In the realm of economics, a recession refers to a significant decline in economic activity that lasts for a sustained period. However, market pundits and financial practitioners quote a wide range of definitions from general to specific. In the following, we provide a framework to help better define and follow the path up to and through a recession. By understanding the indicators, the causes, and the impacts of recessions, we can better educate investors, potentially avoid many behavioral errors, and have a greater chance of effectively navigating the economic turmoil.

ECONOMIC INDICATORS OF A U.S. RECESSION

We should start by addressing the most popular industry definition of a recession, which is often quoted as “two consecutive quarters of declining Gross Domestic Product (GDP).” However, it is important to note that a decline in GDP for two consecutive quarters is not necessarily indicative of recession due to the way that GDP is calculated. The first two quarters of 2022 provide a notable example of this issue. As a result of supply chain issues and backlogs of imports at U.S. ports that were resolved in early 2022, the amount of goods imported into the U.S. spiked. Because imports are deducted from economic activity in the GDP calculation, the massive increase in imports overwhelmed other economic activity and resulted in negative GDP growth during the first quarter. This happened despite increases in employment, investment, and spending, which positively impacted economic activity.

There are other factors that are more indicative of a U.S. recession. For our purposes, we will focus on four factors that help define economic health and assess recessionary risks.

These measures of economic activity include nonfarm employment, real (inflation-adjusted) personal income less transfers, real retail sales, and industrial production. Similar factors are included in the National Bureau of Economic Research’s (NBER) business cycle dating process, and for good reason. For example, a surge in unemployment rates reflects the dwindling employment opportunities and weakened labor market, which are often prevalent during a recession. In times of economic downturn, personal income and consumer spending tend to decrease significantly, and result in reduced demand and economic activity. Furthermore, contractions in industrial production highlight the decline in manufacturing and overall economic output. Combining these factors, one can see how impactful a simultaneous downturn can be to the economy and markets.

THE ROLE OF THE NBER

The NBER plays a vital role in defining U.S. recessions by determining the official start and end dates based on extensive analysis of economic data. According to the NBER, a recession involves a significant decline in economic activity that is spread across the economy and lasts more than a few months. These measures of economic activity include nonfarm employment, real personal income less transfers, real personal consumption expenditures, and industrial production.

IMPACT OF U.S. RECESSIONS

U.S. recessions have far-reaching consequences on various aspects of the economy. Firstly, employment and wages are severely affected with job losses and income reductions leading to financial hardships for individuals and families. Businesses and industries suffer during recessions through reduced profits, bankruptcies, and closures. Changes in consumer behavior and spending patterns as people prioritize essential needs and cut back on discretionary expenses create a ripple effect across multiple sectors. Moreover, recessions prompt governments to implement stimulative policy measures, such as tax cuts or increased public spending, to mitigate the impact and spur economic recovery.

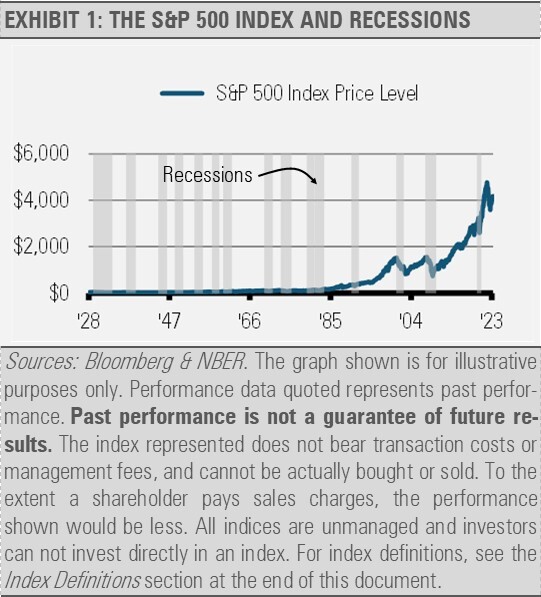

For investors, recessions often cause stock market turmoil and price declines as well as a rally in U.S. Treasury bonds and other assets that carry a perception of safety. As the following graph shows, some of the most significant S&P 500 Index price declines have occurred during recession.

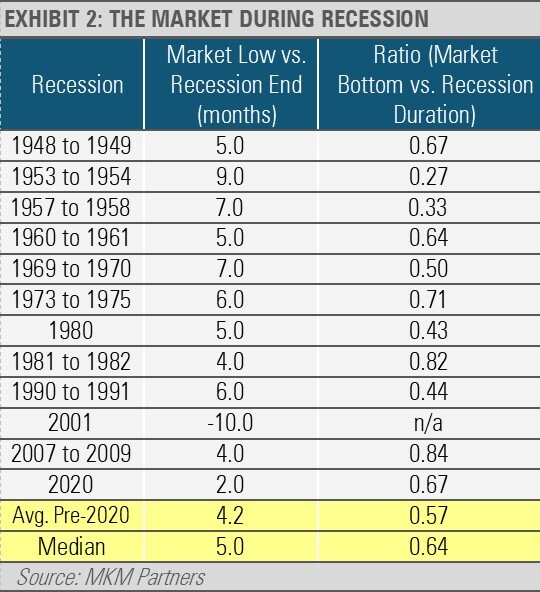

However, it is also important to note that the U.S. equity market has historically bottomed and begun to rally before the recession is over (exhibit 2). As a result, we do not think that investors should wait for better economic news as much of the recovery could have taken place before economic headlines improve.

THE FOUR DIMENSIONS OF ECONOMIC HEALTH

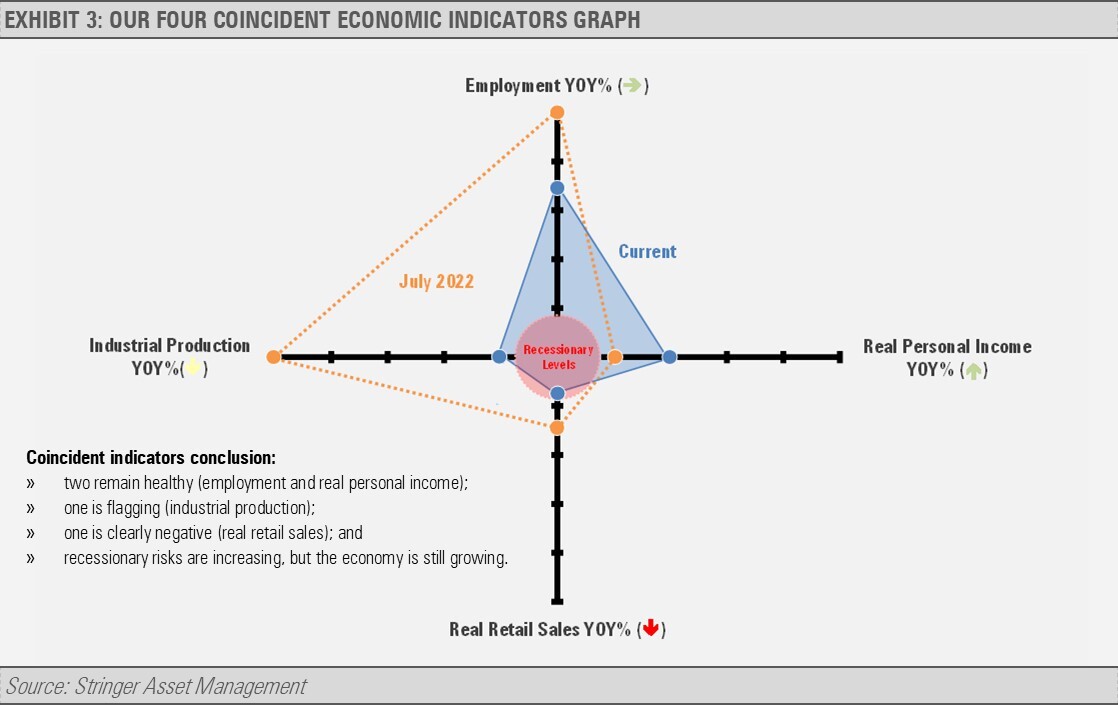

Using proxies for the primary areas that the NBER uses to help differentiate economic growth from recession, we can track the health of the economy and likelihood of a recession. Following trends in these coincident indicators may help investors better understand the state of the economy.

The unemployment rate has historically climbed 0.5% year-over-year and jobs creation slows near a recession. In addition, real personal income less transfers tends to peak at the end of a business cycle just as the economy is tilting into recession. Furthermore, the year-over-year growth rate of industrial production has historically weakened significantly or turned negative during recession. Lastly, real retail sales’ year-over-year growth tends to soften near a recession but may remain slightly positive.

According to these measures, our work suggests that the U.S. economy has gotten significantly closer to recession over the past year.

Of the four coincident economic indicators, real income has improved with persistent wage growth and falling inflation. Employment growth remains strong, but the average pace of monthly jobs creation has slowed. Industrial production is barely above its level from a year ago as growth has stagnated. Lastly, real retail sales have fallen from year-ago levels.

Measuring changes in the factors that contribute to a recession can provide some perspective for investors wondering where we are in the current business cycle. However, it’s also important to keep in mind that not all recessions are created equal as they can vary in depth and breadth. We have also learned that equity market recoveries tend to precede economic recoveries. Based on this knowledge, we think that continued participation in the markets makes the most sense while tactical shifts to more defensive sectors as well as areas that benefit late in the business cycle can help investors participate in near-term market gains, potentially protect principal, and be poised to take advantage of the opportunities beyond the recession. Today, given the increased likelihood of economic and market challenges ahead, we think that investors should take defensive steps to help protect their portfolios from downside risks.

CONCLUSION

Understanding the defining characteristics of a U.S. recession is essential for individuals, businesses, and policymakers to navigate economic uncertainties effectively. By monitoring key indicators, analyzing causes, and recognizing the impacts of recessions, we can make informed decisions and devise appropriate strategies to mitigate the adverse effects. Recognizing the role of institutions like the NBER in determining recessionary periods provides a standardized framework for evaluating economic downturns. Ultimately, acknowledging and comprehending U.S. recessions is crucial for managing the impacts of economic and market risks on investors’ portfolios.

For more news, information, and analysis, visit the ETF Strategist Channel.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.

Index Definitions:

S&P 500 Index – This Index is a capitalization-weighted index of 500 stocks. The Index is designed to measure performance of a broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.