EXPOSURE TO INTERNATIONAL STOCKS

Our portfolio management teams have decided to lower overall exposure to international equities. In our shorter-horizon portfolios, we have left the proceeds in cash. In our longer-horizon portfolios, we have reallocated the proceeds back into US stocks, thus keeping our overall stock weighting approximately the same. Our base case remains that the world will avoid recession in the near-to-intermediate term, but complications as discussed above have caused us to lower our conviction level. Since mid-May, when we last wrote about trade (Weekly View, 5/13/19) there has been a series of rolling events that, in aggregate, have darkened the near-term outlook for international stocks. In our opinion, these include:

- Increased threat of a protracted, multi-front ‘trade war’ between the US, China and other trading partners. While we believe that the US and its partners have more to gain via an eventual cease-fire as opposed to a prolonged altercation, the longer this uncertainty drags on, the higher the probability of lasting damage to the global economy. Importantly, we believe this dynamic has the potential to impact earnings in both developed and emerging market economies should the trade war drag on.

- European political uncertainty. Following the departure of Theresa May as Prime Minister in the UK, the risks around a potential ‘no-deal’ Brexit have increased, though we still believe this to be a low-probability event. In general, the mixed results of the European Parliamentary elections last week have fractured established party politics in many major European nations and increased uncertainty, including around who may succeed Mario Draghi as head of the European Central Bank this fall.

- Continued deceleration in economic survey data in numerous developed and emerging market economies, which may challenge the global economic recovery.

As we discussed earlier, our technical analysis of global stocks – the ‘message of markets’ – is corroborating our increased near-term caution, suggesting international stocks have worse odds of positive absolute and relative returns versus the US over the next 3 months. We would note that the U.S. economy is still the strongest major economy, that the US still holds the upper hand in trade negotiations; thus, we continue to believe that a trade war will hit many international economics harder than the U.S.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Registration as an investment adviser does not imply any level of skill or expertise.

Comments regarding asset class weightings refer to our Advantage portfolios, for information on our other portfolios, please refer to our website.

This article was written by the team at RiverFront Investment Group, a participant in the ETF Strategist Channel.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

In a rising interest rate environment, the value of fixed-income securities generally declines.

It is not possible to invest directly in an index.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared with the 2016 strategic allocations for each portfolio, as opposed to compared with the portfolios’ composite benchmarks.

Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Small-, mid- and micro-cap companies may be hindered as a result of limited resources or less diverse products or services and have therefore historically been more volatile than the stocks of larger, more established companies.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

MSCI World Index — is a stock market index of 1,500 stocks of all the developed markets in the world, as defined by MSCI. The index includes securities from 24 countries but excludes stocks from emerging and frontier economies.

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations.

RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated (“Baird”), a registered broker/dealer and investment adviser.

Copyright ©2019 RiverFront Investment Group. All Rights Reserved. 864410